Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 27, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Changing tastes sees Zumiez join other clothing retailers targeted by short sellers

- Short sellers cover in GoPro supplier Ambarella as stock price decline loses momentum

- Japanese childcare products manufacturer Pigeon most shorted ahead of earnings in Apac

North America

Most shorted ahead of earnings this week in North America yet again, is recently listed Zoe's Kitchen with 28.3% of its shares outstanding on loan (short interest).

Shares in Zoe's have risen by 10% as short sellers continue to cover in 2016 in the past six months, while over a third of short positions in the Mediterranean casual dining chain have been closed. Consensus forecasts currently point to Zoe's posting a loss for the fourth quarter.

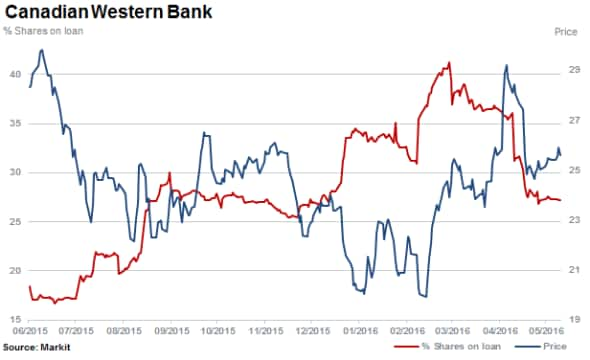

Second most shorted in North America is Canadian Western Bank with short interest of 27.2% currently. Seeing some covering in the past three months, short sellers have shed a quarter of positions. Exposed to the rising Canadian property market the firm has been targeted by short sellers for some time.

Youth apparel and accessories retailer Zumiez is the latest clothing retailer to fall foul of changing consumer tastes. Short interest has increased almost five fold in the past 12 months rising to 20.3%. The company's stock has sold off by a third during the same time, with consensus earnings indicating the company will post a first quarter loss.

Zumiez joins retailers Conn's, Five Below, Lands End and Ascena Retail in the top ten most shorted stocks in North America ahead of earnings.

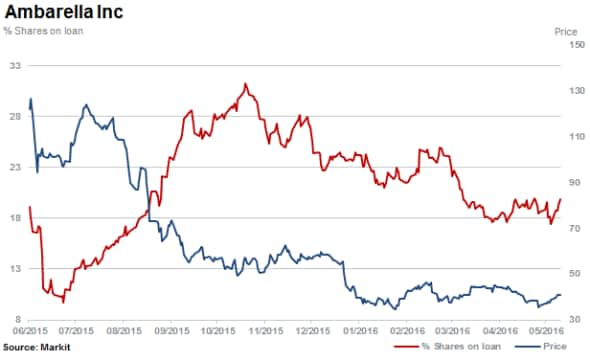

With 19.9% of shares outstanding on loan currently and previous target of activist short campaign, Ambarella has seen its shares dive by 54% in the past 12 months with shorts covering a fifth of positions as the shares look to have bottomed.

Ambarella supplies imaging chips to GoPro who itself has seen a surge in short interest in the past few weeks, rising to 13.9%.

Western Europe

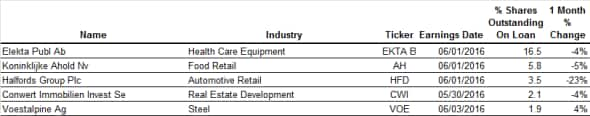

Most shorted ahead of earnings in Europe for a second year running is Elekta Pub who has seen short interest decline. Currently the stock stands at 16.5%, having climbed 16% since lows in early May 2016.

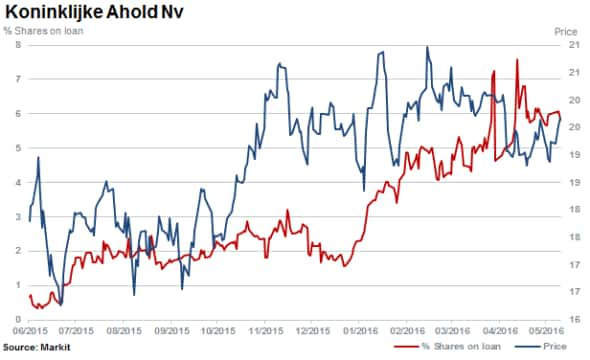

Second most shorted ahead of earnings in Europe is Dutch based retailer Koninklijke Ahold who operates a number of retail brands throughout Europe and the US. Short interest has surged in the past six months to reach 5.8% currently.

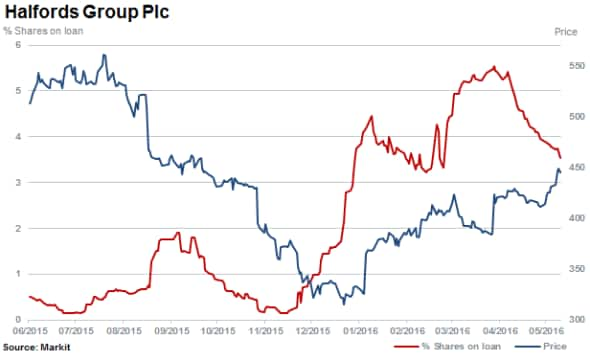

Shares in British leisure and cycling products retailer Halfords have rallied 33% since the start of the year with short sellers covering 35% of positions since mid-April.

Apac

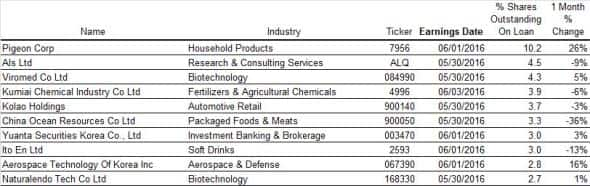

Making another appearance in the most shorted ahead of earnings for a consecutive quarter is Pigeon, a manufacturer of child care products in Japan. Japanese manufacturers have been under pressure as of late a stronger yen continues to impact the relative costs of the country's exports.

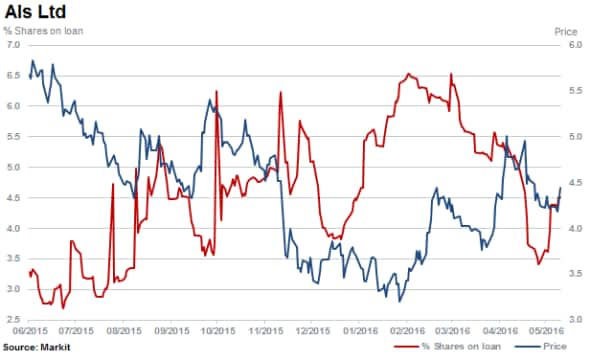

Second most shorted in Apac is Australian based research, testing and analytical services provider Als who serves the shale and mineral exploration industries. Short sellers have covered by a third from the highs of February where 6.5% were sold short. However, there has been a recent 30% surge in short interest rising to 4.5%.

Markit Dividend Forecasting, expects a 48% cut to the company's dividend amid the challenging operating environment being experienced in the commodities sector.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052016-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052016-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}