Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 21, 2016

Most shorted ahead of earnings

A look at how short sellers are positioning themselves in companies announcing earnings in the coming week

- Retailers Gamestop and Urban Outfitters heavily shorted

- Mitie Group sees large jump in short interest post Brexit

- China Digital Holdings most shorted firm announcing results in Asia this week

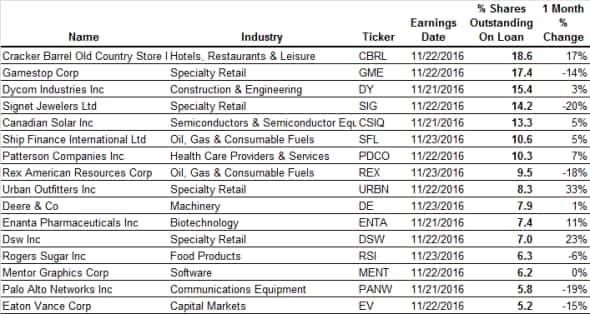

North America

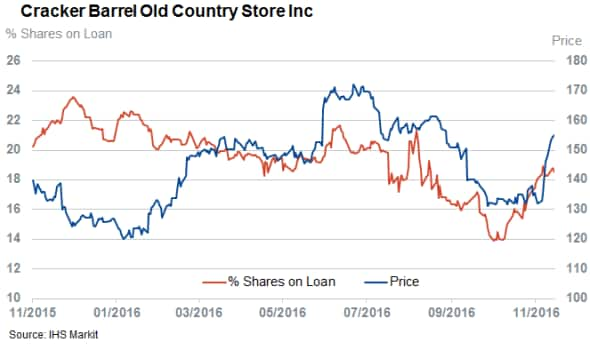

Retailers and consumer focused firms make up the bulk of the heavily shorted companies announcing earnings in this shortened earnings week. Foremost among short seller's minds is casual dining chain Cracker Barrel which has 18.6% of its shares out on loan. Cracker Barrel shares have surged in the post-election rally, but short sellers are staying the course as demand to borrow Cracker Barrel shares has also rallied significantly over the last week.

On the retail side, we see Gamestop with 17.4% of shares out on loan to short sellers. The company has continued to struggle in recent years as it sees itself increasingly cut out of the loop as shoppers skip bricks and mortar stores for cheaper online alternatives for both consoles and games. Interestingly, the company's steadily declining share price has not inspired short sellers as Gamestop's current short interest is roughly a third of the recent high set back last December.

Short sellers have also doubled down in clothing retailer Urban Outfitters in light of the recent rally as the company's short interest has jumped by a third in the last month. This rise in short interest could be vindicated should Urban Outfitter's results mirror that of fellow short target Abercrombie & Fitch which fell heavily on Friday after disappointing revenues.

On the other side of the short momentum we've seen short sellers cover a fifth of their positions in jeweler Signet which has also enjoyed a strong run in the recent rally.

Another company seeing material short covering in the run-up to earnings is fund manager Eaton Vance which has seen a 15% fall in demand to borrow its shares in the last month. This fall in short interest mostly came in the last week as the post-election rally sent US shares surging to new highs. This rally disproportionally helped fund managers as investors expect a bump in their revenues owing to their AUM driven model. The recent bout of covering takes the demand to short Eaton Vance to the lowest level in over a year.

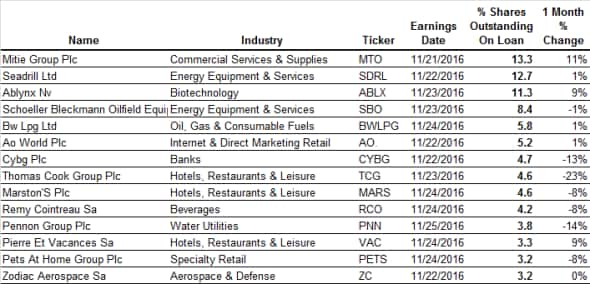

Europe

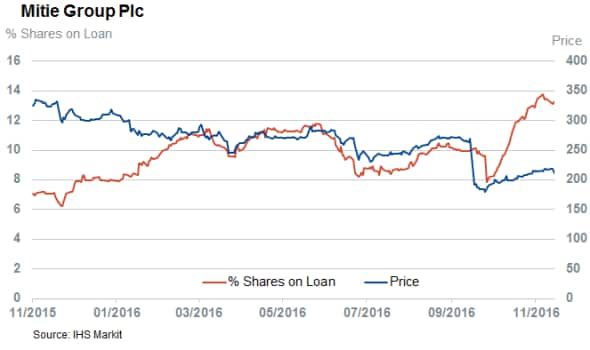

Mitie Group finds itself the most shorted firm among European companies announcing earnings this week with 13.3% of its shares out on loan. The British property service firm's last earning update sent its shares down by over a quarter as the firm announced that the UK's decision to leave the European union had impacted revenues as clients trimmed facilities servicing costs. Short sellers think the firm's slump may still have legs as Mitie's current short interest is over a third higher than on the eve of its September update.

Scottish bank Cybg was also singled out as a potential sufferer in the wake of the Brexit referendum, but the company's shares have managed to recover most of the ground lost after the referendum. This recovering has seen short sellers cover nearly half their positions over the last few weeks to the current 4.7% of shares outstanding.

Cybg isn't alone among post Brexit shorts seeing heavy covering as Thomas Cook and Marston's have also seen a decrease in the demand to borrow their shares in the last month.

The other high conviction short play announcing earnings this week is offshore drilling operator Seadrill. Analysts are forecasting more pain ahead for offshore operators as contracts roll off, forcing operators to slash charter rates in order to win new contracts in the current highly competitive post oil slump market.

Asia

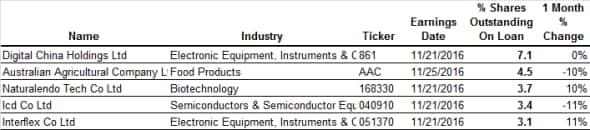

Asian short sellers won't be too glued to earnings updates this week as only five firms in the continent see more than 3% of their shares out on loan ahead of earnings.

The most shorted firm in this small group is investment holding Digital China Holdings. Digital China came under scrutiny from short sellers after a large special dividend due which was followed by a fourfold increase in the demand to borrow its shares.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}