Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 25, 2015

Low yields drive covered bonds innovation

The extra yield and relative safety offered by covered bonds has proved a hit with investors over recent years, but the recent ECB driven rally has squeezed yields.

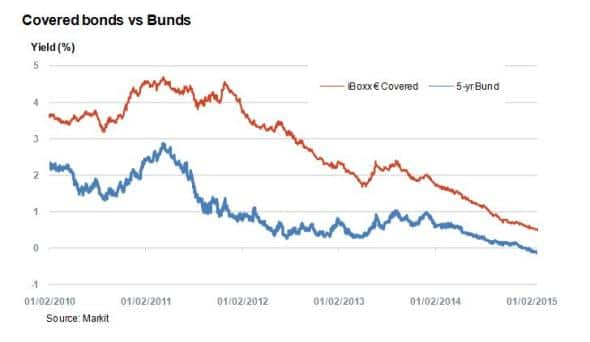

- Three rounds of European asset purchases have seen the yield of the iBoxx € Covered index fall to five year lows

- The iBoxx € Covered index now yields 61bps over five year bunds, down from 300bps in 2012

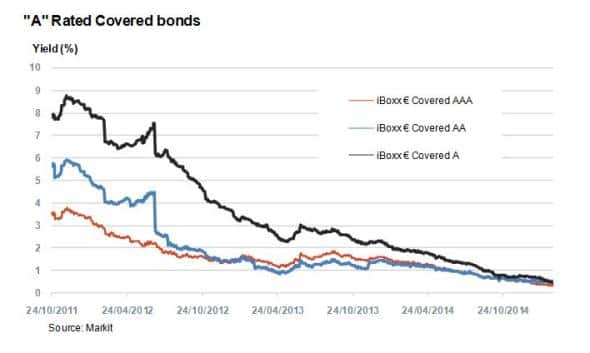

- Investors haven't shown much concern for credit ratings as all three "A" rated iBoxx sub indexes trade in line with each other

Danske Bank, an AAA rated Danish bank, today set pricing on its latest €1bncovered bond offering. At mid swaps minus 2bps, the deal was almost twice over subscribed. The tight spreads have been representative of covered bonds this year, as investors look for yield among safe assets.

A popular form of bank debt in Europe and a key funding instrument, covered bonds have several distinct features that set them apart from regular debentures. They are a secured form of debt, collateralised by a high quality asset pool usually made up of residential mortgages or public sector loans. Sitting higher on the capital structure than senior unsecured debt, the bonds also offer full recourse to the credit institution. This is all subject to supervision and regulation under a general or special law based framework.

Based on this structure, it's easy to see why over the past 200 years, not a single covered bond has ever defaulted. Even during the financial crisis of 2008, the bonds remained resilient, even in the worst hit mortgage markets in Europe.

Covered bonds also gain from being defined by regulators as high quality liquid assets which are therefore looked upon favourably by European bodies, such as the Basel liquidity framework.

Yields slide

In October last year, the ECB implemented its third covered bond purchase programme in an attempt to further inject liquidity into the market in midst of a stalling economy.

Since then, yields on the iBoxx € Covered index have dropped significantly to a five year low of 0.49%. The index, which has an average maturity of 4.8 years, provides around a 61bps premium over 5 year bunds, which have been in negative territory since the ECB decided to launch full QE at the end of January. This spread has been largely consistent of late but reached as high 300bps during the European sovereign risk crisis in 2011.

The compression of yields has led some to believe that a zero coupon covered bond is on the horizon. Already in February we have seen the level tested with Nord/LB issuing four year notes at 0.025%.

Risk converging

An interesting development over the last few years has been the convergence in yields between the top rated covered bonds in Europe. The current yield spread between the iBoxx € Covered AAA and the iBoxx € Covered A stands at 14bps, the tightest it has ever been and down from 70bps a year ago, suggests investors are starting to judge all A and above rated covered bonds as the same in risk terms. This distortion coincides with the ECB's stimulus programmes.

The trend also illustrates how sovereign risk had big part to play when covered bonds were shunned in 2011 and 2012 when yields topped over 4% for AAA ratings. Many peripheral countries were downgraded and subsequent credit institutions and their debt, including covered bonds, was also downgraded.

Innovation required

Today's low yields raise the question of how covered bonds can adapt to attract investors. With investors looking for yield, issuers have started to look at more innovative ways to bundle risk. New types of covered bonds have come to the fore such as those with a conditional pass through structure, or those that offer duel recourse structures backed by pools of SME (Small and medium sized enterprises) loans.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022015-Credit-Low-yields-drive-covered-bonds-innovation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022015-Credit-Low-yields-drive-covered-bonds-innovation.html&text=Low+yields+drive+covered+bonds+innovation","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022015-Credit-Low-yields-drive-covered-bonds-innovation.html","enabled":true},{"name":"email","url":"?subject=Low yields drive covered bonds innovation&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022015-Credit-Low-yields-drive-covered-bonds-innovation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Low+yields+drive+covered+bonds+innovation http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022015-Credit-Low-yields-drive-covered-bonds-innovation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}