Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 22, 2016

Treasury investors head for shallow water

Investors are indicating a lack of faith in the Fed sustaining the low interest rate environment for much longer, as they actively shift to the shallower, less volatile side of the treasuries yield curve.

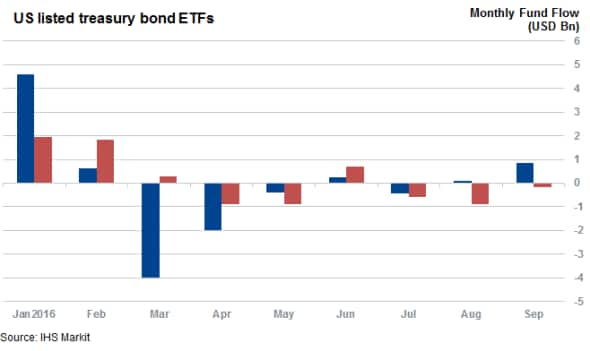

- Liquidity Investors have reduced their long-dated ETF holdings by over $1bn since July

- Short-dated treasury ETFs experienced over $132m of inflows after yesterday's Fed announcement

- Long-dated bond are still a winning trade YTD, but this advantage is being eroded amid "mini taper tantrum

Dissent among Fed members was at its highest in over 18 months following yesterday's vote to keep the Federal funds rate unchanged, with only three members voting in favor of raising interest rates. With the market now anticipating a rate hike in December, investors are actively de-risking their ETF holdings since the start of August, choosing to act now rather than wait for the treasury to make the first move. This has resulted in investors pulling over $1bn out of funds exposed to volatile long dated treasuries, instead choosing to pool these funds into relatively safer short dated products, which have experienced over $820 m of inflows over the same period.

Investors have also continued to shun long dated treasury ETFs, with the asset class experiencing $67m of outflows yesterday alone following the news . Short dated products continued their momentum with a $133m one day inflow haul, indicating that investors are skeptical of the ability of the Fed to continue to sustain low interest rates for much longer.

This rotation of funds is significant in as represents 10% and 5% of the AUM managed by long and short dated ETFs at the start of August respectively.

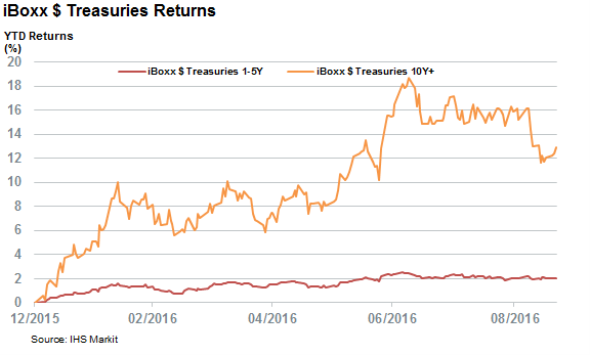

Long dated treasuries are still far ahead of their shorter dated peers in terms of returns delivered by investors year to date, according

Markit iBoxx, but the performance differential has been narrowing in the last three months. The year to date total returns delivered by Markit iBoxx Treasuries 10Y+ index was 16% ahead of its relatively short dated Treasuries 1-5Y peer back in early July, but Fed interest uncertainties have caused the index to relinquish a third of its outperformance. Most ground lost by long dated treasuries occurred in in the two weeks since the September 8th ECB meeting over what has been dubbed the "mini taper tantrum".

Long dated bonds were yesterday's winning trade as the long dated Markit iBoxx Treasuries 10Y+ index delivered 46bps of total returns while short dated peers traded flat. The fact that ETFs tied to long dated bonds continued to see outflows indicates that investors are less preoccupied with chasing returns and more focused on preserving capital ahead of future Fed meetings.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092016-credit-treasury-investors-head-for-shallow-water.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092016-credit-treasury-investors-head-for-shallow-water.html&text=Treasury+investors+head+for+shallow+water","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092016-credit-treasury-investors-head-for-shallow-water.html","enabled":true},{"name":"email","url":"?subject=Treasury investors head for shallow water&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092016-credit-treasury-investors-head-for-shallow-water.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Treasury+investors+head+for+shallow+water http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092016-credit-treasury-investors-head-for-shallow-water.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}