Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 26, 2015

Tech vulnerability to strong dollar

Despite broadly outperforming the market over the last six months, US listed tech shares are disproportionally exposed to international revenues, which could be impacted by the rising dollar.

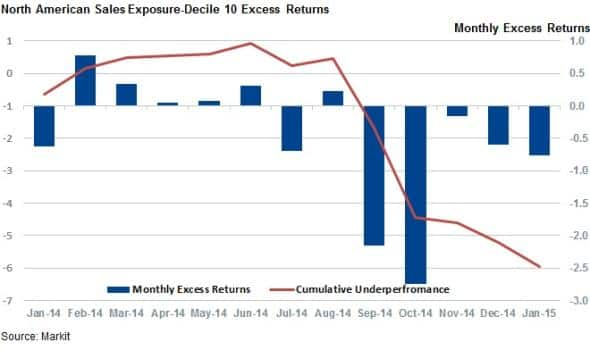

- The recent dollar index spike has seen the US listed companies with the least North American sales exposure under perform their peers by 7% in the last five months

- Technology shares make up over a third of the decile group with the least onshore revenue in the US

- Short sellers have added to their positions in firms exposed to international revenues over the last six months

The recent central bank actions globally have seen the value of the dollar soar to recent highs against many of its most important trading pairs. The dollar index, a weighted exchange rate calculation of the US dollar against its major trading partners hit a ten year high last week after rising by over 18% from where it stood at the end of last summer.

This trend looks set to continue as the strengthening US economy raises the pressure on the US Federal Reserve Bank to raise interest rates, while continuing weakness offshore raises the prospects of the US treading a lonely path on the road to monetary tightening.

While the jury is still out as to whether the strengthening dollar is a good thing for the global economy, its continued climb will no doubt be a thorn in the side of US exporters, which face the prospect of losing ground to their foreign rivals.

Exposed shares underperform

Markets appear to have taken notice of the recent strength in the dollar and the subsequent operational challenges it poses to export reliant firms, as the 10% of companies which derive the lowest proportion of their revenues from within North America have seen their shares underperform the rest of the market, according to Markit's research signal North American Sales Exposure Factor.

This factor ranks firms according the proportion of their business derived in North America, and has seen the 10% of shares with the least domestic exposure - essentially the ones which derive the majority of their revenue offshore - underperform the rest of the market by 7% in the last five months. This trend emerged in September and has carried on in the subsequent five months as the dollar continued to gain strength on its trading partners.

While correlation does not necessarily point to causation, there is a logical link between a rising dollar and headwinds for the firms whose business is the most exposed to the currency moves.

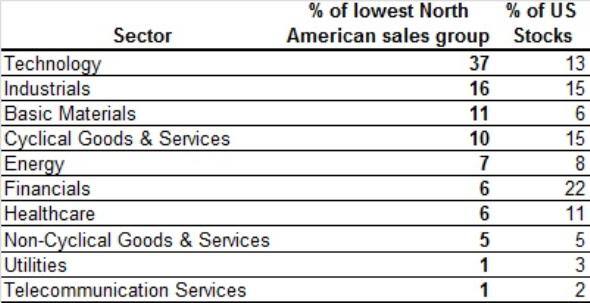

Tech features prominently

The one sector that is arguably the most exposed to the rising dollar is technology as the sector is by far the best represented among the group of shares with the least North American sales exposure. These firms comprise over a third of the companies with the least percentage of their revenues from North America, despite making up only 13% the US stock universe.

While many of these companies, such as semiconductor manufacturers, such as Boadcom and Qualcomm, have a natural hedge against the dollar as US consumers make up a large part of the end user base, currency fluctuations have seen several firms adjust their international strategies.

Tech firms have generally performed in line with the rest of the market in recent months, if the Nasdaq composite is anything to go by. But the rising dollar has the potential to give foreign companies an edge over their US competitors, which could drag on results in the coming year.

Short sellers add to their positions

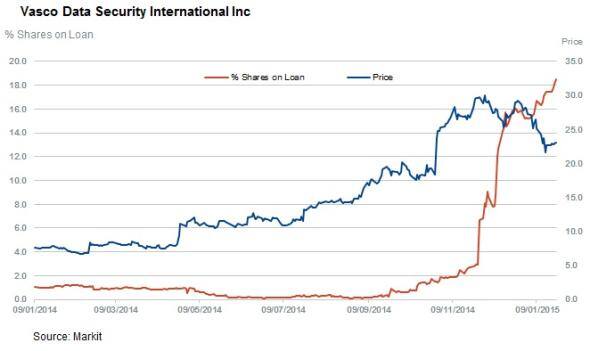

Another measure of negative sentiment towards firms with a large proportion of non-North American revenue is highlighted by the fact that short sellers have added to their average positions in the companies with the highest international sales. These firms have seen average short interest spike up by 4% in the last six months whereas the overall US group has seen average 2% covering.

The company seeing the largest spike in short interest in the universe is Vasco Data Security which has seen over 18% of its shares sold short in the last six months. The firm has over 90% of its revenue offshore which earns it the second worst North American Sales exposure rank.

Vasco has been the exception in the tech space as short sellers have not shown a large appetite towards shorting the sector in the last six months as evident by the fall in average % of shares out on loan over this period.

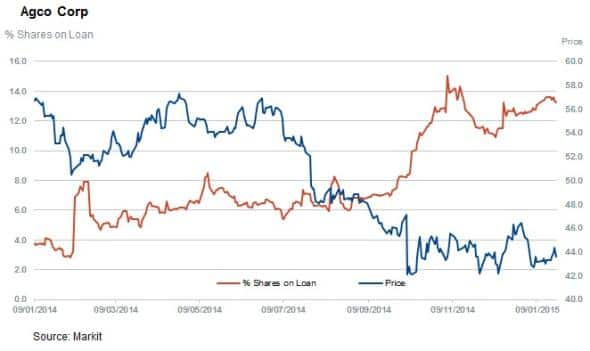

The one sector that short sellers have been more active in is the industrials sector, with capital goods firms seeing large increases in average short interest. One such firm is AGCO, which supplies agricultural equipment and has seen short interest more than double in the last 12 months to 13% of shares. This was most likely encouraged by the fact that the firm derives nearly 75% of its revenues from outside North America.

Simon Colvin, Research Analyst at Markit

Posted 26 January 2015

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26012015-Equities-Tech-vulnerability-to-strong-dollar.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26012015-Equities-Tech-vulnerability-to-strong-dollar.html&text=Tech+vulnerability+to+strong+dollar","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26012015-Equities-Tech-vulnerability-to-strong-dollar.html","enabled":true},{"name":"email","url":"?subject=Tech vulnerability to strong dollar&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26012015-Equities-Tech-vulnerability-to-strong-dollar.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tech+vulnerability+to+strong+dollar http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26012015-Equities-Tech-vulnerability-to-strong-dollar.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}