Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 26, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Highly shorted Lumber Liquidators shares plunge further as FDA report released

- UK's most shorted Carillion rallies 10% but shorts still holding onto positions

- Marine fleet operators and Singapore app developer among the most shorted in Apac

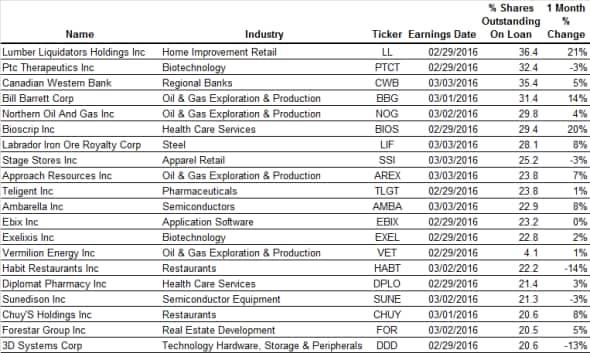

North America

Most shorted ahead of earnings this week in North America is Lumber Liquidators with 36% of shares outstanding on loan. Shares in the laminate floorer first plunged in 2015 after reports of excessive levels of formaldehyde were found in the company's laminates.. Shares have fallen 70% in the past 12 months.

Shares have recently come under renewed pressure as a U.S federal agency report exposed that some types of the company's flooring were more likely to cause cancer than was previously estimated.

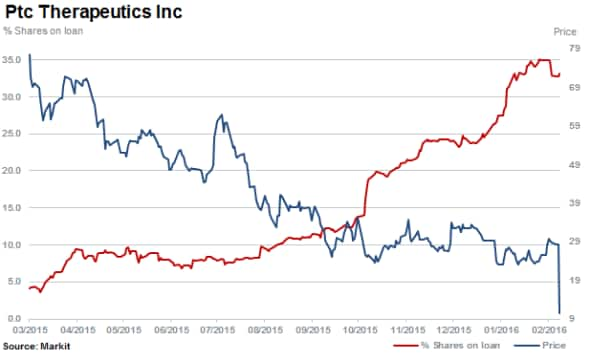

Second most shorted ahead of earnings is Ptc Therapeutics with 32% of shares outstanding on loan. The company saw shares fall almost 60% this week after the company received a 'refuse to file' letter from the FDA regarding Trnaslarna, a therapy treating muscular dystrophy.

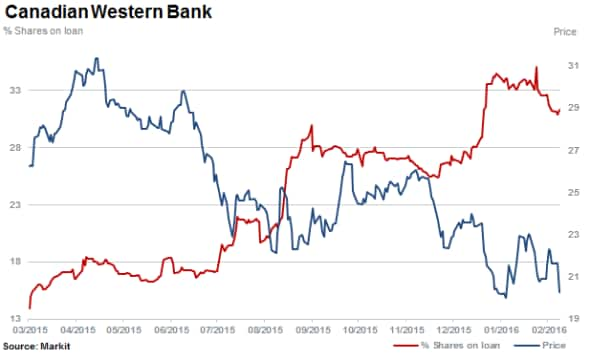

Shares have slid by a fifth in the last three months for Canadian Western Bank which continues to attract high levels of short interest with 31% of shares outstanding on loan as short sellers target a potential bubble in Canadian property.

Lastly, the fifth most shorted stock in North America is oil and natural gas company Bill Barrett with 31% of shares outstanding on loan. Shares are down 85% over the past 12 months.

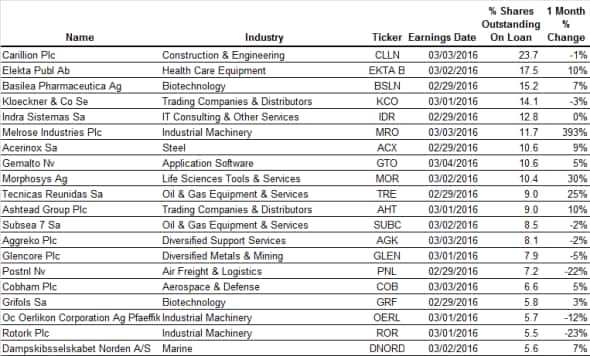

Europe

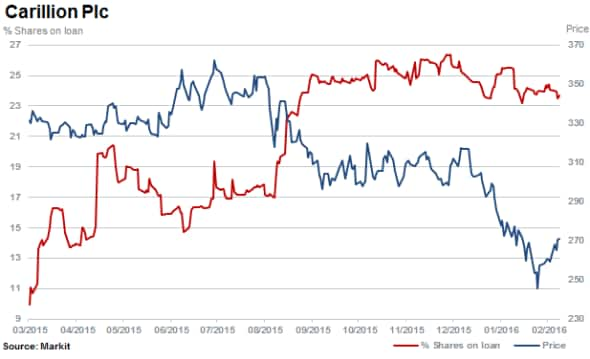

Most shorted ahead of earnings in Europe is construction services group Carillion with a quarter of its shares outstanding on loan. Carillion is currently the most shorted stock across the FTSE 100 and 250. Even after an impressive 10% rally in shares over the past few weeks there has been minimal covering of short positions as average shares out on loan declined by only 1%.

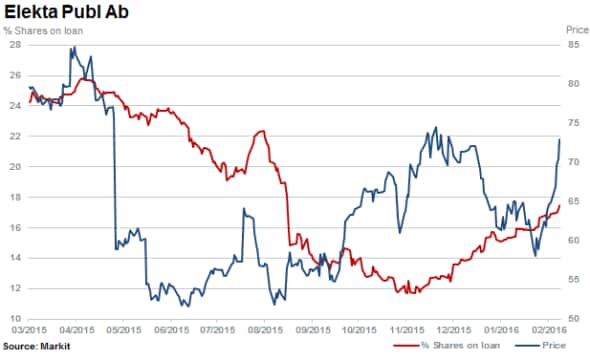

Second most shorted in Europe is cancer care firm Elekta with 18% of shares outstanding on loan. Short sellers have once again begun to build positions in the stock with short interest up by 50% in the past three months despite a recent 25% rally.

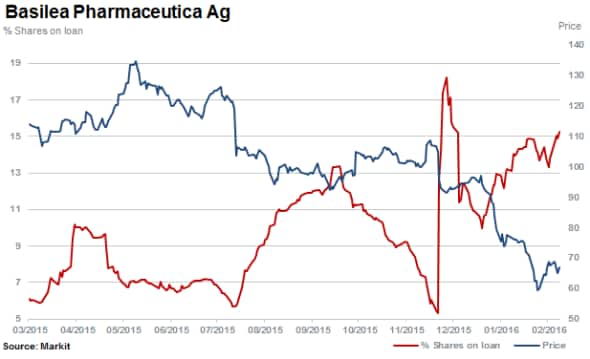

Shares in Swiss based developer of antibiotics and oncology drugs Basilea, have fallen by 40% over the last 12 months. The firm has also seen an increase in short interest which has doubled in the past three months.

Kloeckner and & Co returns to the most shorted ahead of earnings in Europe. Although short sellers have continued to cover positions with 16% of shares currently outstanding on loan, having declined 30% over the past six months.

Apac

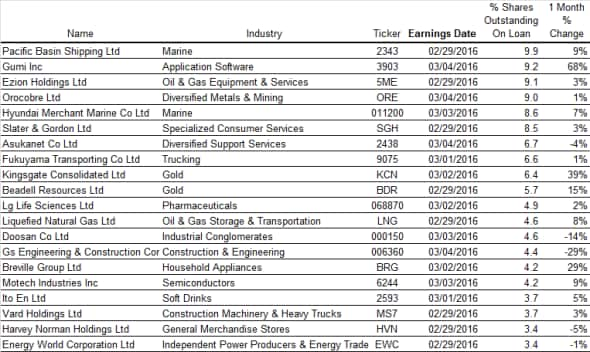

Most shorted ahead of earning in Apac is Pacific Basin Shipping with just fewer than 10% of shares outstanding on loan. The owner and operator of Supramax dry bulk and modern Handysize ships has seen shares outstanding on loan decline over the past 12 months as shorts continue to take profits. Shares in the firm have declined by 56% in the last six months alone.

Second most shorted is Singapore and Philippines based mobile game developer Gumi. The company has recently seen a sharp spike in short interest ahead of earnings, reaching 9.2% of shares outstanding on loan. Shares in the stock have fallen over 50% in the last three months.

Ezion Holdings with 9% of shares outstanding on loan operates a fleet of special purpose vessels supporting the offshore oil and gas industry. Shares have fallen 53% in the last 12 months with short interest 8% higher on the year currently.

Third most shorted is Australian listed, Argentinian based chemicals and minerals company Orocobre. With 9% of shares outstanding on loan the firm has seen short interest double in the last three months, while shares have rallied by almost 60%.

To receive more information on Securities Finance, Research Signals, Exchange Traded Products, Dividend Forecasting or our Short Squeeze model please contact us

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}