Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 26, 2016

UK consumers prop up ailing economy in first quarter

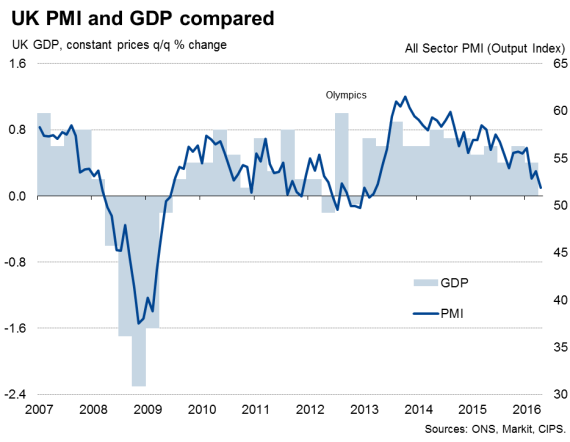

Updated official data confirm that the pace of UK economic growth slowed in the opening quarter of the year; a trend which survey data maintained into the spring.

The economy grew 0.4% in the first three months of 2016, according to the second estimate of GDP from the Office for National Statistics, unchanged on the preliminary number and down from 0.6% in the final quarter of last year. The upturn leaves the economy 2.0% larger than a year ago, down from an initial estimate of 2.1%.

The data show an economy reliant on consumer spending to sustain growth, with business investment, construction, manufacturing and exports all in decline.

The second quarter is looking even worse. Markit/CIPS PMI survey data forewarned of the first quarter slowdown and paint and even bleaker picture of the economy slowing to near-stagnation at the start of the second quarter.

Not just Brexit worries

The disappointing start to the year suggests the economy will struggle to attain 2% growth in 2016 without a substantial rebound in the second half of the year, which in turn will of course largely depend on the EU referendum.

It is tempting but wrong to assign all of the blame for the slowdown on 'Brexit' uncertainty. While business survey evidence indicates that rising uncertainty has caused growth to weaken in recent months, there has also been an underlying cooling in the economy which has been driven by slower global economic growth, which has slumped to the weakest for over three years in recent months.

The first quarter saw growth also slow sharply in the US, and many emerging markets remain either in a state of malaise or decline. The Eurozone, the UK's largest trading partner, has seen only tentative signs of growth lifting higher. Meanwhile, closer to home, companies and households indicate that ongoing austerity and weak wage growth continue to dampen domestic demand, and the strength of the pound by historical standards has hurt exports.

None of these factors look likely to change suddenly, with the exception that Brexit uncertainty will hopefully lift after the referendum, allowing growth to revive again. However, the extent to which growth will rebound remains very unclear, given the other headwinds facing the economy, suggesting we should not be complacent about the underlying health of the economy.

Consumer reliance

Looking at the latest numbers in detail, mining and quarrying fell 2.3%, with manufacturing output dropping 0.4% to cause a 0.4% slump in total industrial production. Construction also saw output fall 1.0%. That left services as the main driver of growth once again, with output up 0.6% in the first three months of the year, unchanged on the earlier estimate.

It was rising household expenditure that provided the main impetus to the economy, a 0.7% increase in which offset a 0.5% decline in business investment and a 0.3% drop in exports. Government spending also helped prop up growth, rising 0.4%.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052016-economics-uk-consumers-prop-up-ailing-economy-in-first-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052016-economics-uk-consumers-prop-up-ailing-economy-in-first-quarter.html&text=UK+consumers+prop+up+ailing+economy+in+first+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052016-economics-uk-consumers-prop-up-ailing-economy-in-first-quarter.html","enabled":true},{"name":"email","url":"?subject=UK consumers prop up ailing economy in first quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052016-economics-uk-consumers-prop-up-ailing-economy-in-first-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+consumers+prop+up+ailing+economy+in+first+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052016-economics-uk-consumers-prop-up-ailing-economy-in-first-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}