Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 23, 2017

Macro risk subsides but single name still harbors volatility

A year ago this week, the credit markets were digesting the shock of a 'leave' vote in the Brexit referendum. What followed was a period of extreme volatility and it seemed that 2017 was set for more of the same.

But many of us have been proved wrong. The Markit iTraxx Europe closed at 99bps on July 27 2016, two business days after the vote. A year later the index is trading at 55bps - its tightest level since April 2015 - and volatility has, with a few minor blips, stayed at very low levels.

So why didn't the predicted rollercoaster year materialize? A number of reasons could be cited, including solid, consistent economic growth in the Eurozone countries. But perhaps more relevant is what didn't happen. Political risk has been the dog that didn't bark. The Dutch election was a non-event, while Emmanuel Macron emerged from nowhere to claim victory in the French presidential election, much to the relief of everyone bar National Front voters. Angela Merkel's Christian Democrats are well ahead in the polls and she looks set to retain her chancellorship. Only Italy has the potential to reignite volatility, and it is by no means certain that an election will happen this year rather than next.

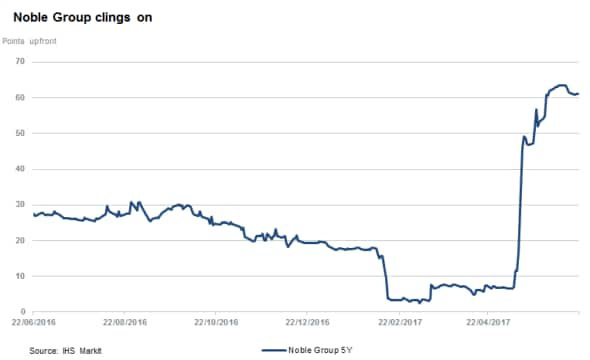

On a macro level, it would therefore be no surprise to see a quiet summer, barring unexpected monetary policy actions. But idiosyncratic risk remains, and one name in particular is worth monitoring in the coming weeks. Noble Group, an Asian commodities trader, has struggled for some time and matters appear to be coming to a head this year. It managed to secure a 120-day extension to a credit facility, buying it some time. But though the firm's equity price rose on the news, the fixed income markets reflect that the extension may be delaying the inevitable. Noble CDS shot up from 10 points upfront in May to 60 points earlier this month as its dire predicament became apparent and barely budged on news of the loan extension. Indeed, the apparently positive news only prompted a question to be put to the ISDA DC, asking if a restructuring credit event had occurred.

At the time of writing, the ISDA DC was still opining on this question. But even if they decide a credit event has not occurred, Noble's scheduled interest payments over the next few months may prompt speculation that a failure to pay could happen. IHS Markit data shows that the firm's perpetual bond is trading at 15 points, while its March 2018 bond is trading at 43 points. We will soon find out if Noble manages to escape the summer without a credit event.

This article originally appeared in Global Capital.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-credit-macro-risk-subsides-but-single-name-still-harbors-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-credit-macro-risk-subsides-but-single-name-still-harbors-volatility.html&text=Macro+risk+subsides+but+single+name+still+harbors+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-credit-macro-risk-subsides-but-single-name-still-harbors-volatility.html","enabled":true},{"name":"email","url":"?subject=Macro risk subsides but single name still harbors volatility&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-credit-macro-risk-subsides-but-single-name-still-harbors-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Macro+risk+subsides+but+single+name+still+harbors+volatility http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-credit-macro-risk-subsides-but-single-name-still-harbors-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}