Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 26, 2015

Turkish delight turns sour

In a move that mirrors Turkey's credit market, equities have taken a bearish turn with both short interest and dividends reflecting the recent market slump.

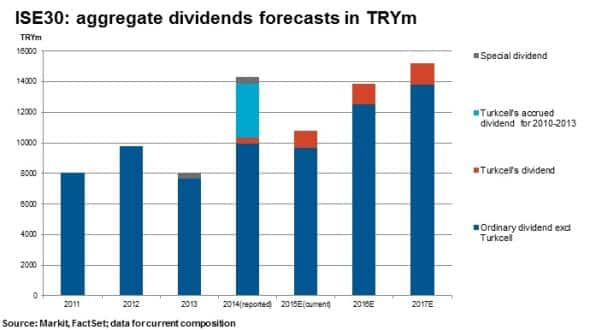

- Aggregate dividends paid by ISE 20 companies set to decline by 26% in the current fiscal year

- Dividend drop less severe at 6% excluding large accrued dividends from Turkcell in 2014

- Average short interest in ISE 20 constituents up by 56% since January 1st 2015

Dividends set to fall

Markit is expecting Turkish dividends to tumble by 26% in 2015 to TRY10.8bn, largely due to the absence of Turkcell's accrued dividends for 2010-2013, which were distributed in 2014. Turkcell has helped lift the telecommunications sector higher, contributing 28% of total dividends compared with banking's now second highest contribution of 23%.

Double digit dividend cuts are projected for the basic resources and construction material sectors. Excluding Turkcell's dividend distributions, total aggregate dividends for the region would have decreased by 6%.

As a result of recently reported higher unemployment and bigger budget deficit numbers, the Turkish Lira has weakened, hitting record lows against the US dollar. The negative macroeconomic outlook has also affected earnings estimates.

Markit's latest Turkey PMI data has signalled a downturn in the manufacturing sector with new orders, output and exports falling for the fourth consecutive month.

Markit is cautiously forecasting dividends for Turkish companies with positive trends in earnings at the lowest range of payout ratios outlined in dividend policies or based on historical averages. Looking forward, dividend forecasts for 2016 and beyond are more positive with growth of 30% expected in 2017 and 10% in 2018.

Short interest up

On average, the percentage of free float out on loan for the ISE 20 has increased by 56% from 1.2% to 1.9%. The most short sold company by this metric is Istanbul based Bizim Toptan Satis Magazalari (BTSM). The company operates a chain of wholesale cash and carry stores, focused on fast moving consumer goods.

Bizim has seen revenue growth and earnings stall in recent years after posting successively strong years of growth prior to 2012. This has been reflected in the share price which has halved in the last two years.

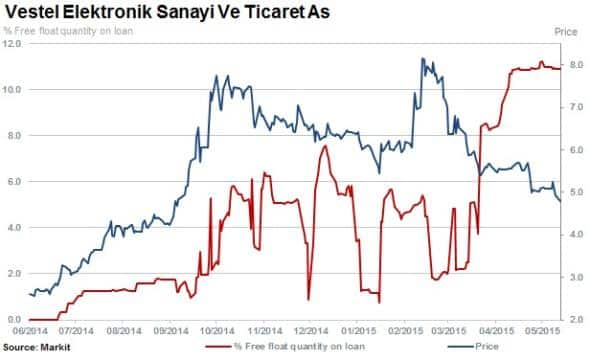

A Turkish manufacturer who has recently seen a rise in shorting activity is Vestel Elektronik Sanayi. The company is based in Istanbul and produces electronic equipment including televisions and white goods. The group is 68% exposed to European sales and has seen its percentage of free float quantity on loan double since April to 11%.

The stock is up 92% over the last 52 weeks but has declined 28% year to date. While consensus forecasts point to record sales for the firm, operating profits are expected to decline.

Concerns are growing that Turkey's economy will be negatively impacted by recent movements in global markets. The country may continue to run out of steam, exacerbated by a recent slump in foreign direct investment.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-equities-turkish-delight-turns-sour.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-equities-turkish-delight-turns-sour.html&text=Turkish+delight+turns+sour","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-equities-turkish-delight-turns-sour.html","enabled":true},{"name":"email","url":"?subject=Turkish delight turns sour&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-equities-turkish-delight-turns-sour.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Turkish+delight+turns+sour http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-equities-turkish-delight-turns-sour.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}