Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 22, 2015

Investors focus on value

Despite losing out to growth over the last five quarters, value investments still command the respect of the market.

- Growth focused ETFs outperformed value peers by over 8% since January of last year

- The shares which offered the best value underperformed those that offered the least value by 10%

- Shares which offer the best value still see the lowest average short interest

Value versus growth

Growth has triumphed over value by 8.2% in the last 12 months according to the performances the iShares Russell 1000 Value ETF and its peer focused on growth.

The weighting of constituents in the value index favours lower book-to-price ratios whereas the growth index focuses on stocks that are ranked and weighted according to their growth potential. Russell index methodologies utilises two variables to rank growth stocks; a medium term forecasted growth rate (2 year) and a long term historical growth rates (5year).

Despite the recent underperformance of value to its more favoured growth peers, ETF investors still added $13.5bn of inflows across the 43 US listed value funds. Growth's outperformance has not gone unnoticed however as the 85 growth focused ETFs have seen twice the inflows seen by value products over this period of time.

Value in energy

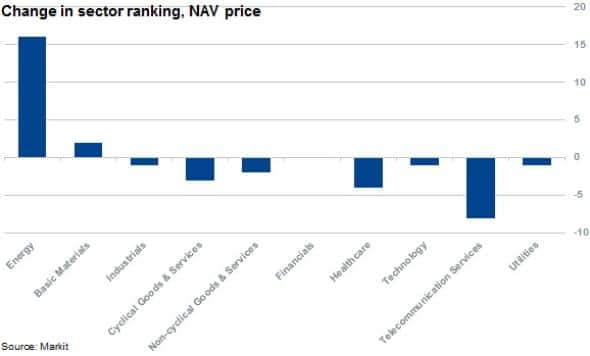

A useful proxy in gauging the relative value of stocks across sectors is Markit's Research Signals' Net Asset Value to Price factor. Using net book values and ignoring goodwill, intangible assets and adjusting for price, stocks are ranked according to their NAV. For analysis, individual companies are grouped into in deciles.

The energy sector has seen the largest increase in average ranking over the last six months with the telecommunication and healthcare sectors value rank having declined the most. The oil industry's reaction to the fall in crude prices has seen dramatic share price declines and asset base revaluations. This has have had a net effect of improving the sector's relative value metrics.

The increased ranking could be behind the recent underperformance seen in value names, and should oil prices recover the underperformance could narrow.

Short sellers sceptical of growth

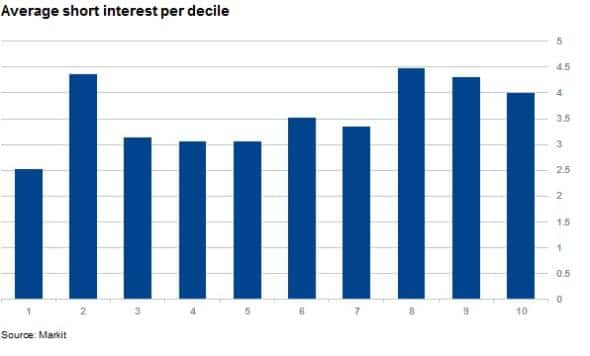

Ignoring sector performances, the outperformance of growth strategies using the NAV to price factor in the last 12 months confirms the market's recent performance bias towards growth. The net spread of going long the most valuable stocks and going short the least valuable stocks, would have delivered a negative 11% return.

Short sellers have exhibited scepticism towards overvalued stocks (deciles 8, 9 and 10) which have seen the highest levels of short interest. In contrast, the shares which offer the best value (decile 1) have seen the lowest short interest on average.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-equities-investors-focus-on-value.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-equities-investors-focus-on-value.html&text=Investors+focus+on+value","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-equities-investors-focus-on-value.html","enabled":true},{"name":"email","url":"?subject=Investors focus on value&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-equities-investors-focus-on-value.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+focus+on+value http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-equities-investors-focus-on-value.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}