Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 27, 2017

Week Ahead Economic Overview

Policymakers take centre stage during the week, with both the Federal Reserve and the Bank of England announcing their latest monetary action. January PMI results will provide analysts with an insight into economic trends in all of the major global economies, while preliminary fourth quarter GDP figures for the euroarea and Russia are released. The week concludes with an update on US non-farm payrolls.

When the US Federal Reserve gathered for its December meeting, policymakers decided to raise the federal funds target range by 25 basis points to between 0.5% and 0.75%. The hike was widely expected after stronger economic data flow highlighted improvements in the health of the world's largest economy. Since then, Fed chairwoman Janet Yellen has downplayed the central banks hesitancy around tightening monetary policy, recently stating she considers "it prudent to adjust the stance of monetary policy gradually over time". Consequently, despite the Fed outlining three quarter basis point interest rate hikes over the course of 2017, the consensus is that monetary policy will remain unchanged next week.

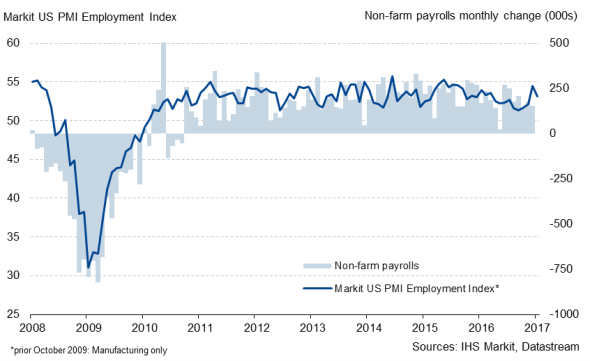

US Employment PMI Index vs non-farm payrolls

Subsequently, updated US labour market data will provide a major indication of the timing of the next Fed interest rate hike. Although US non-farm payrolls increased by 156k jobs in December, well below the consensus forecast of 178k, average hourly earnings picked up by 2.9% annually, the biggest gain in wages since 2009. Many economists now believe the labour market is running at near full capacity, and if next week's update can show further signs of real wage growth and solid job creation, then a change in monetary policy may not be far away. Meanwhile, January's US PMI results will give a snapshot assessment of the health of the world's largest economy. Flash estimates for both the manufacturing and services sectors were encouraging, with the two surveys collectively pointing to 2.5% annual economic growth.

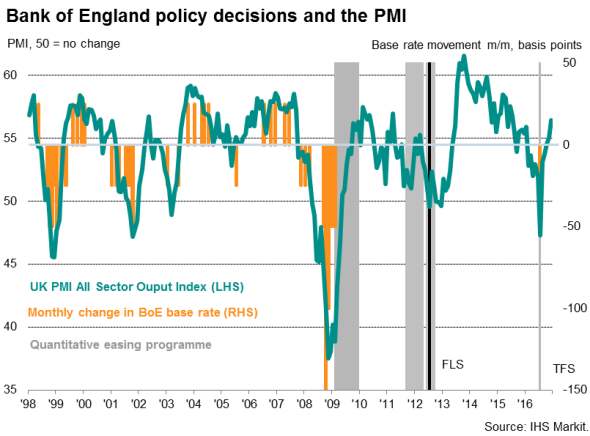

After theUK inflation rate for December jumped to 1.6%, its highest since July 2014, and the initial estimate for fourth quarter GDP growth signalled a 0.6% expansion of the economy, analysts have since been talking as much about the likelihood of an interest rate rise as they have a cut. The Governor of the Bank of England, Mark Carney, recently warned that there were "limits to the extent to which above-target inflation can be tolerated", and with the weakness of the pound and higher global commodity prices continuing to exert further upward inflationary pressures, then action may be taken sooner rather than later to cull this trend. However, similarly to the Federal Reserve, the consensus is that next week's policy meeting will conclude with interest rates remaining at a record low level of 0.25%, providing the Bank with more time to mull over upcoming economic data before determining future monetary action.

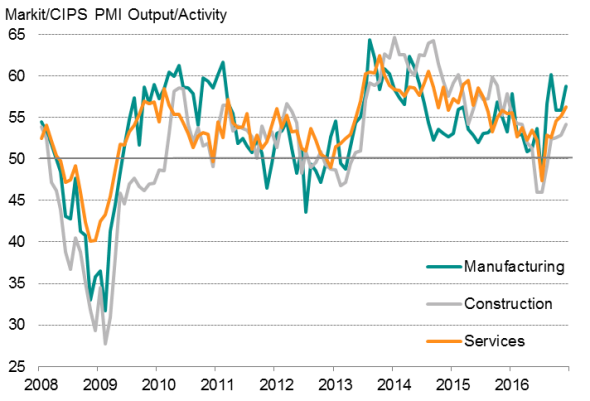

One set of data releases that will gain the BoE's attention are the UK PMI's for January. A strong end to 2016 was signalled by survey data in December, as the PMI reached a 17-month high. If next week's update indicates further solid growth and higher inflationary pressures, then policymakers could adjust monetary policy sooner than expected.

UK output by sector

Source: IHS Markit.

Over in Frankfurt, the Governing Council of the ECB hold its first non-monetary policy meeting for 2017. Prior to this, Eurostat provides its first estimate on the eurozone Q4 2016 GDP growth rate, along with inflation and unemployment figures for December. PMI data for the final month of 2016 showed the euro area expanding at the fastest pace since May 2011, thereby signalling a 0.4% increase in GDP for the fourth quarter.

Meanwhile, the Bank of Japan will also determine its latest monetary action. However, with core consumer prices falling 0.2% in the year to December, forecasters are anticipating central bankers to keep interest rates unchanged at -0.1% this time round.

Finally, Russian fourth quarter GDP data are published, with analysts looking for signs that the recently encouraging economic data flows have finally been reflected in economic growth. Following this update, the Central Bank of Russia will decide whether to alter its one-week repo rate from its current 10% level.

Monday 30 January

Japanese retail sales data are released in the early hours.

In Germany, the latest preliminary consumer price index is released.

The first estimate for Spanish Q4 2016 GDP data are available.

Greece releases its producer prices index and latest retail sales figures.

Tuesday 31 January

The NAB business conditions indicator is issued in Australia.

In Japan, central bankers meet to determine latest monetary policy, while an update is provided on the latest unemployment rate and preliminary industrial output figures.

Indian infrastructure output data are released.

Eurostat provides preliminary eurozone GDP figures for Q4 2016, while inflation data and latest unemployment rates are also published.

German retail sales are issued alongside the latest unemployment rate.

Meanwhile, both Italy and Brazil's unemployment rates and producer prices indexes are updated.

Inflation data are released in Spain.

Wednesday 01 February

January's PMI data are released by IHS Markit for a number of economies around the world.

Preliminary Russian GDP data for the fourth quarter of 2016 are published.

The ECB's first non-monetary policy meeting for 2017 is scheduled.

Brazilian industrial output figures for December are released.

In the US, the Federal Reserve officials also gather for the first time this year to set monetary policy, while mortgage application data are issued.

Thursday 02 February

Trade balance numbers for Australia are updated.

Japan's consumer confidence indicator and capital flows data are out.

The eurozone's latest producer prices index is released.

In the UK, an interest decision will be made by the Bank of England, while their quarterly inflation report will also be published.

Friday 03 February

IHS Markit releases worldwide services and whole economy PMI results.

Bank lending data for India are updated.

The Central Bank of Russia meets to set latest monetary policy.

Retail sales data are released for the eurozone.

Over in Italy, the preliminary consumer prices index is issued.

The week concludes with the release of latest non-farm payrolls in the US along with average hourly earnings data.

Samuel Agass | Economist, Markit

Tel: +441491461006

samuel.agass@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012017-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012017-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012017-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012017-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012017-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}