Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 26, 2016

Eurozone flash PMI near two-year low as service sector growth wanes

The September flash PMI indicates that the eurozone economy lost further momentum at the end of the third quarter. Signs of stronger life were seen in manufacturing, but a weakening of activity growth in the services economy suggests domestic demand is waning.

Losing slight momentum

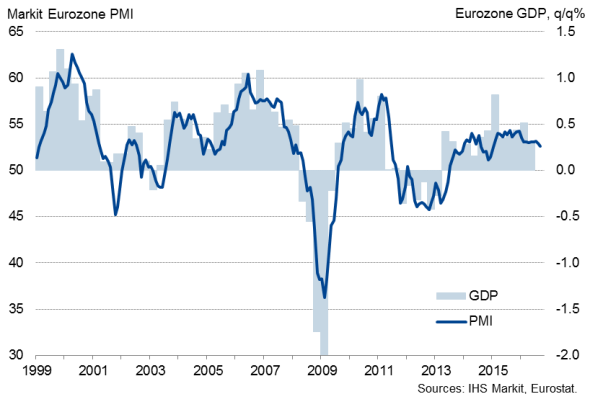

At 52.6, down from 52.9 in August, the flash estimate of the Markit Eurozone PMI" edged down to its lowest since January 2015.

The latest reading is not weak enough to change the signal that the economy expanded at a 0.3% quarterly rate in the third quarter (similar to that seen on average over the first half of the year), but the drop in the PMI suggests that growth is waning as we head into the fourth quarter.

Eurozone GDP and PMI

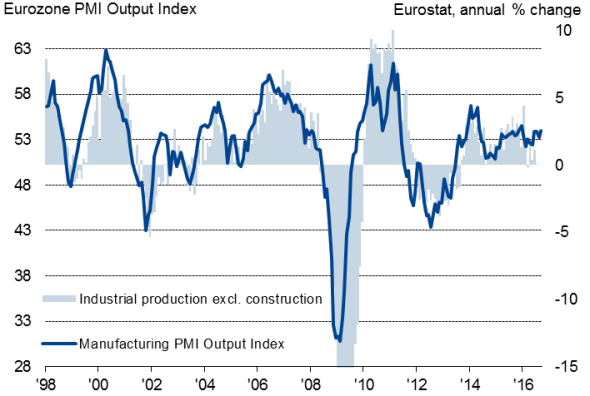

Digging down into the data shows that the manufacturing economy in fact gained slight momentum. Factory output rose at the fastest rate seen since December. Production rose especially strongly in Germany and was steady for a second month running in France (an improvement on the declines seen through much of the year to date). Elsewhere in the region, factory output growth hit a three-month high.

Eurozone manufacturing output

Sources: IHS Markit, Eurostat.

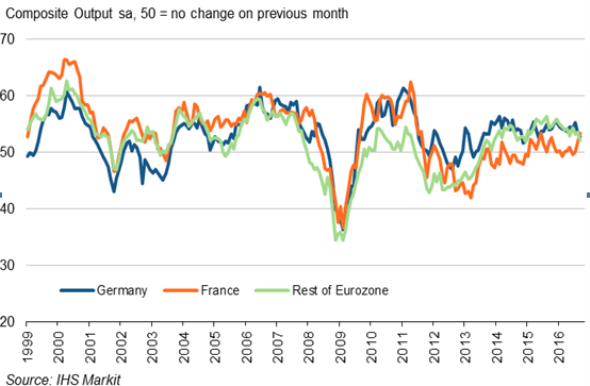

The eurozone weakness was therefore concentrated in the service sector, where activity showed the smallest monthly increase since December 2014.

Although France saw the strongest uplift in services activity since June of last year, its performance bucked a wider trend of slowing growth. Services activity barely rose in Germany, registering the smallest expansion since June 2013, and the increase in services activity across the rest of the region was the smallest since December 2014.

Core v. Periphery PMI Output Indices

France

Source: IHS Markit.

Germany

Source: IHS Markit.

Domestic demand worries

The poor performance of the service sector hints at a weakening of home demand within the euro area, as the sector tends to be more domestically-focused than manufacturing. Note also that the latter's stronger performance was helped by export orders rising at the fastest rate since March 2014. It was also worrying to see service sector optimism about the year-ahead dropping to a 21-month low in September.

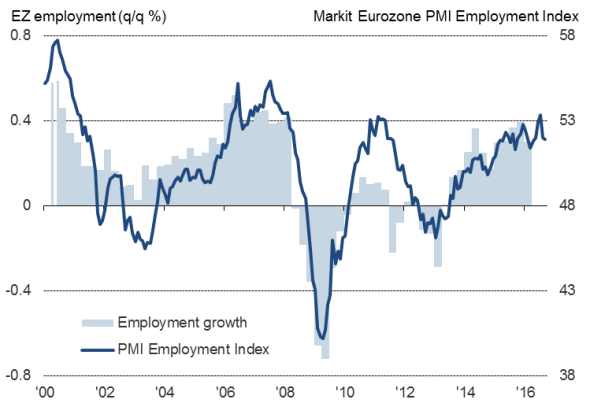

Solid job growth belies labour market split

While the overall rate of job creation slowed for a second month in a row, the average increase in employment over the third quarter has been the highest since the second quarter of 2011. Solid job gains are being seen in both manufacturing and services, but the worry is that the job market is looking increasingly skewed.

Hiring in Germany's manufacturing sector rose to the highest since January 2012 and further robust (albeit slowing) job gains were seen in the German services economy. In contrast, only a marginal increase in overall employment seen in France, and elsewhere across the region the hiring trend slowed to one of the weakest seen for almost two years.

Eurozone employment

Sources: IHS Markit, Eurostat.

Prices stabilise

There was better news on output charges, which rose (albeit marginally) for the first time since August of last year. The worry here is that higher selling prices mainly reflected rising input costs, which rose for a sixth successive month, suggesting profit margins may have continued to be eroded.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-economics-eurozone-flash-pmi-near-two-year-low-as-service-sector-growth-wanes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-economics-eurozone-flash-pmi-near-two-year-low-as-service-sector-growth-wanes.html&text=Eurozone+flash+PMI+near+two-year+low+as+service+sector+growth+wanes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-economics-eurozone-flash-pmi-near-two-year-low-as-service-sector-growth-wanes.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI near two-year low as service sector growth wanes&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-economics-eurozone-flash-pmi-near-two-year-low-as-service-sector-growth-wanes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+near+two-year+low+as+service+sector+growth+wanes http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-economics-eurozone-flash-pmi-near-two-year-low-as-service-sector-growth-wanes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}