Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 26, 2016

Japan running out of Abenomic arrows

Analysts have aggressively downgraded the outlook for longer term earnings in Japan as the yen continues to rise, placing more pressure on exports which are vital to achieve the country's growth ambitions.

- Earnings outlook for Japanese firms rapidly deteriorates as analysts revise estimates lower

- Japanese exporters see earnings dilution as yen strength continues - despite NIRP

- Number of Japanese companies expected to lead global earnings growth halves

Currently hosting the G7 summit, Japan's prime minister Shinzo Abe has hinted that the planned (but already delayed) sales tax hike in 2017 may in fact not go ahead as the economy once again grapples with stagnation.

Alluding to the fragile economy and 'crisis' like conditions being experienced, Abe plans to further nurture markets as the country's extensive monetary easing programme continues. This includes support through substantial Bank of Japan (BoJ) purchases of domestic ETFs, amid some of the strongest ETF outflows of foreign funds seen in two years.

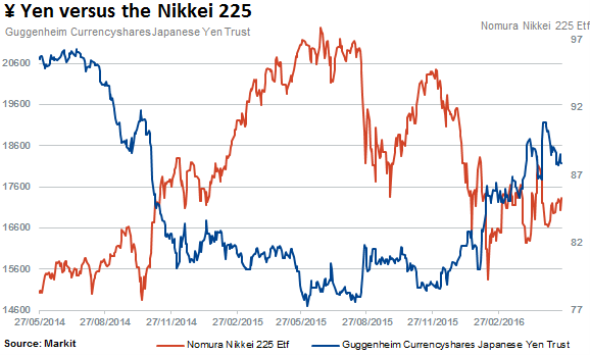

However the BoJ is running out of economic arrows to stimulate the economy. The launch of the negative interest rate policy (NIRP) in late January has largely backfired with the yen trading towards two year highs. The stubbornly strong yen and emerging market selloff has seen stock the Nikkei 225 slump in 2016, reversing some of the Abenomics boom seen in equities since 2012.

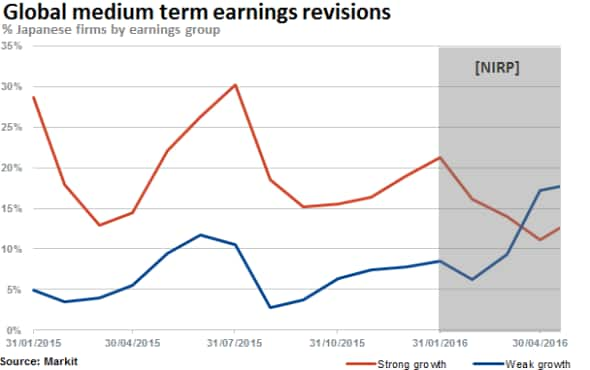

With a stronger yen, the earnings outlook for firms hoping to grow exports on the back of stimulus has dimmed. According to Markit Research Signals 3-M Revision in FY2 EPS factor, which ranks firms according to revisions to medium term earnings estimates, analysts have downgraded their earnings estimates for Japanese firms across the board.

Over a global universe of 7000 stocks, the number of Japanese companies ranked in the top 10% of firms expected to grow earnings over a two year time horizon has halved in the past 12 months.

This trend accelerated post the introduction of NIRP in January. Additionally, the bottom 10% of firms expected to grow earnings (seeing the worst revisions to earnings estimates) has seen the number of companies swell, increasing by over two fold.

Short sellers follow the analysts

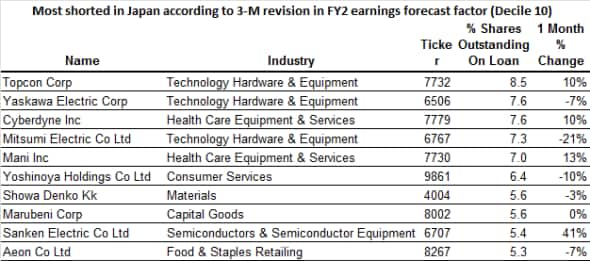

One of the most shorted companies in Japan currently that ranks in the bottom ten percent of firms expected to grow earnings is Topcon Corp with 8.5% of its shares currently sold short.

Recently reporting declining earnings, Topcon shares are down two thirds in the past 12 months. The firm manufactures and exports optical and digital imaging technology products, including mapping drones and eye care equipment, with three quarters of the company's sales coming from outside of Japan.

The top five most shorted Japanese companies where analysts have downgraded earnings outlooks the most are all related to equipment in the healthcare and technology sector.

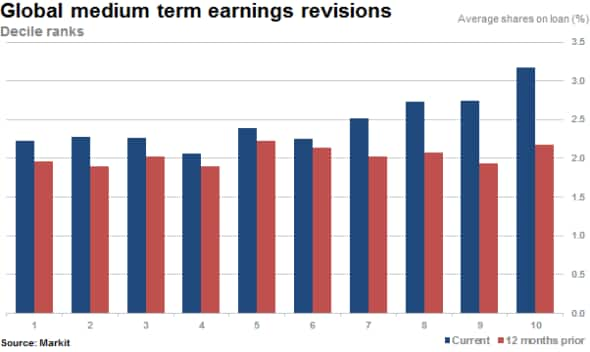

Globally, over the past 12 months, short sellers have congregated more towards companies that are expected to deliver poor earnings growth over the medium term as seen above, with short interest rising in the bottom half (decile 5-10) of companies ranked according to 3M revisions to FY2 earnings estimates.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052016-Equities-Japan-running-out-of-Abenomic-arrows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052016-Equities-Japan-running-out-of-Abenomic-arrows.html&text=Japan+running+out+of+Abenomic+arrows","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052016-Equities-Japan-running-out-of-Abenomic-arrows.html","enabled":true},{"name":"email","url":"?subject=Japan running out of Abenomic arrows&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052016-Equities-Japan-running-out-of-Abenomic-arrows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+running+out+of+Abenomic+arrows http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052016-Equities-Japan-running-out-of-Abenomic-arrows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}