Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 27, 2015

Shanghai-Hong Kong disconnect

Following dramatic collapses in certain Hong Kong stocks this past week, companies' shares that rallied substantially in the past year, particularly those rising ahead of underlying fundamentals, are coming under increased scrutiny.

- Goldin shares recover, while suspended Hanergy still confounds investors

- Non-cyclical goods & services, energy and healthcare: most in demand sectors to short

- Demand to borrow Hanergy high prior to fall as company used stock as collateral

With over $36bn in paper losses across just three single names in Hong Kong, the roller coaster for investors is set to continue. The irrational exuberance of investors have been previously been explained by expectations of fiscal stimulus and monetary easing as economic growth slowed, but investors and companies themselves are at ends to explain the continued growth.

Price collapse in such large stocks has regulators duly concerned, as reduced values not only impact single name investors but also global ETF investors.

The opening of the Shanghai-Hong Kong connect in November 2014 aimed to bridge the divide between two distinct investor pools and increase liquidity. But there are signs that this has instead just opened markets to retail investors who are opening a record amount of trading accounts and trading on margin.

Hanergy suspended

Shares in Hanergy Thin Film Power Group (HTF) increased by 1,389% between May 2013 and May 19th 2015. HTF shares then plunged 47% last week before trading was halted, wiping out US$18.6bn from Hanergy's market cap.

HFT showed relatively low levels of shares outstanding on loan, however demand to short sell remained high right up until suspension, with the cost to borrow peaking above 30% in April 2015. Plenty of controversy continues to surround HTF and its parent company, Hanergy Group, which accounted for two-thirds of last year's revenue.

HTF is ranked 92 on Markit's Research Sigbnals Short Interest factor and 100 on the Implied Loan Rate factor within a universe of 391 Hong Kong stocks. These factor ranks indicate a relative strength of conviction among short sellers and HFT ranked 91 and 100 respectively before May 20th 2015 - the day on which trading was halted.

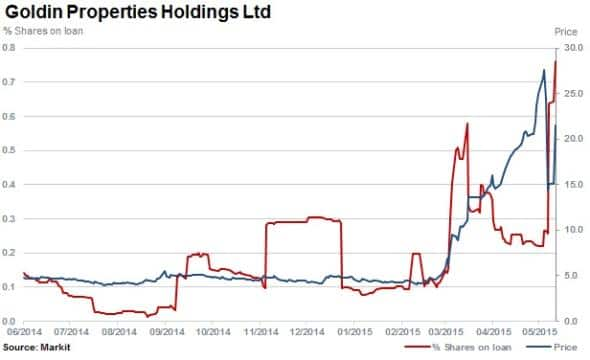

While shares in Goldin Financial and Goldin Property also collapsed substantially, these stocks were not suspended and were able to recover this week despite the company being seemingly unaware of any concrete motives for the large swings.

Goldin Financial and Goldin Property do not have high levels of shorting activity; however the demand to borrow remains high with both ranking in the 9th and 10th deciles on the Implied Loan Rate factor respectively -indicating the relative high demand to borrow these stocks across the Hong Kong market.

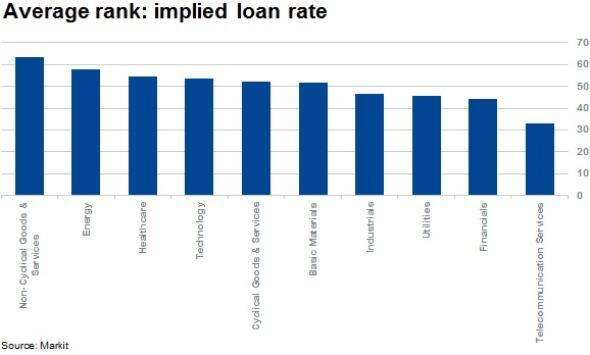

To put the Implied loan rate factor rankings of HFT, Goldin Financial and Property into context, the average sector ranks for a universe of 391 Hong Kong Stocks reveals that the most expensive or in demand sectors by short sellers on average are non-cyclical goods & services (63), energy (58) and healthcare (54). These sector averages are well below the decile ranks of the individual names.

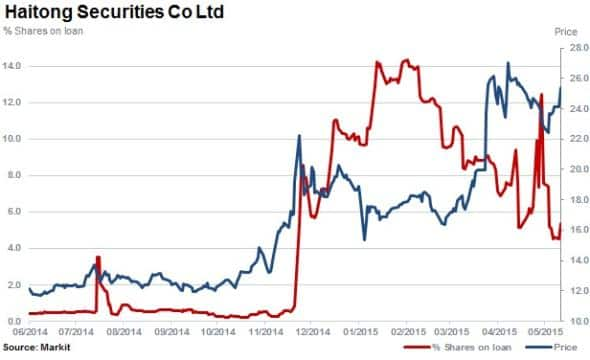

Relatively smaller in size than HFT but also ranking in the 10th decile is Haitong Securities, which provides financial services including securities brokerage.

The firm's share price has risen by 122% in the last 12 months. Reported sales and earnings have also dramatically increased during this period, indicative of increased trading activity in the region. These underlying factors may explain the share price movement in Haitong, which some other names in the region fundamentally lack.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052015-Equities-Shanghai-Hong-Kong-disconnect.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052015-Equities-Shanghai-Hong-Kong-disconnect.html&text=Shanghai-Hong+Kong+disconnect","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052015-Equities-Shanghai-Hong-Kong-disconnect.html","enabled":true},{"name":"email","url":"?subject=Shanghai-Hong Kong disconnect&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052015-Equities-Shanghai-Hong-Kong-disconnect.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shanghai-Hong+Kong+disconnect http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052015-Equities-Shanghai-Hong-Kong-disconnect.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}