Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 26, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to companies due to announce earnings in the final week of the second quarter results season.

- S&W Seed is the most US shorted company ahead of earnings

- Neopost is one of three European companies seeing significant demand to borrow

- Japanese retailers UNY Group is the most shorted Asian firm announcing earnings

North America

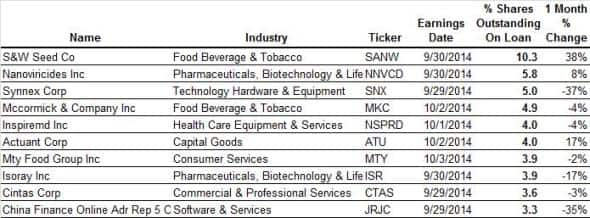

The last week of the second quarter earnings season sees only 150 companies announcing results this week. Of these, there only 10 companies with more than 3% of their shares out on loan.

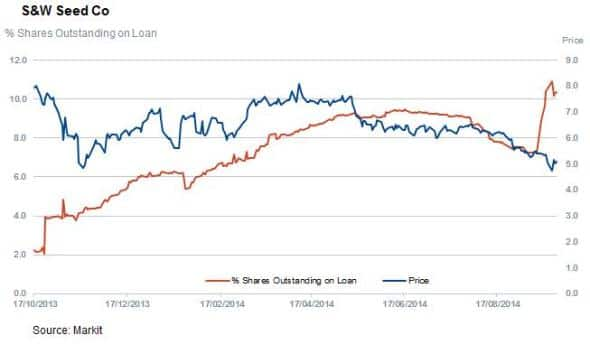

Agricultural company S&W Seed is the most shorted company with 10.3% of its shares out on loan prior to its Tuesday earnings call. The company also has the dubious honour of having seen the largest jump in short interest ahead of results with short sellers having increased their borrow by 38%. While the cause for the increased demand to borrow is hard to pin down, the firms main crop alfalfa has been under pressure in recent years as the California drought continues to bite. This has seen its shares fall by over a quarter since the start of the year.

Also making the list of the heavily shorted companies in the sector is spice firm McCormick which has 5% of shares out on loan. The firm has seen relatively flat demand to borrow however with short interest fluctuating between 5% and 6% over the last six months.

Sector wise, retailers continue to make poplar shorts, though all four firms currently see their shares trade near annual highs.

Pharma firms continue to be well represented amongst heavily shorted names ahead of earnings with three stocks making this week's list. Nanoviriciteds tops the group with just under 6% of shares out on loan after failing to come up with a revenue generating product since its listing in 2006.

The other two healthcare firms are InspireMD and Isoray which both have 4% of their shares out on loan.

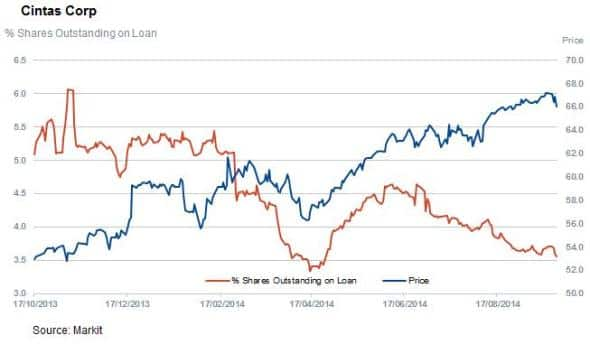

Finally, uniform company Cintas has seen shorts retreat in the wake of a recent buoyant share price.

Europe

Earnings activity is also tame in Europe with only three firms reporting results with more than 3% of shares out on loan.

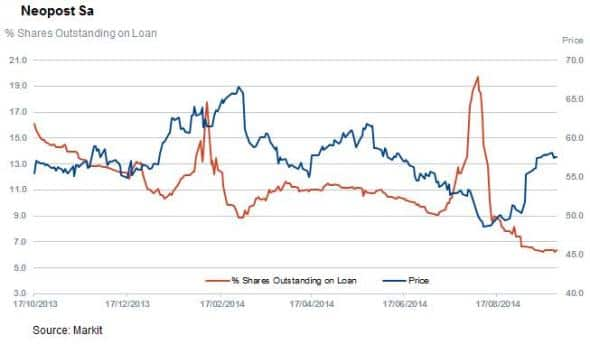

French mailroom equipment company Neopost sees the largest demand to borrow ahead of earnings with 6.4% of the company's shares out on loan. This large demand to borrow hides the fact that short sellers have been actively covering their positions in the last few months as the firm has seen shorts nearly halved their positions since the start of the year. Demand to borrow the stock is close to its lowest level in over three years.

The same can't be said for UK firm Globo which recently saw shorts surge to new highs in the last couple of months. While demand to borrow has receded somewhat in the last few weeks, it is still over twice the level seen in January with just under 5% of shares out on loan.

Newly listed Austrian real estate firm Bowog has also seen a surge in demand to borrow in recent weeks with the proportion of shares out on loan jumping by more than three times the level seen a month ago.

Asia

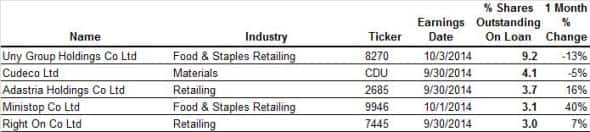

Japanese firms make up four of the five companies with more than 3% of shares out on loan ahead of results. Of these three are retail firms which have continued to come under pressure as shorts bet that consumer spending will continue to come under pressure in the wake of Prime Minister Abe's recent economic intervention. This looks to have played out last weekwhen Asahi reported weaker than expected results which sent the heavily shorted retailer's shares down sharply.

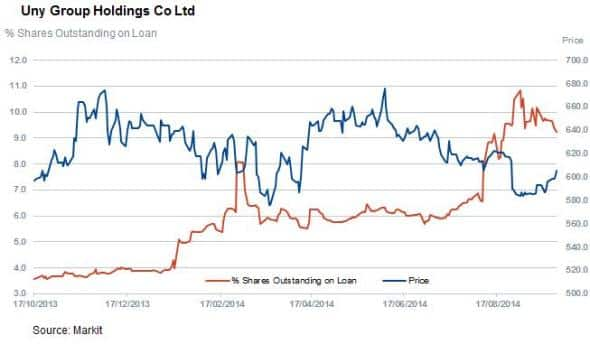

Top of this week's list is Uny Group which has 9% of shares out on loan, twice the level seen at the start of the year.

Both of the other two retailers seeing heavy short interest ahead of results, Adastria and Ministop, have seen shorts add to their positions in the weeks leading up to results.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092014-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}