Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 25, 2014

Retailers on short seller holiday list

Shorts have been actively adding to their position in the run up to the crucial holiday shopping season, but a closer look sees that shorting activity is concentrated towards a minority of shares.

- Average short interest across S&P 500 retailers is up by 50% year to date

- The recent surge is driven by three names which have recently faced operational headwind

- ETF investors have been adding to their US retail exposure at the greatest pace in five years

The US holiday shopping season goes into full swing this week with the post Thanksgiving "Black Friday" shopping extravaganza as shoppers shake off their post turkey blues to grab early bargains. Consumer spending in the four weeks leading up to Christmas will show whether US households have felt much of the recent economic lift - which has seen the US surge ahead of the rest of the world in recent months.

While unpredictable weather could put a damper on early trading, the recent fall in gas prices combined with an improving wage picture bodes well for retailers coming into the most crucial period of the year.

Shorts up but not across the board

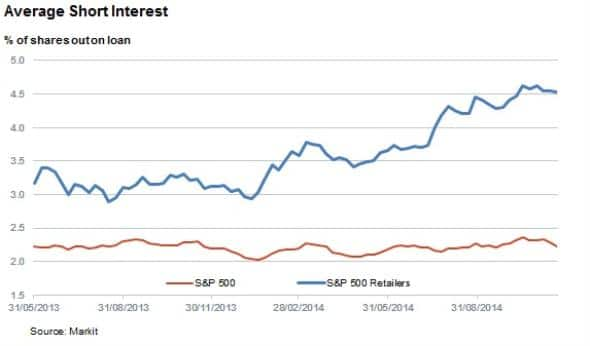

Despite what many would see as positive momentum coming into the holiday shopping season, average short interest across the 30 retailers in the S&P 500 now stands at 4.5%, 50% higher than at the start of the year. These retailers see twice the average short interest relative to other constitutents.

This number seems to indicate an increase in bearish sentiment across the sector coming into the holiday shopping season. However, on closer inspection of the numbers, shorting activity and much of the recent increase is driven by a few names which have had some recent operating challenges. This is evident by the fact that the three most shorted companies in the index make up over 40% of shorting activity. Last year, average short interest coming into the holiday shopping season was more evenly spread across the sector.

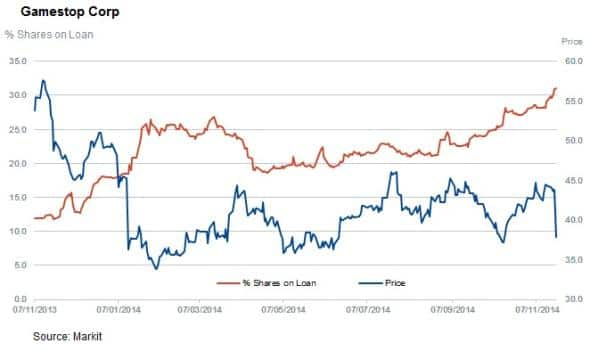

Driving this trend has been video game retailer GameStop, which has seen short interest shoot up in recent weeks to 30% of shares outstanding marking a new yearly high.

This surge in demand to borrow seems to be driven by the fact that primary sales from the latest batch of consoles has not lived up to expectations. The company is also facing increased competition in the games sales market with consoles increasingly offering players the ability to download games directly, as well as retail giant Walmart's recent move into the second hand game market.

The other two retail companies that see significant demand to borrow are auto accessories retailer CarMax and department store firm Kohl's. Both have seen demand to borrow increase significantly in recent weeks in the wake of earnings announcements which failed to live up to analyst expectations. In fact, both these firms have peers which have recently posted strong earnings announcements which have sent shorts covering.

Large firms not targeted

The largest retail constituents of the index have seen little in the way of short selling. HomeDepot and Target both saw shorts cover after posting better than expected revenues in their latest quarterly results, which have sent shares up sharply.

While not a pure retailer, Walmart has also seen better than expected numbers which have sent its shares up to all time high levels.

ETF investors eager to gain exposure

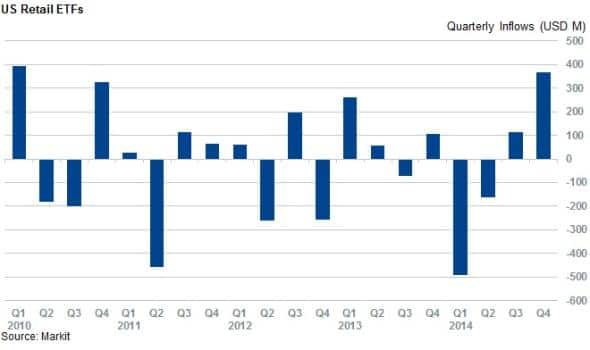

ETF investors are equally bullish about retailers coming into the holiday shopping period. The three ETFs which target the sector have seen large inflows in the last few weeks. These ETFs have seen $367m of inflows since the start of October, putting them on track for their best quarterly inflow in over five years.

This looks to have been a well timed move as SPDR S&P Retail ETF, the largest retail exposed ETF has outperformed the broader S&P 500 ETF by 4.7% since the start of the quarter.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112014-Equities-Retailers-on-short-seller-holiday-list.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112014-Equities-Retailers-on-short-seller-holiday-list.html&text=Retailers+on+short+seller+holiday+list","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112014-Equities-Retailers-on-short-seller-holiday-list.html","enabled":true},{"name":"email","url":"?subject=Retailers on short seller holiday list&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112014-Equities-Retailers-on-short-seller-holiday-list.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Retailers+on+short+seller+holiday+list http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25112014-Equities-Retailers-on-short-seller-holiday-list.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}