Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 22, 2017

Eurozone recovery regains poise, price pressures intensify

The eurozone economy ended the third quarter on a strong note, with growth of business activity picking up to its highest since May to register one of the strongest monthly improvements seen over the past six years. The data also point to rising price pressures, opening the door wider for a tapering of stimulus by the ECB

The headline IHS Markit Eurozone PMI rose to 56.7 in September, according to the preliminary 'flash' estimate (based on approximately 85% of final replies), up from 55.7 in August. The data smashed Reuters' poll consensus of 55.5, in which even the optimistic analyst was only expecting a reading of 56.0.

Solid growth despite stronger euro

Inflows of new orders showed the largest monthly gain since April 2011, representing a renewed surge in demand after the pace of new order growth had slowed in the prior two months.

As such, the survey data point to 0.7% GDP growth for the third quarter, with accelerating momentum boding well for a buoyant end to the year.

The stronger euro was cited as a concern among manufacturers, but as yet appears to have had only a modest impact on exports. Manufacturing in fact remains a major driver of the current upturn, with export sales playing an important role in pushing order books higher and encouraging further investment in expansion.

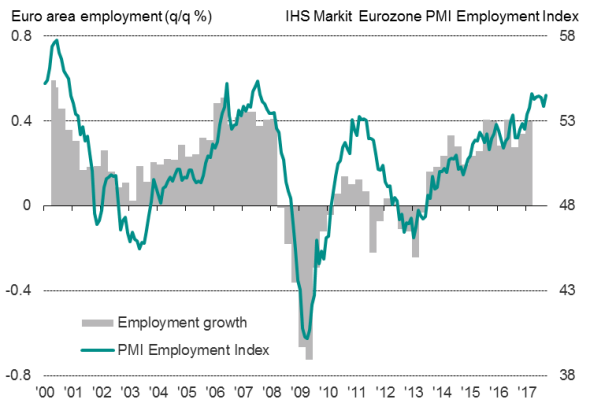

Across both manufacturing and services, job creation was the second-highest seen over the past decade, with manufacturing job gains passing through prior survey records to register the largest monthly rise in factory headcounts for over two decades.

Eurozone employment

Capacity constraints

However, despite the increase in payroll numbers, capacity continues to be stretched. Backlogs of work rose to the greatest extent since February 2011 as companies struggled to cater for the higher inflows of new work.

Suppliers' delivery times, a key gauge of capacity constraints in manufacturing supply chains, meanwhile signalled the highest incidence of delays for six-and-a-half years.

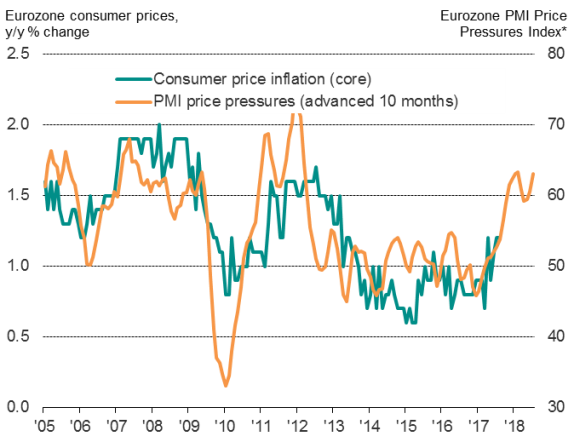

Price pressures

With demand often exceeding supply, price pressures have intensified. Input cost and selling price inflation gathered pace for a second successive month, with both reaching the highest rates since April.

Eurozone inflation

Sources: IHS Markit, Eurostat

Prices charged for services rose to the greatest extent since May, while the increase in factory gate prices was the joint-highest since June 2011.

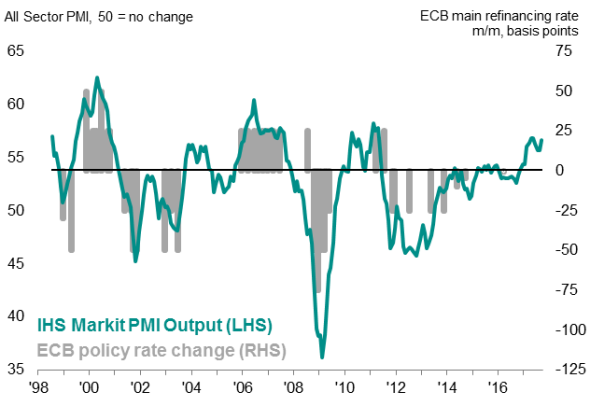

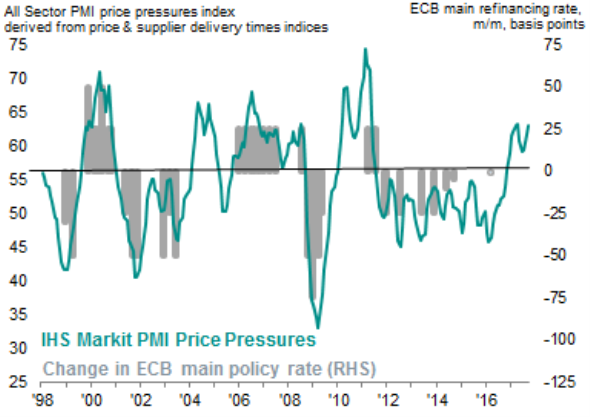

The rise in business activity and accompanying build-up of price pressures will fuel expectations that the ECB is poised to announce its intention to rein-back some of its stimulus, reducing its asset purchases in 2018.

ECB policy and PMI business activity

ECB policy and PMI price pressures*

* blended index of price and supply chain pressures.

Sources: IHS Markit, ECB

Flash PMI data for both France and Germany also easily beat expectations. Both saw rates of expansion accelerate to the highest seen for over six years. Both also registered further improvements on the already-impressive employment gains seen in prior months. The survey data point to GDP rising by 0.6-7% in the third quarter in both countries.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092017-Economics-Eurozone-recovery-regains-poise-price-pressures-intensify.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092017-Economics-Eurozone-recovery-regains-poise-price-pressures-intensify.html&text=Eurozone+recovery+regains+poise%2c+price+pressures+intensify","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092017-Economics-Eurozone-recovery-regains-poise-price-pressures-intensify.html","enabled":true},{"name":"email","url":"?subject=Eurozone recovery regains poise, price pressures intensify&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092017-Economics-Eurozone-recovery-regains-poise-price-pressures-intensify.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+recovery+regains+poise%2c+price+pressures+intensify http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092017-Economics-Eurozone-recovery-regains-poise-price-pressures-intensify.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}