Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 24, 2015

Economic worries mount amid near-stagnation of Japanese manufacturing

A near-stagnation of manufacturing activity in March suggests that Japan's disappointing recovery is once again losing momentum. The latest flash PMI survey data point to renewed weakness after Japan pulled out of a brief recession, induced by last year's sales tax rise, with a 0.4% expansion of GDP in the final quarter of 2014. The survey also indicates a softening of price pressures.

Any growth is focused on the export sector, and Markit's dividend forecasts consequently see the export-oriented auto sector leading the pay-outs this year. However, overall dividend growth is expected to be markedly lower than in 2014 due to the slower pace of economic growth and pressure on profits from higher import costs due to the weak yen, and the outlook could deteriorate further in the absence of more aggressive policy action.

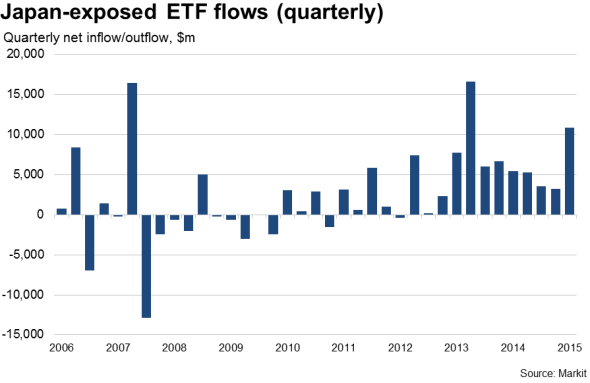

With growth faltering and price pressures cooling, the survey results therefore add further to the likelihood of the Japanese authorities stepping up their stimulus efforts. Investor sentiment has already been buoyed by the Bank of Japan's asset purchase programme, and ETF data suggest Japanese equities in particular found further favour in March. ETFs exposed to Japanese equities have enjoyed a net inflow of $3.7bn so far in March, taking the inflow into Japanese ETFs in the first quarter to $10.8bn; the largest quarterly increase since the second quarter of 2013.

Export-led growth

Markit's Manufacturing PMI fell to a ten-month low in March, according to the flash estimate (based on approximately 85% of all replies expected for the month), signalling the weakest expansion since the sector pulled out of last year's downturn. At 50.4, down from 51.6 in February, the headline PMI fell for a second successive month to signal a near-stagnation of activity in the goods-producing sector.

Goods exports

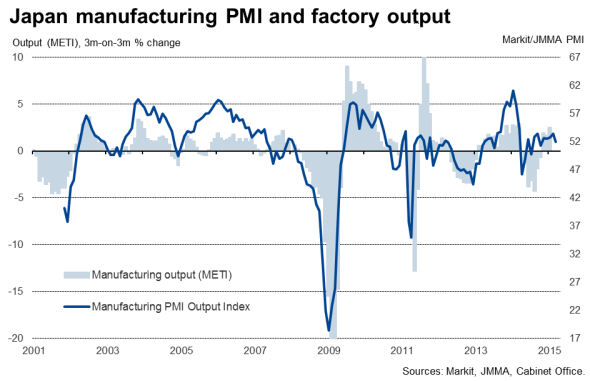

Factory output growth slowed to the weakest since last October, suggesting that the official production measure has likewise declined after the 3.6% monthly gain recorded in January (the latest official statistic available at the time of writing).

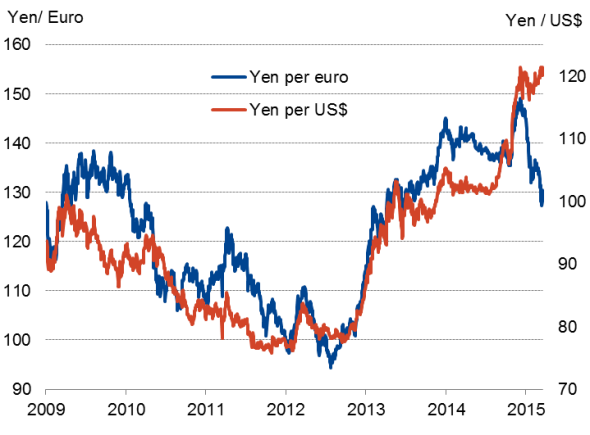

The output trend weakened in response to new orders falling for the first time since May of last year. This deterioration in demand was led primarily by ongoing domestic market weakness. Growth of new export orders also waned from February's 14-month peak, but remained solid by recent standards, buoyed by the yen's depreciation against the dollar. Exports therefore continue to provide the main source of demand for Japanese goods producers.

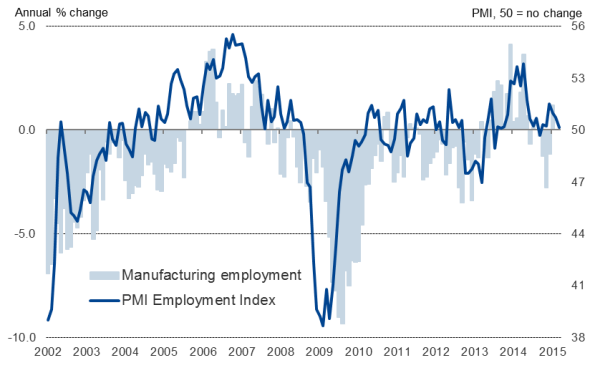

The downturn in order books prompted firms to cut back on job creation, leading to a near-stagnation of employment during the month and the worst hiring trend since last September.

Employment

Price pressures moderate

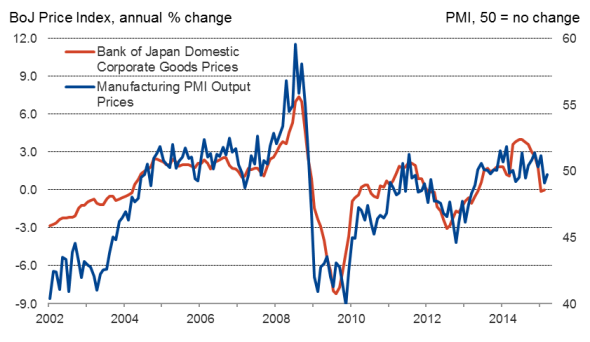

The survey also brought further disappointing news in relation to the government's struggle to drive inflation up to 2.0%. Manufacturers reported the smallest monthly increase in input costs for just over two years, with selling prices dropping (albeit only marginally) for a second month in a row. The inability to raise prices was generally linked to weak final demand.

Corporate goods prices

The near-stagnation of employment also points to a slacking labour market, which will in turn do nothing to reinvigorate a much needed upturn in wage growth.

More stimulus?

There are worries that the Bank of Japan will be reluctant to further expand its asset purchase programme , having already upped its QE programme from "60-70 trillion per year to "80 trillion last October, as the stimulus appears to be having a disappointing impact on the real economy. However, the survey data suggest that more will need to be done in terms of stimulus to avoid Japan sliding back into deflation in coming months, raising the likelihood of fiscal expansion and incentives for employers to raise wages.

Weaker dividend outlook

Even in the absence of further stimulus, the export-boost received from the weaker yen is expected to help Japan's corporate performance this year, albeit with dividends not seeing the same gains as last year. Aggregate dividends from the JPX-Nikkei Index 400 constituents are expected to rise 14% to JPY 7.3t in the fiscal year 2015, compared to 19.3% in 2014, according to Markit's dividend forecasting team.

The Automobiles & Parts sector is forecast to be the top paying sector again, led by Toyota, accounting for 19.3% of the total pay-outs, followed by Industrial Goods & Services (16.6%), and Banks (11.1%).

Exchange rate

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Economic-worries-mount-amid-near-stagnation-of-Japanese-manufacturing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Economic-worries-mount-amid-near-stagnation-of-Japanese-manufacturing.html&text=Economic+worries+mount+amid+near-stagnation+of+Japanese+manufacturing","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Economic-worries-mount-amid-near-stagnation-of-Japanese-manufacturing.html","enabled":true},{"name":"email","url":"?subject=Economic worries mount amid near-stagnation of Japanese manufacturing&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Economic-worries-mount-amid-near-stagnation-of-Japanese-manufacturing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economic+worries+mount+amid+near-stagnation+of+Japanese+manufacturing http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Economic-worries-mount-amid-near-stagnation-of-Japanese-manufacturing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}