Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 25, 2016

Most shorted ahead of earnings

A look at how short sellers are positioning themselves in companies announcing earnings in the coming week

- Short sellers take aim at Smith & Wesson post-election

- Elekta sees resurgence in demand to borrow its shares heading into earnings

- Australian firms TFS and Metcash both have more than 10% of shares on loan heading into earnings

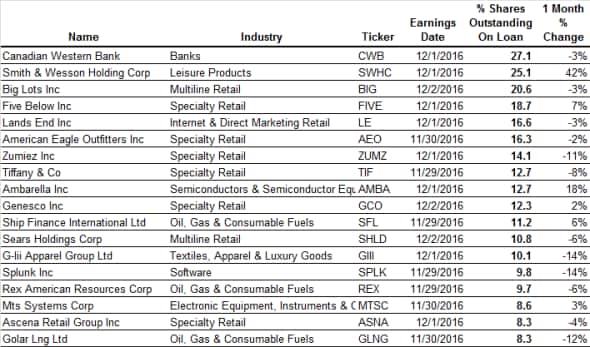

North America

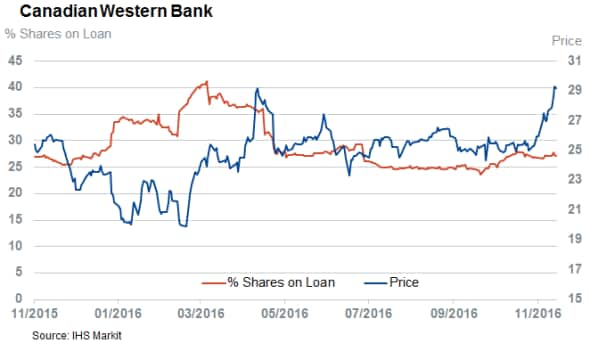

Canadian bank Canadian Western is the most shorted company announcing earnings in North America this week. The mortgage lender had come under severe pressure from short sellers earlier in the year as investors worried about the impact of falling oil prices as the company was relatively overexposed to loans made to the energy industry as well as the wider energy dependent Alberta economy. These fears have subsided somewhat in recent month and demand to borrow the company’s shares, which had stood as high as 40% of Canadian Western’s shares, has fallen by a third. The remaining shorts, which still represent over a quarter of Canadian Western’s shares, are also feeling the impact of the post US election equities rally as the firm's shares have rallied by more than 10% to a new yearly high in the last two weeks. Short sellers are still holding relatively steadfast in light of the recent rally as demand to borrow Canadian Western stock has stayed flat in the last month.

Oil shorts have shown no such resolve in light of recent surges in Rex Resources and Golar LNG which have both seen sustained covering in the last four weeks.

Short covering has definitely not been the case in the second most shorted company announcing earnings this week, gunmaker Smith & Wesson, as demand to borrow the company’s stock has surged by more than 40% in the last month. The US election has also played a key role in driving short seller behavior in this name as investors realized that gun control wouldn’t feature high on a Republican congress’s agenda. Previous efforts to control gun sales in North America had perversely driven gun sales higher as consumers tried to get ahead of possible limits. Short sellers are betting that the 15% slump in Smith & Wesson shares seen in the wake of the election will continue as consumers no longer feel the need to get ahead of gun control legislation. Smith & Wesson was arguably the most successfully short position to come out of the surprise election as its short interest had tripled in the weeks leading up to the election.

Retailers continue to feature heavily in the most shorted ahead of earnings list as Big Lots, Five Below and Lands’ End round out the list of the five most shorted companies announcing earnings this week.

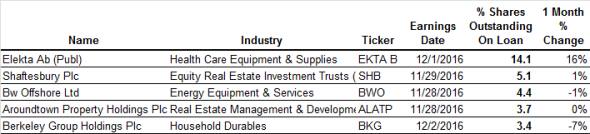

Europe

Perennial short Elekta is the most shorted European company announcing earnings this week by a factor of three. The cancer and neuroscience firm has seen a 16% jump in short interest in recent weeks after the US International Trade Commission delivered an initial determination that some of Elekta’s radiotherapy technology infringed on patents held by competitor Varian.

Real estate firms make up three of the remaining four high conviction short positions announcing earnings this week, led by UK REIT Shaftsbury. The owner of several West End freeholds has come under scrutiny from short sellers after the Brexit referendum as investors looked for liquid alternatives to play the UK real estate market. Short sellers have continued to play an active part in Shaftsbury despite a recovery in its share price which has seen it bounce back above its pre referendum result.

London property developer Berkeley has not enjoyed such a recovery, but short sellers have not shown the same desire to keep their positions open as the current demand to borrow its shares is roughly half the levels seen over the recent highs.

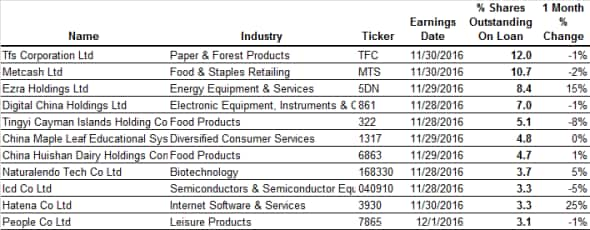

Asia

Australian sandalwood producer TFS Corporation is the most shorted Asian firm announcing earning in Asia this week as it has 12% of its shares out on loan. This current demand to borrow represents an all-time high for the firm as it has more than doubled in the last three months.

Retailer Metcash is the other very high conviction short announcing earnings this week. Although still very high, the appetite to sell Metcash share short is severely diminished from there it stood last year when over 25% of its shares were out on loan to short sellers.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}