Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 26, 2015

Market alpha returns but short sellers hold fire

The recent oil price stump has provided more alpha for investors to exploit, but short sellers have shown little appetite to take the other side of the recent all-time highs.

- Average shorting activity in the S&P 500 stays flat for 2015, despite the recent highs

- The energy sector is the only part of the market to see a sustained increase in shorting activity

- ETF investors have reduced their exposure to the S&P 500 overall, but some sectors have seen rising popularity

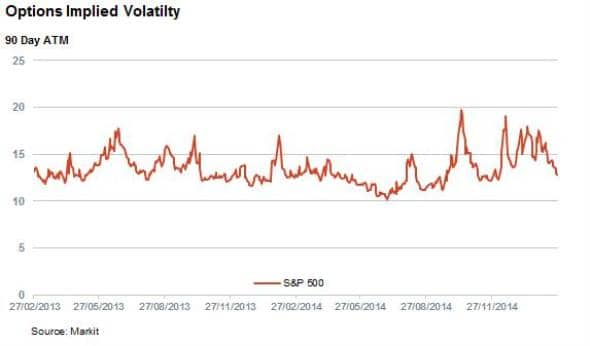

Volatility has returned to the US market over the last three months. Despite an initial stumble which saw the S&P 500 slump by over 3% in the first month of the year, February's strong 6% rebound has seen the market continue its all-time high streak.

The recent bout of volatility has been identified by the in the options market as 90 Day At The Money Implied Volatility for options written against the S&P 500 index , a measure of market volatility, has spent the opening six weeks of the year above the 14% mark, their longest such stretch since the start of 2013. This marks a departure from the trend seen last year when new market highs prompted falls in options implied as tracked by Markit Daily Volatility.

Alpha returns to the market

The recent market swings have also differed from previous instances as the current volatility has seen shares move more independently from each other in the last few months than at any time in the previous couple of years. The standard deviation of monthly returns across the constituents of the S&P 500, a measure of the disparity of individual stock returns in the current market, has averaged 0.067% in the opening two months of the year; over a third higher than the 0.055% averaged in 2014 and 2013.

This increased disparity of returns, driven in large part by the fallout from the collapse in oil prices and rising dollar, has made the current market environment more favourable for stock pickers compared to the last two years. The current market volatility is a long way off the financial crisis highs, but still provides plenty of scope for stock pickers to beat the market.

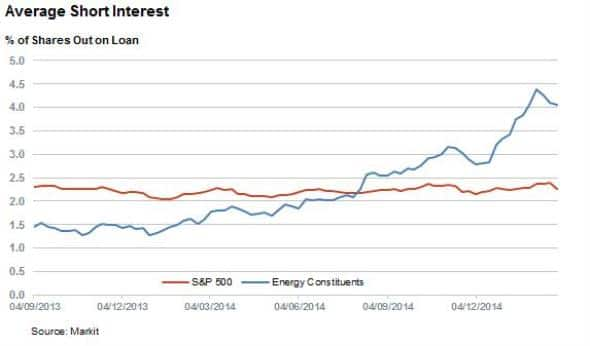

Short sellers not betting on alpha

Short sellers have not shown much interest in taking advantage of the increasingly fertile ground for stock pickers as evident by the flat average short interest number in the market. The average percent of shares out on loan across the S&P 500 has stood still at 2.3% of shares outstanding for the last three months.

Despite the flat average demand to borrow figure, some sectors have seen increased short interest, most notably the energy sector where average short interest across the 45 constituent firms has jumped by 5% since the start of the year to hit 4.3% of shares outstanding. This rise, largely driven by Peaboby Energy, Helmerich and Southwestern Energy, now makes the energy sector the second most shorted component of the S&P 500, behind the much smaller telecommunication services.

Investors shun broad market exposure

One trend that has become evident during the recent spike in alpha has been a shunning of broad sector exposure by ETF investors. A review of the US listed ETF products that track the S&P 500 and its constituent sub-indexes shows that the 25 funds that track the entire index, including the SPDR S&P 500 ETF, experienced $26.4bn of outflows in January. This marks a record outflow for the asset class and could indicate that investors have started to pull out of these beta driven products for higher alpha strategies.

In addition, funds that offer a relatively narrow exposure to component sectors of the index have attracted over $320m of inflows in the opening weeks of the year; putting them on track for a record quarter.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-equities-market-alpha-returns-but-short-sellers-hold-fire.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-equities-market-alpha-returns-but-short-sellers-hold-fire.html&text=Market+alpha+returns+but+short+sellers+hold+fire","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-equities-market-alpha-returns-but-short-sellers-hold-fire.html","enabled":true},{"name":"email","url":"?subject=Market alpha returns but short sellers hold fire&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-equities-market-alpha-returns-but-short-sellers-hold-fire.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Market+alpha+returns+but+short+sellers+hold+fire http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-equities-market-alpha-returns-but-short-sellers-hold-fire.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}