Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 23, 2015

Tech loses steam

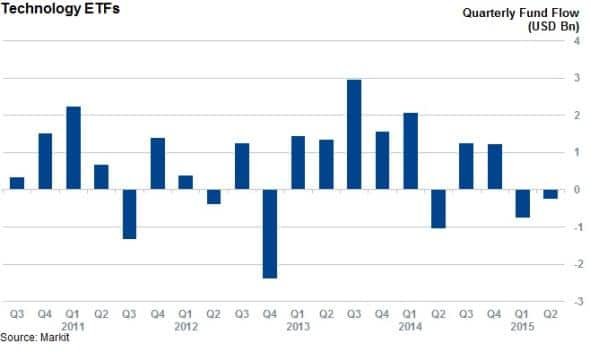

Following last year's outperformance, the technology sector's inability to maintain its market beating momentum has seen investors flee technology ETFs this year.

- Technology ETF outflows have reached almost $1bn this year

- Short interest has increased, but short sellers have yet to fully commit to the trade

- Hard drive maker Seagate has led the shorting activity

The technology constituents of the S&P 500 outperformed the wider index by over 5% in 2014, a feat which they have not been able to match this year. The tech sector has broadly matched the overall index return in 2015.

The industry's heavy reliance on foreign revenues also has impacted returns due to the rising dollar. The currency's strength has continued to play out this earnings season with Texas Instruments and IBM negatively affected.

ETF outflow

The sector's recent loss of momentum has seen investors start to pare back their holding of technology focused ETFs. The 120 technology focused ETFs, which are overwhelmingly exposed to US equities, saw outflows of $740m in the first quarter. The opening three weeks of the second quarter has seen this trend continue with these funds having lost a further $230m, bringing the yearly outflow total to almost $1bn.

The two funds that witnessed the greatest outflows are the iShares U.S. Technology ETF and Technology Select Sector SPDR Fund ETF which have seen $1.9bn and $900m of redemptions respectively so far this year.

Offsetting these large outflows is the newly launched iShares Exponential Technologies ETF. The fund has proved popular since its launch in March and now manages $641m.

Another relatively new fund, the Pure Funds ISE Cyber Securities ETF has also proved popular with investors who added over $400m of exposure in the last three and a half months to take AUM past the $600m mark.

This has proven to be a shrewd move as both these funds have also managed to outperform the broader technology sector over the last month.

Shorts not biting

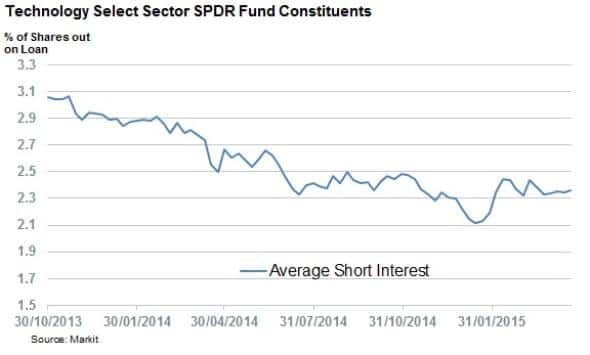

Short sellers have not been as active in the technology space as the bearish ETF flows would suggest. Short sellers had spent most 2014 covering their positions in the wake of the sector's strong performance but have so far shown little appetite to return to the sector.

The average short interest across the 72 constituents of the Technology Select Sector SPDR Fund is up by 10% since the start of the year to 2.3% of shares on loan. However, average short interest is still considerably below the levels seen at the start of last year when the same group of shares had 3% of shares out on loan.

Pockets of short interest

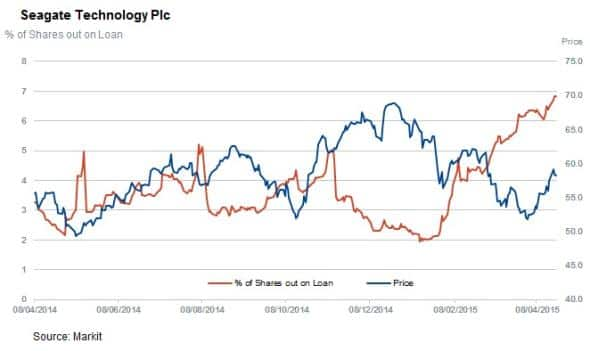

Despite the apparent low appetite to short the technology sector, one name stands out having seen a tripling in demand to borrow since January. Short interest in Seagate Technology has jumped to 6.8% of shares outstanding in the last few months to make it the most shorted tech hardware component of the SPDR Technology ETF.

Fellow hard drive manufacturer Sandisk also sees above average short interest with over 4% of the firm's shares now out on loan.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-equities-tech-loses-steam.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-equities-tech-loses-steam.html&text=Tech+loses+steam","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-equities-tech-loses-steam.html","enabled":true},{"name":"email","url":"?subject=Tech loses steam&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-equities-tech-loses-steam.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tech+loses+steam http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-equities-tech-loses-steam.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}