Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 23, 2016

Eurozone growth dented by lower business optimism

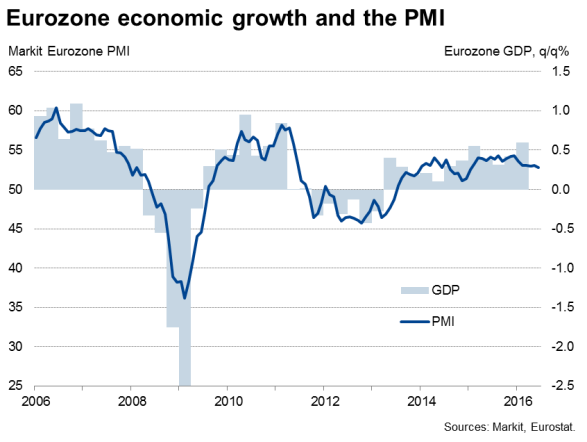

June's flash PMI survey data from Markit point to steady though disappointingly lacklustre Eurozone economic growth. Rising political uncertainty appears to have caused the pace of expansion to weaken slightly and business confidence about the outlook to deteriorate.

Steady 0.3% GDP growth in Q2

The flash PMI fell from 53.1 in May to 52.8, rounding off the worst calendar quarter since the fourth quarter of 2014. The second quarter is therefore likely to see economic growth slacken from the solid 0.6% expansion seen in the opening quarter of the year to around 0.3%.

An acceleration in the rate of goods production, to the best seen so far this year, was offset by a weakened pace of expansion in services, the slowest for 18 months. While goods producers benefitted from better export sales, service sector companies appear to have been affected by a drop in confidence in domestic markets. Business expectations in the service sector slipped to an 11-month low across the region in June, with companies often citing worries about political change and rising economic uncertainty, albeit with few explicit references to a potential 'Brexit'.

A solid performance from Germany's manufacturing economy looks to have helped drive a solid 0.4% expansion of the currency area's single largest member state in the second quarter, but business activity in France remains in a far more fragile state and confidence has deteriorated further. We estimate that French GDP is growing at an underlying rate of less than 1% per annum, contrasting with more upbeat recent GDP numbers.

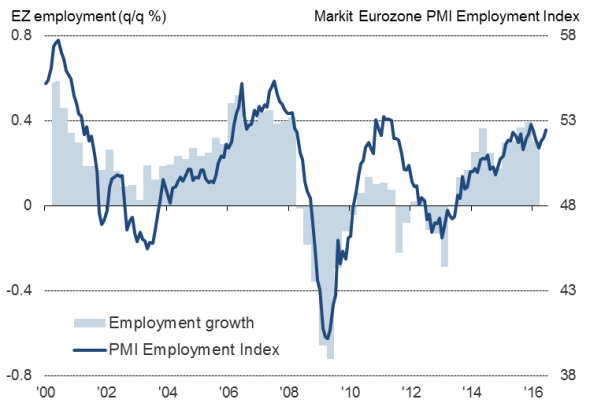

Robust hiring

The good news is that demand is growing at a sufficiently strong pace to sustain reasonably robust hiring. Firms took on additional staff at the fastest rate seen so far this year in order to expand capacity to meet demand. Stronger rates of job creation were seen in both manufacturing and services.

The survey's Employment Index points to a near-0.4% quarterly rise in euro area employment, rising in June to one of the highest levels seen over the past five years. Again, however, national variations were noteworthy: strong hiring in Germany contrasted with a decline in French employment.

However, demand is still not strong enough to generate inflationary pressures. Firms are having to soak up higher costs, notably for fuel and labour, but cut their own selling prices amid intense competition. Prices charged for goods and services fell on average, sustaining the trend of downward price pressures recorded almost continuously since late-2011.

Employment

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062016-economics-eurozone-growth-dented-by-lower-business-optimism.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062016-economics-eurozone-growth-dented-by-lower-business-optimism.html&text=Eurozone+growth+dented+by+lower+business+optimism","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062016-economics-eurozone-growth-dented-by-lower-business-optimism.html","enabled":true},{"name":"email","url":"?subject=Eurozone growth dented by lower business optimism&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062016-economics-eurozone-growth-dented-by-lower-business-optimism.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+growth+dented+by+lower+business+optimism http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062016-economics-eurozone-growth-dented-by-lower-business-optimism.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}