Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 24, 2016

US flash PMI signals heightened economic downturn risk

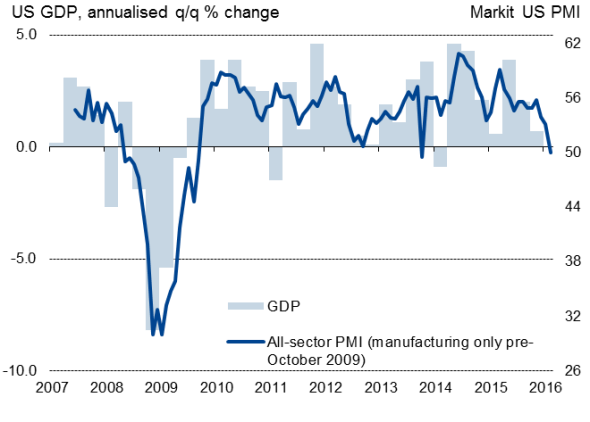

Markit's PMI survey data show a significant risk of the US economy falling into contraction in the first quarter. The flash PMI for February shows business activity stagnating as growth slowed for a third successive month. Slumping business confidence and an increased downturn in order book backlogs suggest there's worse to come.

The composite Output Index from the manufacturing and services PMI surveys sank from 53.2 in January to 50.1 in February, according to the 'flash' releases, which are based on approximately 85% of usual monthly replies.

With the exception of the government shutdown in October 2013, the February reading was the worse since the recession. Business activity in services fell for the first time since the shutdown, accompanying a marked slowdown to near-stagnation in manufacturing.

Markit US PMIs and economic growth

Markit PMI v US GDP (trend)*

* GDP in the second chart above is smoothed and converted into a monthly series by taking the mean of the current month and the preceding and following three month values. This helps take some of the volatility out of the official data as shown in the first chart above.

Weather impact only part of story

It's worth remembering that the month saw adverse weather affecting many parts of the country, so some bounce-back may be seen in March.

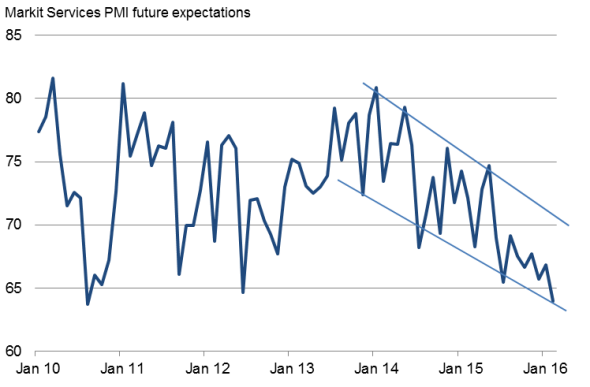

But the weather can only explain part of the slowdown. It's clear that business confidence in the service sector has faltered significantly, reaching the lowest level in five-and-a-half years in February.

Optimism about the outlook has been on a downward trend over the past two years, with worries about the global economic outlook, financial market volatility, the presidential election and interest rate policy all taking a further toll on business morale in February.

Business optimism sinks lower

Backlogs of work - representing orders that each company has received but not yet started or completed - fell for the sixth time in the past seven months, and at the steepest rate since August 2013. Both manufacturers and services providers reported dwindling backlogs of work in February, suggesting both sectors are facing deteriorating demand conditions. Inflows of news business hit a 13-month low in services, while falling exports led to a marked slowing in new orders growth among goods producers.

Prices are falling again as companies compete to win market share; a boon for consumers but adding to the deflationary picture.

The weakening order book situation suggests that any bounce-back from the weather in March may therefore prove to be only a temporary respite to a steady downward trend.

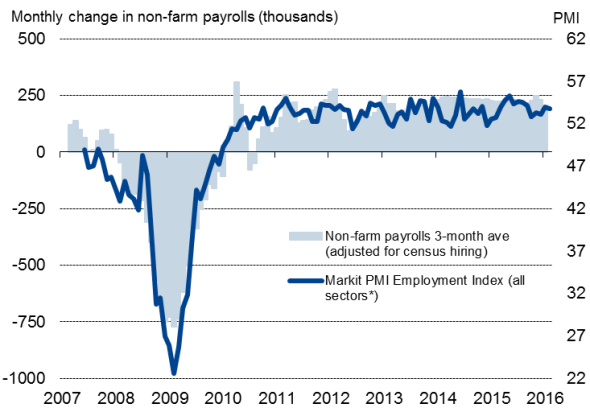

Job creation remained solid

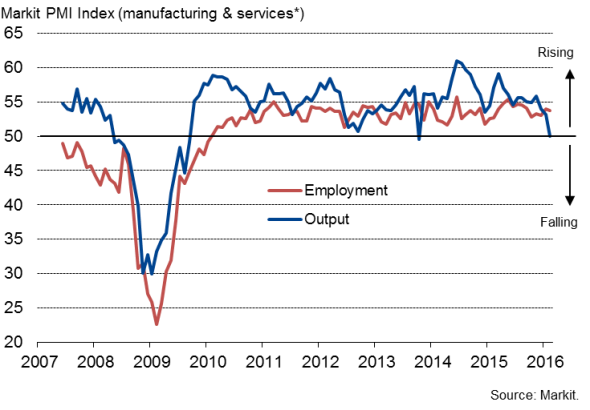

On a brighter note, employment continued to rise at a solid pace according to the February surveys, running at a level consistent with a 200,000 non-farm payroll gain. However, the stalling in growth of business activity alongside the increase in hiring points to a marked deterioration in labour productivity during the month, which in turn suggests that companies may start to cut back on hiring.

Employment

PMI employment and output*

* Manufacturing only pre-October 2009

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-economics-us-flash-pmi-signals-heightened-economic-downturn-risk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-economics-us-flash-pmi-signals-heightened-economic-downturn-risk.html&text=US+flash+PMI+signals+heightened+economic+downturn+risk","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-economics-us-flash-pmi-signals-heightened-economic-downturn-risk.html","enabled":true},{"name":"email","url":"?subject=US flash PMI signals heightened economic downturn risk&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-economics-us-flash-pmi-signals-heightened-economic-downturn-risk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+signals+heightened+economic+downturn+risk http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-economics-us-flash-pmi-signals-heightened-economic-downturn-risk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}