Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 26, 2015

Russian credit on the mend

A rising rubble together with a lull in the Ukraine conflict has resulted in a strong recovery in Russian credit.

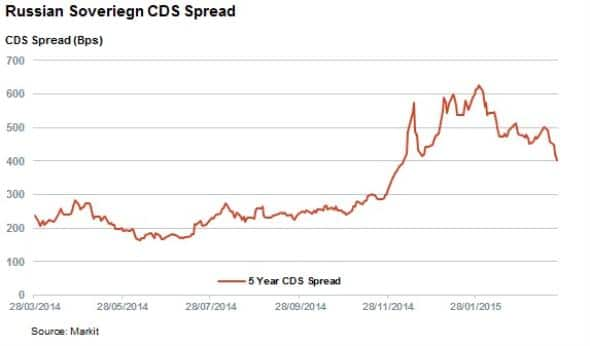

- Russia's CDS spread has recovered to levels last seen in December 2014

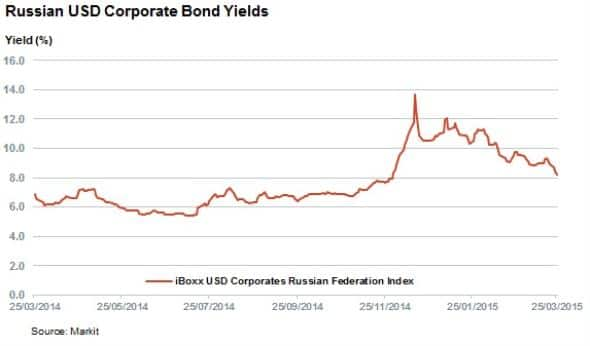

- Markit iBoxx USD Corporates Russian Federation Index yield down 1.5% in the last month

- Dollar denominated corporate Russian bonds have returned 11.6% since January 1st

The ceasefire in Eastern Ukraine has alleviated fears of further sanctions against Russia, which is reflected in the recovery of the country's currency. The Rubble is now trading at 56 to the dollar, which marks a 20% rally from the lows seen in the depths of the crisis.

Russian investors will also take solace in the latest bounce in oil prices, stemming from the recent turmoil in Yemen. However, the commodity still has a long way to go to reach the level where it can balance the Russian budget. The country is still expected to enter a deep recession in the coming year.

CDS spreads tighten

These recent developments have seen Russian sovereign CDS spreads tighten to their lowest level of the year. 5-yr CDS spreads for the country are just north of 400bps, a third lower than the 600bps recorded prior to the ceasefire.

The speed of the improving outlook is staggering: spreads have tightened by 91bps in the last week alone.

Improving credit outlook drives returns

Bonds issued by Russian companies in dollars have also been buoyed by these market developments as Russian firms will be better able to service their foreign currency denominated debt.

The yield of the Markit iBoxx USD Corporates Russian Federation Index has tightened significantly in the last month. The index, which tracks dollar denominated bonds, now yields 8% - over 200bps tighter than before the ceasefire came into effect on the 11th of February.

Interestingly, Russian bonds didn't react to resumption of hostilities in Ukraine in a similar way to Russian CDS spreads during January.

Today's tightening yields are converting into hard returns for investors. The index returned 6.5% last month and 4.3% in March so far. Despite the recent tightening, the index still yields 680bps over US treasuries, which is twice as high as the levels seen only last year. One could argue the rally still has a long way to go before the situation normalises.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-Credit-Russian-credit-on-the-mend.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-Credit-Russian-credit-on-the-mend.html&text=Russian+credit+on+the+mend","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-Credit-Russian-credit-on-the-mend.html","enabled":true},{"name":"email","url":"?subject=Russian credit on the mend&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-Credit-Russian-credit-on-the-mend.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russian+credit+on+the+mend http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-Credit-Russian-credit-on-the-mend.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}