Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 26, 2015

Turkish credit not reflecting lira slide

The recent collapsing lira has not turned investors away from dollar denominated debt issued by Turkish corporates.

- The Markit iBoxx USD Corporates Turkey Index asset swap rate has stayed flat at 300bps over the last eight months

- CDS spreads have also remained steady in the index constituents

- Credit investors have been less forgiving of domestic debt, as Turkish sovereign CDS spreads have widened by 35bps from last November

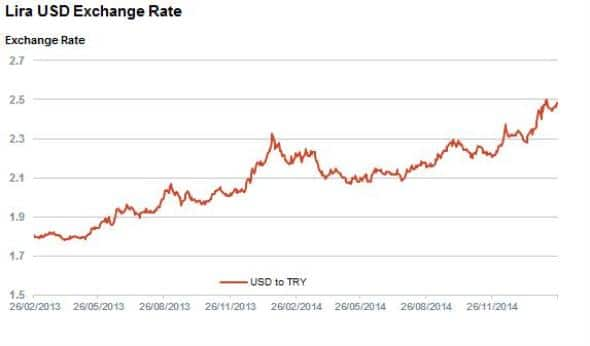

The recent tension between Recep Tayyip Erdogan, Turkey's newly elected president, and the country's central bank has exacerbated the slide in the country's already weakened currency against the dollar. The president's repeated calls for Turkey's central bank to cut its benchmark in order to encourage growth has pitted him against the notionally independent central bank which has kept rates high in order to defend the lira in the foreign exchange markets.

The markets look to siding with Erdogan as the eventual winner of this tussle as evident by the fact that the lira hit its lowest point in over ten years against the dollar on February 11th when it hit 2.5 against the US dollar. This is the result of a culmination of a 38% slide against the dollar since the middle of 2014 when the US first started to tighten its monetary policy.

Bonds not reflecting lira swings

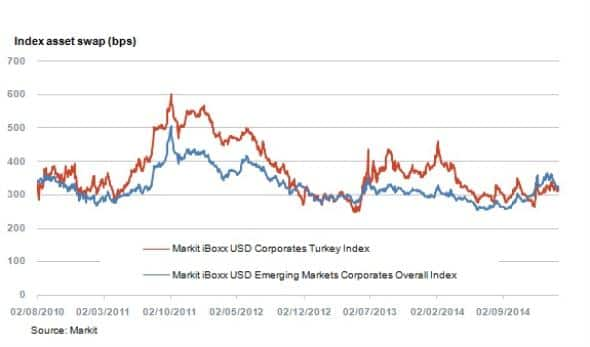

Despite the lira's recent slide, dollar denominated bonds issued by Turkish companies have held relatively steady in recent weeks. The return spread of Markit iBoxx USD Corporates Turkey Index has remained steady in the 300bps range since the start of the year. This steady spread indicates confidence by credit markets that the issuing institutions will be able to meet the increased cost of their debt in lira terms.

This market calm contrasts with the previous bout of lira weakness in the second half of 2013 which saw the extra yield required by investors to hold dollar debt issued by Turkish institutions over reference US treasuries jump by one third to hit 400bps.

The recent fall oil prices may also be providing some stability to Turkish credit, as Turkey is highly dependent on imported energy.

This tailwind is represented in the fact that Turkish credit now trades roughly in line with the rest of emerging market dollar denominated credit. The spread difference between the Turkish iBoxx index and the Markit iBoxx USD Emerging Markets Corporates Overall Index, which has many more energy constituents, has evaporated from a 40bps premium last summer.

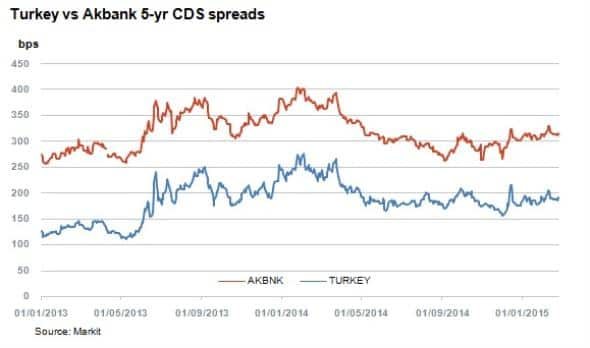

CDS spreads hold steady

Credit markets have also held steady during the recent period of lira weakness. Akbank, whose various bond issuances make up 12% of the iBoxx USD Corporates Turkey Index, has seen its CDS 5 year spread hold in the 300bps range since the start of the year.

The remainder of the constituents of the index have also exhibited the same trend, although with low liquidity.

Sovereign spreads widen

One aspect of the CDS market that has shown signs of widening in the wake of the political spat has been sovereign Turkish credit. 5 year CDS spreads for sovereign Turkish credit have widened by 35bps since the start of December, possibly reflecting unease about the increasingly militant tone struck by Erdogan against the country's central bank.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-credit-turkish-credit-not-reflecting-lira-slide.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-credit-turkish-credit-not-reflecting-lira-slide.html&text=Turkish+credit+not+reflecting+lira+slide","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-credit-turkish-credit-not-reflecting-lira-slide.html","enabled":true},{"name":"email","url":"?subject=Turkish credit not reflecting lira slide&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-credit-turkish-credit-not-reflecting-lira-slide.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Turkish+credit+not+reflecting+lira+slide http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-credit-turkish-credit-not-reflecting-lira-slide.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}