Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 22, 2017

Irrationally Exuberant Flight to Safety

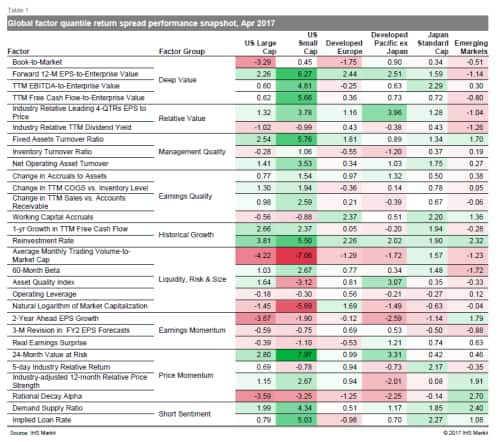

While the post-election Trump reflation trade has lost some steam in the US in recent months as the President struggles to get his legislative agenda passed, European investors turned more optimistic in April after the first round of the French presidential election showed the pro-euro candidate as the front runner. Factor performances also diverged across regional markets as a risk-on trade prevailed in European and emerging markets, while US and developed Pacific markets moved more toward a risk-off stance (Table 1).

US: Investors disfavoured high risk shares and those with the highest demand to sell short, captured by 24-Month Value at Risk and Demand Supply Ratio, respectively

Developed Europe: Optimism fed into price trend indicators such as Industry-adjusted 12-month Relative Price Strength and toward small cap names gauged by Natural Logarithm of Market Capitalization

Developed Pacific: Valuation remained a preferred style across developed Pacific markets, with strong performance associated with factors such as Forward 12-M EPS-to-Enterprise Value

Emerging markets: Price momentum's rebound in March was reinforced last month with positive returns to Rational Decay Alpha

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052017-equities-irrationally-exuberant-flight-to-safety.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052017-equities-irrationally-exuberant-flight-to-safety.html&text=Irrationally+Exuberant+Flight+to+Safety","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052017-equities-irrationally-exuberant-flight-to-safety.html","enabled":true},{"name":"email","url":"?subject=Irrationally Exuberant Flight to Safety&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052017-equities-irrationally-exuberant-flight-to-safety.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Irrationally+Exuberant+Flight+to+Safety http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052017-equities-irrationally-exuberant-flight-to-safety.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}