Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 24, 2015

ETF currency hedges hit the sweet spot

ECB and FED policy divergence has seen investors increasingly employ currency hedged ETFs to mitigate the impact of currency swings on investment returns

- $1.7bn of inflows month to date into currency hedged products takes ytd flows to $58bn

- Hedged euro ETFs return to form as dollar index surges back to life

- Inflows see US investors bullish on Japan and Europe but wary of further dollar strength

Getting paid to hedge

Monetary easing in Europe and Japan has dampened cross border investment returns in local currency terms but hedged ETF's lure investors as they can still achieve exposure to regional economic recoveries without the associated expected currency risk. Low to negative interest rates in Europe and Japan and expectations that the US will soon raise rates may even see currency hedged strategies outperform their non-currency hedged peers in the near future..

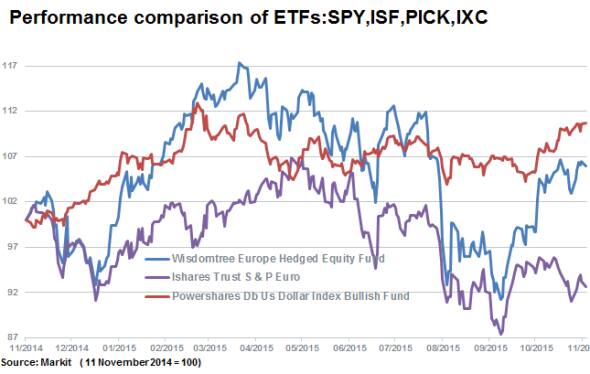

The surge in the Powershares US Dollar Index ETF below (red), which tracks the US dollar versus six major currencies (including the euro and yen); indicates that ETF investors which have hedged exposure would have outperformed in the last month.

Hedged ETF versus the iShares Europe ETF since October.

Hedging flows

The resurgent volatility of the Dollar index has seen investors continue to clamour to currency hedged funds with the asset class gathering over $1.7bn so far in November. This tally adds to a bumper year for currency hedged ETFs as these funds have attracted $58bn of inflows ytd. However, declines in NAV on a net basis have seen total AUM remain flat and the category continues to represent almost 4% of global ETF AUM totalling $120bn.

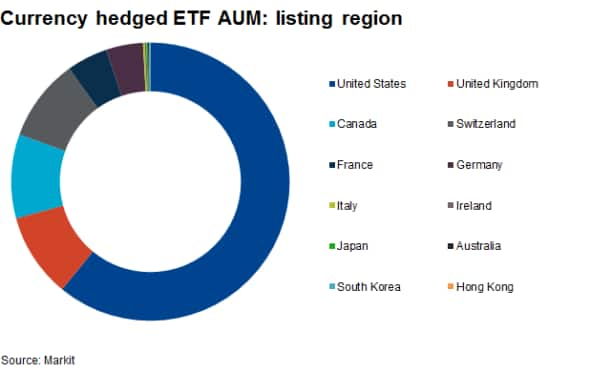

The top regions where investors are taking advantage of hedged products based on AUM by listing countries are the US, UK, Canada and Switzerland. Canada is the relative exception to the rule, but investor demand for currency hedge looks to be driven by its relative closeness to the US given that the great majority of its currency hedged funds have US exposure.

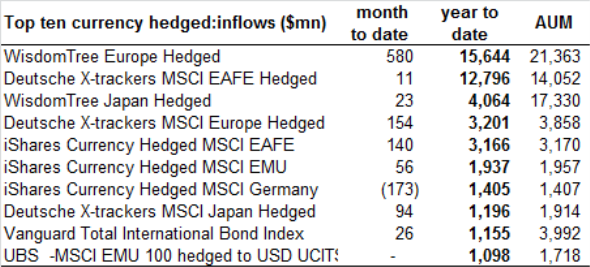

The trend of investors using hedged ETFs to gain exposure to foreign markets, while removing layers of currency risk looks set to continue. ETF issuers, hungry for AUM have consistently launched new products. As ever in the ETF world however three established products have been responsible for the bulk of inflows year to date.

Half the year to date inflows have gone into the WisdomTree Europe Hedged Equity Fund and the Deutsche MSCI EAFE Hedged Equity ETFs. The former provides exposure to Europe but is hedged for any movements between the euro and the dollar while the latter provides exposure to developed markets securities globally with a hedge to currency movements relative to the US dollar (65% exposure to Europe & 34% exposure to Asia).

The continued divergent policies in Europe and the US have seen investors plough even more assets into the Wisdom Tree Europe Hedged fund with the fund seeing $580m of inflows so far this month.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-equities-etf-currency-hedges-hit-the-sweet-spot.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-equities-etf-currency-hedges-hit-the-sweet-spot.html&text=ETF+currency+hedges+hit+the+sweet+spot","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-equities-etf-currency-hedges-hit-the-sweet-spot.html","enabled":true},{"name":"email","url":"?subject=ETF currency hedges hit the sweet spot&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-equities-etf-currency-hedges-hit-the-sweet-spot.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ETF+currency+hedges+hit+the+sweet+spot http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-equities-etf-currency-hedges-hit-the-sweet-spot.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}