Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 23, 2015

China flash manufacturing PMI" hits lowest since March 2009

China's manufacturing economy contracted at the steepest rate for six-and-a-half years in September, according to survey data. Accelerating job losses, slumping export orders, an unwanted build up of unsold inventories and falling prices add to the downbeat news.

Here are the five key takeaways from the September survey:

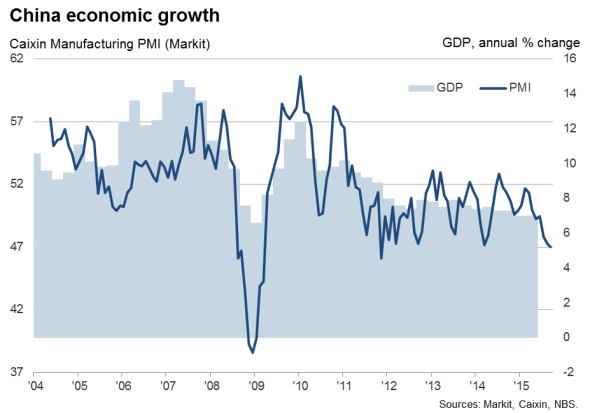

1.Growth has hit a 6 " year low

The headline Caixin China General Manufacturing PMI", compiled by Markit, fell from 47.3 in August to 47.0 in September, according to the flash estimate. The latest reading is the weakest since March 2009, at the height of the global financial crisis. At 47.4, the third quarter average is down sharply from 49.2 in the second quarter and the lowest since the first quarter of 2009. The downturn in the PMI suggests that the pace of economic growth slowed further in the third quarter from the 7.0% annual pace seen in the second quarter.

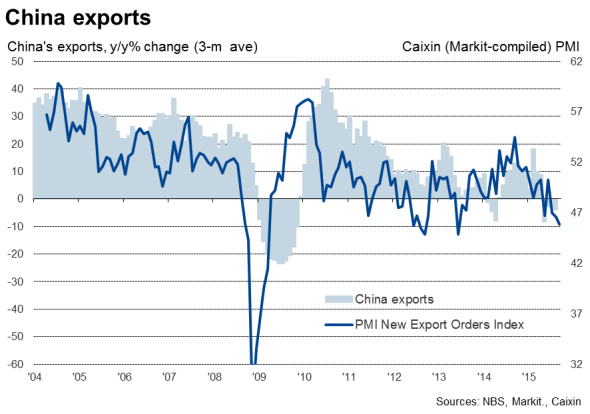

2.Order books are slumping as demand weakens at home and abroad

New orders fell at the fastest rate since November 2011, finishing off the worst quarter for order books since the opening quarter of 2009. Export orders slumped to the greatest extent seen since June 2013, suffering one of the largest declines seen since the global financial crisis.

3.Accelerating job losses will be a particular concern to the authorities

The rate of job shedding quickened to its fastest since January 2009, as companies laid off workers in the face of slumping demand from customers both at home and abroad.

Factory employment

The government is expecting manufacturing growth to slow, but is especially sensitive to weaker economic growth feeding through to higher unemployment. The increased rate at which factories are laying off staff therefore suggests that the authorities may step up their stimulus measures.

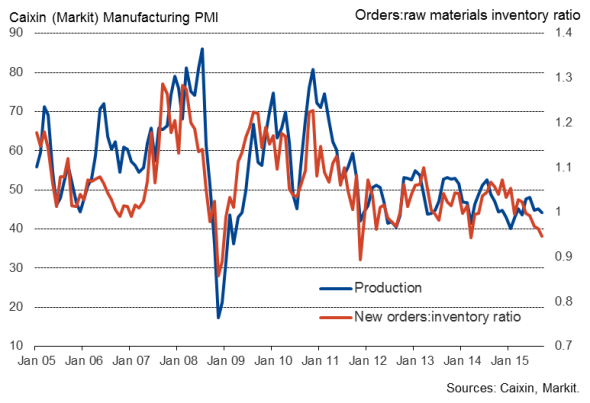

4.A build-up of inventories suggests production will continue to fall in October

Stocks of finished goods rose at the fastest rate for three years (and one of the largest rises in the survey's 11-year history). The increase was commonly the result of disappointing sales. The ratio of new orders to raw material inventories also slipped to one of the lowest seen in the history of the survey, pointing to further downward pressure on production volumes in coming months.

Orders:inventory ratio

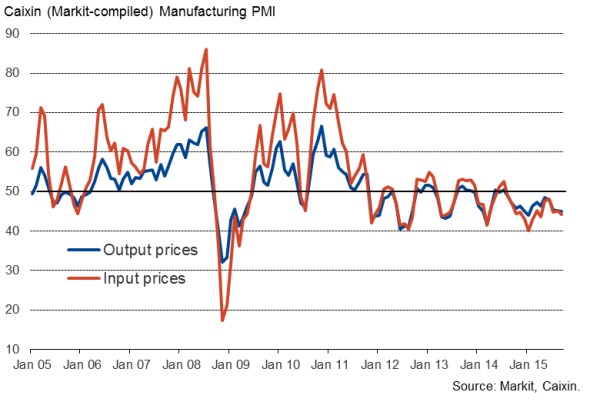

5.Prices fell for fourteenth month running

Factory gate charges fell at the steepest rate for eight months as firms passed on lower input costs in a bid to boost demand. Average raw material prices showed the largest decline for five months, in part reflecting lower global commodity prices. Both output prices and input prices have now fallen for fourteen consecutive months, highlighting ongoing deflationary pressures in the world's largest manufacturing economy.

Prices

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-economics-china-flash-manufacturing-pmi-hits-lowest-since-march-2009.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-economics-china-flash-manufacturing-pmi-hits-lowest-since-march-2009.html&text=China+flash+manufacturing+PMI%22+hits+lowest+since+March+2009","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-economics-china-flash-manufacturing-pmi-hits-lowest-since-march-2009.html","enabled":true},{"name":"email","url":"?subject=China flash manufacturing PMI" hits lowest since March 2009&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-economics-china-flash-manufacturing-pmi-hits-lowest-since-march-2009.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+flash+manufacturing+PMI%22+hits+lowest+since+March+2009 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-economics-china-flash-manufacturing-pmi-hits-lowest-since-march-2009.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}