Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 21, 2014

A single name credit story

Dramatic movements in Abengoa's spreads show that single name credit stories are alive and well

- Abengoa's spreads widened to 1600bps amid uncertainty over debt status

- They have since recovered but still have a risk premium attached

- Dovish comments from Mario Draghi ensure that the week ends on a high

We've commented in recent weeks on volatility, but it's been mainly a macro phenomenon. Geopolitics, Ebola and uncertainty over monetary policy have all contributed to spread oscillations.

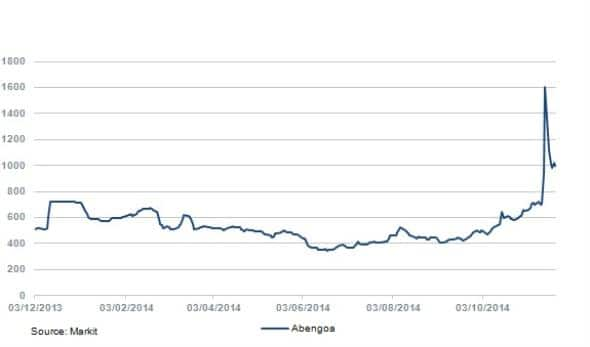

But a little known Spanish renewable energy company provided the market with a welcome single-name credit story. Abengoa, an entrant to the Markit iTraxx Crossover index in March this year, saw it spreads widen dramatically after it revealed that €630 million in green bonds were classified as non-recourse, which ran contrary to the consensus understanding among investors.

This clearly had serious negative implications for Abengoa's balance sheet, and the market responded accordingly. The company's spreads widened from just over 700bps on November 12 to 1,600bps, or 31 points upfront, only two days later, and the inversion of the credit curve signalled that Abengoa was now firmly in distressed territory.

However, by November 18 the company's spreads were back below 1000bps. The rebound was due to Abengoa clarifying that the green bonds were guaranteed by the company and have the same security as other recourse debt. In addition, Abengoa announced a €600bn bond buyback, news that is usually well received by credit investors.

Nonetheless, the debacle raises serious questions about the company's management, in particular its communications strategy. The lack of clarity surrounding the firm's capital structure could result in investors attaching an additional risk premium - the firm's spreads appear to have settled around the 1,000bps mark - and we could see more volatility on this name in the future.

Elsewhere, the CDS market was relatively stable, with spreads trading in a comparatively tight range. Ukraine and Russia saw their spreads continue to widen amid risk of escalation in the conflict and the possibility of further sanctions down the line. Japan's CDS also lost ground after the country's poor growth figures and Prime Minister Abe's decision to call a snap election. The sovereign was quoted at 58bps, its widest level for over a year.

Dovish comments from Mario Draghi should ensure that the week ends on a positive note. The Markit iTraxx Europe was quoted at 62.75bps, 0.5bp tighter over the week. Investors should be cognisant of idiosyncratic credit risk, but it will be macro factors that ultimately drive spread direction over the coming months.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112014-Credit-A-single-name-credit-story.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112014-Credit-A-single-name-credit-story.html&text=A+single+name+credit+story","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112014-Credit-A-single-name-credit-story.html","enabled":true},{"name":"email","url":"?subject=A single name credit story&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112014-Credit-A-single-name-credit-story.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=A+single+name+credit+story http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21112014-Credit-A-single-name-credit-story.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}