Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 22, 2015

Equity investors spurn leverage in fear of rate rise

The prospect of a US rate rise is looming ever closer, prompting the equity market to shun the companies which are most reliant on debt financing.

- Most leveraged US companies have underperformed by 17% in the last year

- Energy stocks are the most exposed to a potential rate rise outside of financials

- Short sellers have increased their positions in leveraged firms by 43% in the last 12 months

US companies have gorged on cheap credit during the last few years of zero interest rate policy. High yield issuers have floated three times the amount of bonds in the last five years compared to those preceding the financial crisis.

With the markets increasingly pricing in an imminent rate rise, the potential risks associated with firms having to refinance their growing bond load at relatively unfavourable rates has seen the equity market turn bearish against the most leveraged US companies.

Leveraged firms face headwinds

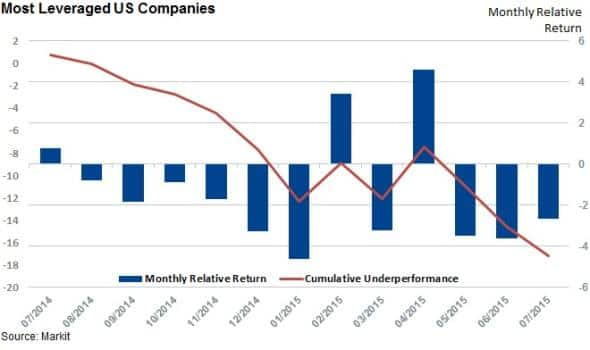

The 10% of US traded companies whose enterprise value contains the largest proportion of debt, as measured by the Markit's Research Signals Market Leverage factor, have grossly underperformed their less leveraged peers over the last 12 months.

These firms, which are arguably the most at risk from a rate rise, have trailed the rest of the Markit US Total Cap universe by 17% in the last 12 months; making them the worst performing group of shares when ranking by market leverage.

Firms which have recently issued debt to buy back shares will no doubt find this a sobering number as this has made them more exposed to a trend which the market has actively shunned in the last year.

The above underperformance is also surprising in its consistency over the last year, as most leveraged shares have underperformed the market in nine of the last 12 months.

Energy firms most exposed

Not surprisingly, not all sectors have been affected by this trend, as some are much more reliant on debt financing than others. financials' shares make up 42% of the most leveraged firms.

Outside of financials, energy names are the second most leveraged firms. Comstock Resources and Energy Xxi the two most leveraged names currently. It's worth noting that that this trend is also driven by the fact that energy share prices have fallen significantly in the wake of the collapse in oil prices. The refinance risk face by energy firms is evidenced by the fact that high yield oil & gas bond yields have surged by over 3% in the last 12 months.

But sector exposure is not the only driving force, as the factor's performance still holds on a sector neutral basis which shows that the equity market has been favouring less leveraged names within sectors. The factor's sector neutral returns for the most leveraged names is still significant at 12.5%.

Short sellers zero in

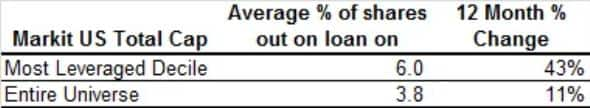

This trend has caught the eye of short sellers as the most leveraged firms have seen short interest surged by 43% in the last 12 months to make them the most shorted group of shares among the Markit US Total cap universe. The average proportion of shares out on loan among the most leveraged firms now stands at 6%; making these firms the most shorted decile group by a long margin.

The standout firm driving this trend is Tidewater, whose short interest has more than tripled in the last year to hit 45% of shares outstanding, making it the second most shorted constituent of the Markit US Total cap universe behind Rex Energy.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-equities-equity-investors-spurn-leverage-in-fear-of-rate-rise.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-equities-equity-investors-spurn-leverage-in-fear-of-rate-rise.html&text=Equity+investors+spurn+leverage+in+fear+of+rate+rise","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-equities-equity-investors-spurn-leverage-in-fear-of-rate-rise.html","enabled":true},{"name":"email","url":"?subject=Equity investors spurn leverage in fear of rate rise&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-equities-equity-investors-spurn-leverage-in-fear-of-rate-rise.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Equity+investors+spurn+leverage+in+fear+of+rate+rise http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-equities-equity-investors-spurn-leverage-in-fear-of-rate-rise.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}