Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 27, 2016

Euro investors pivot on weaker dollar

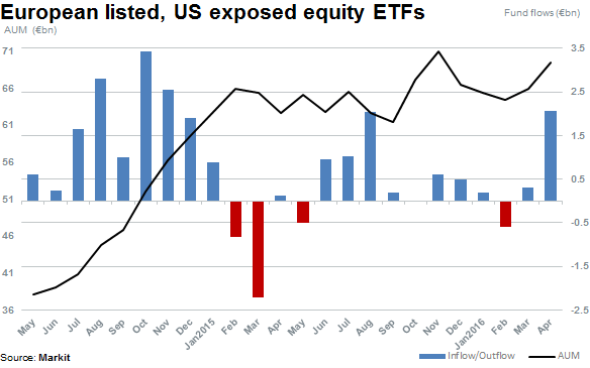

Inflows into European ETFs exposed to US equities surged in April and are looking set to post the largest monthly inflow seen in almost 18 months, despite the recent euro strength taking a shine off returns.

- "2bn of inflows into US equity exposed ETFs take euro AUM back towards highs of "71bn

- US equity ETF listed in Europe have outperformed despite the Euro's recent strength

- Fifth of inflows hedged against further USD movements but majority of AUM is unhedged

European ETF investors, lured by a wide outperformance in US equities are taking advantage of a weaker dollar, wagering "2bn that US markets have further headroom and that the dollar's slide is hopefully over.

ETFs listed in Europe, exposed to the US, have recorded the highest inflows seen in almost 18 months totalling "2bn. This has propelled relevant European listed ETF AUM to within a few percentage points of all-time highs of "71bn, reached in November of last year.

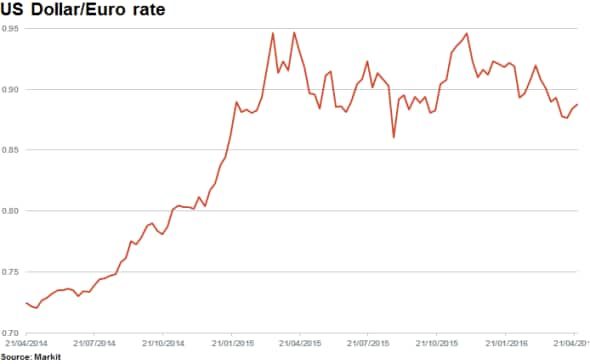

Despite the fact that the dollar has been losing ground to the Euro in recent weeks, which has eroded the value of dollar denominated assets, demand for US equities in Europe remains strong. The US currency is 6% off recent all-time highs registered against the euro last November. With interest rate hikes in the US still a possibility in 2016 and the ECB's extremely accommodative monetary policy there is a strong argument that the current strength of the euro may be a passing trend.

Confidence in a potential dollar rally is also evidenced in the fact that the vast majority of European investors are choosing unhedged ETFs when investing in US assets. While currency hedged ETFs have garnered a fifth of all the year to date inflows seen in European listed ETFs which invest in US equities, these funds only manage 5% of its peer group. US investors, which stand to lose out should the dollar appreciate against the Euro, have proved much more eager to protect against adverse currency fluctuations as currency hedged ETFs manage a third of all US listed European exposed equity ETFs.

Based on the relative position sizes of hedged positions in ETF products exposed to Europe and the US, plus the strong inflows seen in US exposed ETFs in Europe there is the expectation that the dollar will be stronger relative to the euro going forward. That could prove to be a fortuitous trade (on a currency basis alone) for discerning euro based investors.

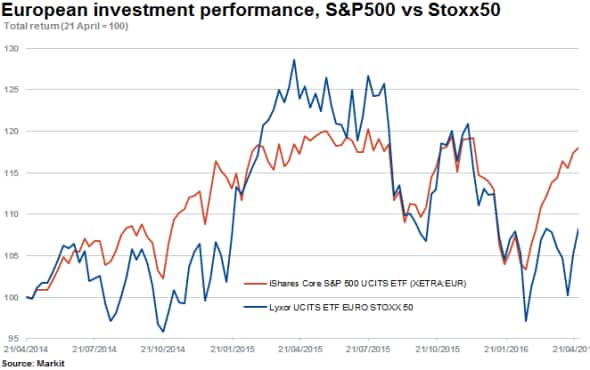

While currency fluctuations play a large part in cross border investing, the US market's recent strength means that the year to date Euro value of US equity returns has far outstripped those delivered by European equities.

The iShares Core S&P 500 ETF ("), the largest US exposed European listed fund is now 10% ahead of the Stoxx 50 index year to date on a total return basis. This performance gap has continued to grow in recent weeks despite the falling value of the dollar.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042016-equities-euro-investors-pivot-on-weaker-dollar.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042016-equities-euro-investors-pivot-on-weaker-dollar.html&text=Euro+investors+pivot+on+weaker+dollar","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042016-equities-euro-investors-pivot-on-weaker-dollar.html","enabled":true},{"name":"email","url":"?subject=Euro investors pivot on weaker dollar&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042016-equities-euro-investors-pivot-on-weaker-dollar.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Euro+investors+pivot+on+weaker+dollar http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042016-equities-euro-investors-pivot-on-weaker-dollar.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}