Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 23, 2017

Flash Japan manufacturing PMI slips to six-month low in May

Japan's manufacturing sector continued to expand in May, fuelling hopes of the economic upturn being sustained in the second quarter, albeit with the pace of growth showing signs of easing.

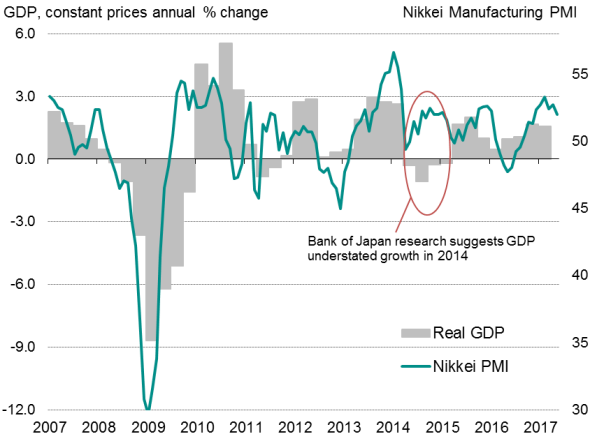

The Nikkei Flash Japan Manufacturing PMI fell from 52.7 in April to 52.0 in May, but remained above the 50.0 no-change level for a ninth successive month. While the decline in the index indicated a slowing in the pace of expansion to the weakest for six months, the index remains historically consistent with robust GDP growth.

Analysts had been caught by surprise by the strength of GDP growth in the first quarter. Official data showed the economy grew 0.5% (2.2% annualised), leaving GDP 1.6% higher than a year ago. The strong performance had been flagged well in advance by Nikkei PMI survey data.

Japan GDP and the Nikkei PMI

The steady growth signalled by the May flash manufacturing index follows news from the sister services PMI survey showing the tertiary sector having expanded for a seventh successive month at the start of the second quarter, notching up a rate of expansion slightly ahead of that seen on average in the first three months of the year. May services PMI data are published on June 5th.

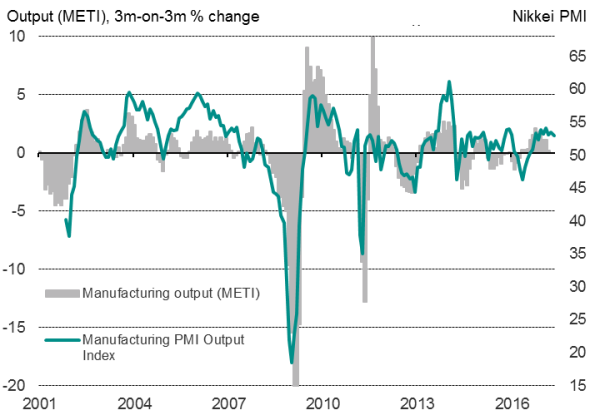

Looking into the detail of the May flash manufacturing PMI, output continued to grow at one of the fastest rate seen over the past three years, although the pace of increase slipped on the back of weaker growth in new orders. Hiring also waned as a result. Production, new orders and employment all recorded the slowest monthly increases since last November.

Manufacturing output

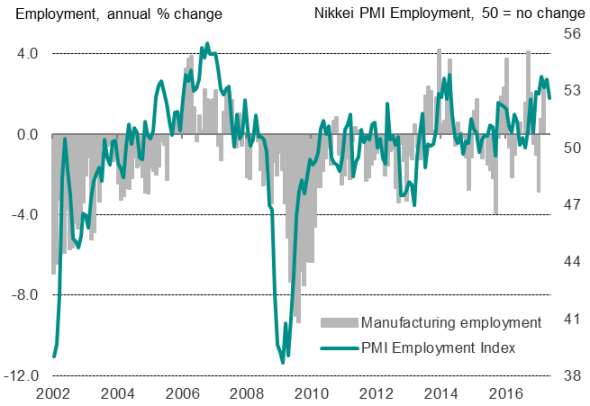

Manufacturing jobs

Sources: IHS Markit, Nikkei, Datastream

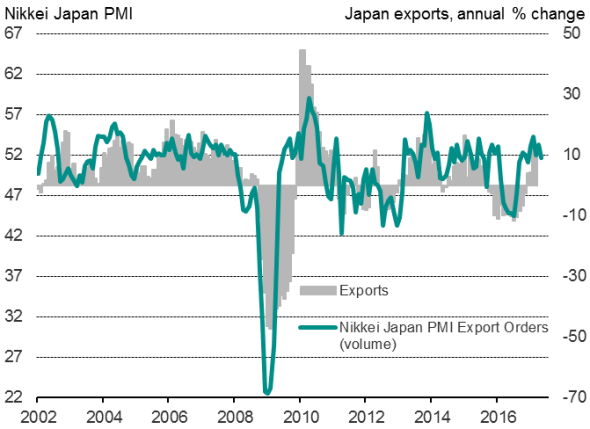

Export orders meanwhile showed the smallest rise for five months but, like the other survey indices, remained relatively elevated and at a level indicative of steady growth in comparable official data. Despite the decline in the export orders index in May, the PMI survey remains at a level historically consistent with near double-digit annual export growth.

Backlogs of work fell for the first time since January, underscoring the recent slowing in the rate at which new business has been expanding, and suggesting employment could remain under pressure in coming months unless new orders perk up.

Exports

Sources: IHS Markit, Nikkei, Datastream

While firms generally remained optimistic about the year ahead, with expectations about future production continuing to run at an elevated level by the survey's historical standards, the degree of optimism was down slightly on that seen in April.

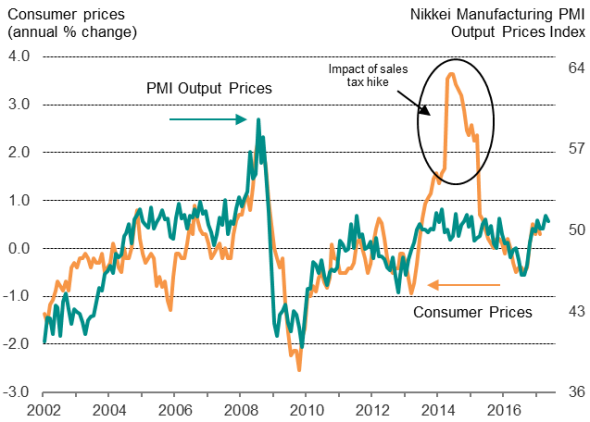

Finally, prices continued to rise. Average prices charged at the factory gate increased at a rate just below April's 29-month high, suggesting that rising industrial prices will feed through to higher consumer prices. However, average input prices rose at the weakest rate for five months, indicating supply chain price pressures are easing, which could result in slower growth of selling prices in coming months.

Inflation

Sources: IHS Markit, Nikkei, Datastream

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052017-Economics-Flash-Japan-manufacturing-PMI-slips-to-six-month-low-in-May.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052017-Economics-Flash-Japan-manufacturing-PMI-slips-to-six-month-low-in-May.html&text=Flash+Japan+manufacturing+PMI+slips+to+six-month+low+in+May","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052017-Economics-Flash-Japan-manufacturing-PMI-slips-to-six-month-low-in-May.html","enabled":true},{"name":"email","url":"?subject=Flash Japan manufacturing PMI slips to six-month low in May&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052017-Economics-Flash-Japan-manufacturing-PMI-slips-to-six-month-low-in-May.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+Japan+manufacturing+PMI+slips+to+six-month+low+in+May http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052017-Economics-Flash-Japan-manufacturing-PMI-slips-to-six-month-low-in-May.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}