Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 25, 2016

Bears miss out on social media payday

Social media shares have borne the brunt of the recent market selloff but few short sellers are lining up to short the market despite its recent underperformance as tracked by the Global X Social Media ETF (SOCL).

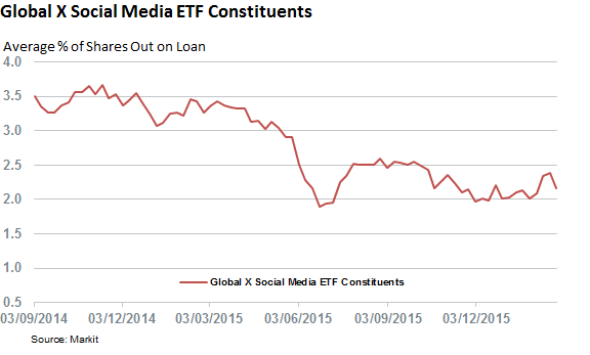

- SOCL constituents saw short interest hover at two year lows prior to selling off heavily in 2016

- Only seven SOCL constituents see more than 3% of their shares out on loan led by Pandora

- Investors have withdrawn over a quarter of SOCL's AUM since the start of the year

Social media companies make up half of the once hotly tipped but now largely discredited, "FANG" trade of fast growing tech companies with a global presence. The market's recent shunning of these high flying mercurial shares, spurred on by a spate of disappointing tech earnings and wider fears surrounding the health of the global economy means that every one of the acronym's four constituents are trading over 10% off their recent highs.

The headwinds faced by the sector's flagship stocks are reflected in the overall sector as the Global X Social Media ETF (SOCL). hit a two and a half year low earlier this month. While the fund has rebounded somewhat in the last 10 days, it is still down by 13% ytd which is more than twice the fall seen by the rest of the market.

The headwinds felt by the sector have been relatively universal as eighty percent of the ETF's constituents have seen their shares retreat year to date.

Collapse catches short sellers out

This recent collapse of the once popular trade looks to have caught short sellers out as the ETF's constituents entered 2016 with a below average short interest. In fact, demand to borrow the fund's constituents fell by over a third last year and short interest stood near a two year low prior to the selloff. This indifference towards social media shares runs against that seen in the rest of the market where short selling stands at multi year highs.

While there has been a 7% increase in demand to borrow social media shares since the start of the year, that number also trails the increase in shorting activity seen in the S&P 500 where average short interest is up by double digits since the start of the year.

Lack of appetite universal

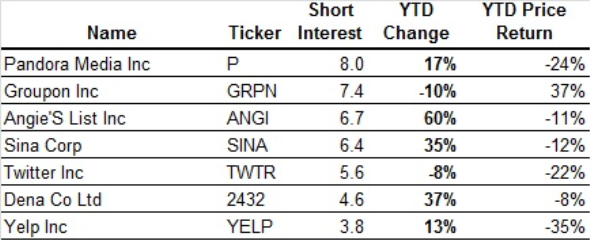

As with the fall in share prices, the lack of appetite to sell social media shares short is fairly universal as only seven of SOCL's constituents see any material short interest as defined by having more than 3% of shares out on loan.

Pandora is the most shorted of the lot with 8% of its shares now out on loan. Its shares have fallen by a quarter as investors' fret about the company's prospects in an increasingly crowded streaming field.

Ironically, Groupon which was the highest conviction short at the start of the year has become a painful short as its shares surged following Alibaba's disclosed stake in the online discounter. Short sellers have covered 10% of their positions as their trades went against them.

The only firm to see a material rise in short interest across the field since the start of the year has been LinkedIn after its shares nearly halved in the wake of a disappointing earnings update. While short interest in the professional social media firm has since quadrupled, the 2.1% of LNKD shares now out on loan is still less than that seen at the start of 2015.

Investors not buying dip

Investors in SOCL have shown little patience to ride out the recent volatility as over $32m of funds have flowed out of the ETF since the start of the year. These strong outflows represent over a quarter of the AUM managed by the fund at the start of the year which underscores the wave of negative sentiment felt by the sector since the start of the year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-Equities-Bears-miss-out-on-social-media-payday.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-Equities-Bears-miss-out-on-social-media-payday.html&text=Bears+miss+out+on+social+media+payday","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-Equities-Bears-miss-out-on-social-media-payday.html","enabled":true},{"name":"email","url":"?subject=Bears miss out on social media payday&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-Equities-Bears-miss-out-on-social-media-payday.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bears+miss+out+on+social+media+payday http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-Equities-Bears-miss-out-on-social-media-payday.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}