Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 27, 2015

Periphery drives eurozone equity returns

As revealed in the latest Flash Eurozone Composite PMI, growth in the region is being led by non-core countries; prompting periphery ETFs to grow at the fastest pace in nine months.

- Investors have added €420m of exposure to outperforming periphery countries in April

- Core country focused ETFs on track for their first monthly outflows of 2015

- Investors have continued to pour money into regional focused ETFs in April

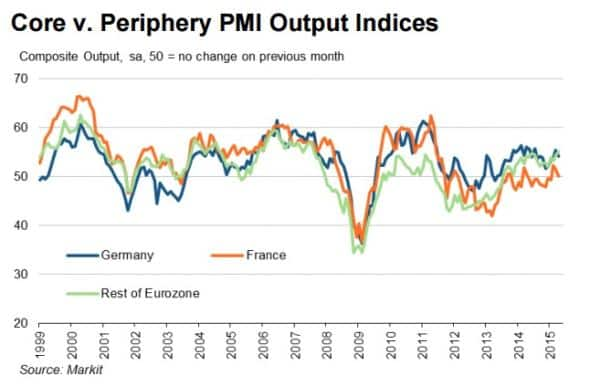

Eurozone growth was driven by countries outside of the "core" eurozone economies of France and Germany, according to the April Flash Eurozone Composite PMI. The survey indicated that output in Germany, the region's largest economy, receded from the recent highs seen in March while France's output indicated no growth on the previous month. These slowing growth figures in the two largest economies in the region contrast with the rest of the eurozone economies, which grew at the fastest pace since August 2007.

ETF investors head to periphery

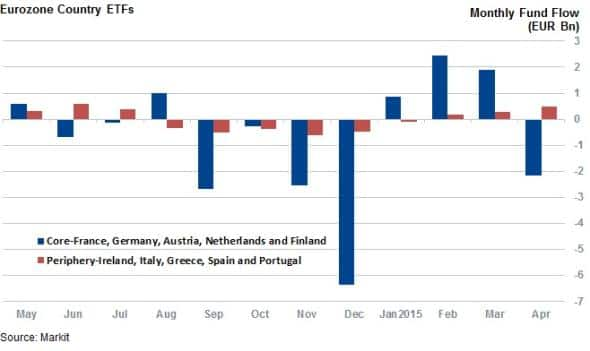

ETF investors were originally slow to get behind the periphery rally, but flows have started to gather pace over the last couple of months. The 42 ETFs that track periphery eurozone equities have seen €428m of inflows in April to date. This puts these funds on track for their best four weeks of inflows since last June.

US investors have played a leading role in this trend as the largest inflow in April was seen by the iShares MSCI Spain Capped ETF which has seen €210m of inflows in April so far.

Core countries see outflows

The gathering pace of flows into periphery equity ETFs contrasts with outflows seen from products that track "core" economies. ETFs tracking German and French equities, along with those that invest in Austria, the Netherlands and Finland have seen over €2bn of outflows so far this month, putting them on track for their first monthly net outflow of the year.

This trend was driven by the largest eurozone country ETF by AUM, the iShares Dax UCITs ETF, which experienced over €3bn of redemptions. These outflows put the fund into negative territory for the year so far.

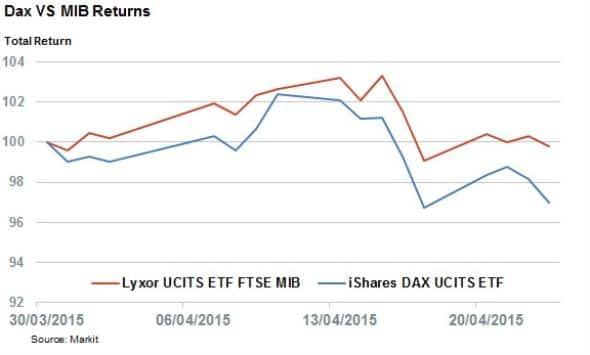

This shift out of core markets into periphery products appears to have been a canny move as the previously mentioned DAX ETF has lagged the largest Italian ETF, the Lyxor UCITS ETF FTSE MIB by 3% in the first three weeks of April.

Regional exposure still popular

Regional focused products, which invest in both core and periphery equities, have continued to be popular. The 130 ETFs which track the eurozone have seen €3.8bn of inflows in April to date.

Although these funds still heavily favour core countries, exemplified by the fact that French and German equities make up 68% of the EURO STOXX 50 ETF by weight, the minority periphery constituents have helped the iShares EURO STOXX 50 ETF outperform the DAX ETF by 2% over April.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-equities-periphery-drives-eurozone-equity-returns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-equities-periphery-drives-eurozone-equity-returns.html&text=Periphery+drives+eurozone+equity+returns","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-equities-periphery-drives-eurozone-equity-returns.html","enabled":true},{"name":"email","url":"?subject=Periphery drives eurozone equity returns&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-equities-periphery-drives-eurozone-equity-returns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Periphery+drives+eurozone+equity+returns http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-equities-periphery-drives-eurozone-equity-returns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}