Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 24, 2017

US flash PMI surveys show faster growth for second month running in May

Growth of US business activity gained a little momentum for a second successive month in May, but the upturn still looks somewhat underwhelming.

At 53.9, up from 53.2 in April, the headline IHS Markit Flash U.S. Composite PMI Output Index pointed to the strongest upturn in private sector output since February.

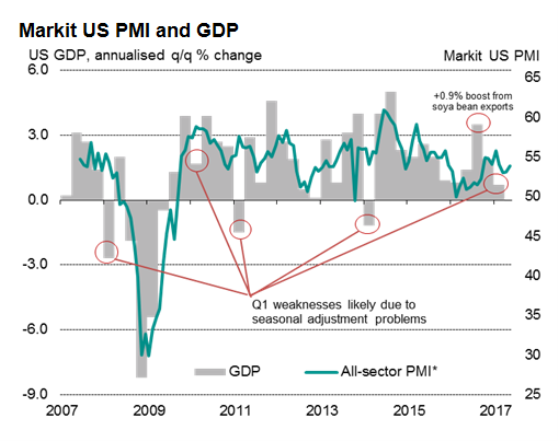

Historical comparisons of the PMI against GDP indicate that the PMI is running at a level broadly consistent with the economy growing at a 0.4% quarterly rate (1.5% annualized). Actual second quarter GDP numbers are likely to be considerably stronger, in part reflecting seasonality in the official data and the weak first quarter.

May saw an encouraging upturn in service sector growth to the fastest so far this year ('flash' index at 54.0), buoyed by rising domestic demand. Manufacturers, on the other hand, reported the smallest rise in production since last September amid lacklustre export sales. The latest 'flash' manufacturing output index reading of 53.3 compares with a recent peak of 56.7 in January and suggests we may see some easing in the official data after the 1.0% rise in production recorded in April .

There were mixed signals for the outlook. Optimism about the year ahead fell slightly, but hiring remained reassuringly solid, thanks to a step-up in service sector recruitment. The survey is indicative of non-farm payroll growth of approximately 160,000.

Average prices charged for goods and services meanwhile showed one of the largest rises in the past two years.

The strengthening of business activity growth and rise in prices will add to expectations of the Fed hiking interest rates again in June.

The IHS Markit PMI data give a reliable advance picture of the underlying trend in GDP data. Times when the survey data have diverged from the official GDP numbers can usually be accounted for by the GDP numbers being distorted, either by residual seasonality or one-off effects such as surge in soya bean exports in the third quarter of 2016.

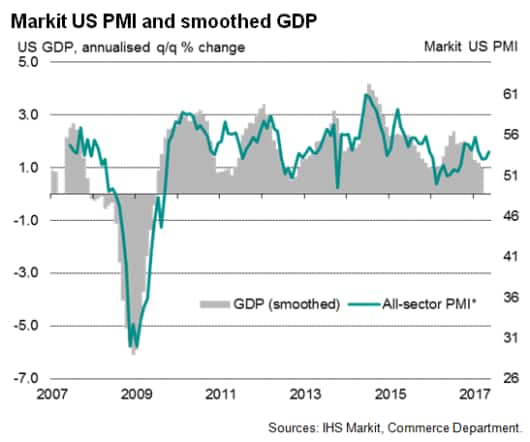

Smoothing the GDP data (using a centered moving average) to remove some of the distortions and residual seasonality reveals a higher correlation (89%) with the PMI and allows easier interpretation of the survey data and underlying economic trend.

The PMI data for January to March were historically consistent with GDP growing at an annualised rate of 1.7% in the first quarter, which compared with an official GDP estimate of 0.7%. For the first two months of the second quarter, the PMI data are signalling an annualised GDP growth of 1.5%.

More charts available in the full report, downloadable below.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-economics-us-flash-pmi-surveys-show-faster-growth-for-second-month-running-in-may.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-economics-us-flash-pmi-surveys-show-faster-growth-for-second-month-running-in-may.html&text=US+flash+PMI+surveys+show+faster+growth+for+second+month+running+in+May","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-economics-us-flash-pmi-surveys-show-faster-growth-for-second-month-running-in-may.html","enabled":true},{"name":"email","url":"?subject=US flash PMI surveys show faster growth for second month running in May&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-economics-us-flash-pmi-surveys-show-faster-growth-for-second-month-running-in-may.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+surveys+show+faster+growth+for+second+month+running+in+May http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-economics-us-flash-pmi-surveys-show-faster-growth-for-second-month-running-in-may.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}