Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 21, 2016

High seas short sellers prefer energy shipping

Short selling activity in global shipping firms stands at a multi-year high as the industry reels from oversupply, which has depressed charter rates and sent several firms heading to cover from creditors.

- Global shipping firms see most short interest in over two years

- Energy shippers 50% more shorted on average than their non-energy peers

- Japanese shipper Kawasaki Kisen Kaisha Ltd is the most shorted non energy stick

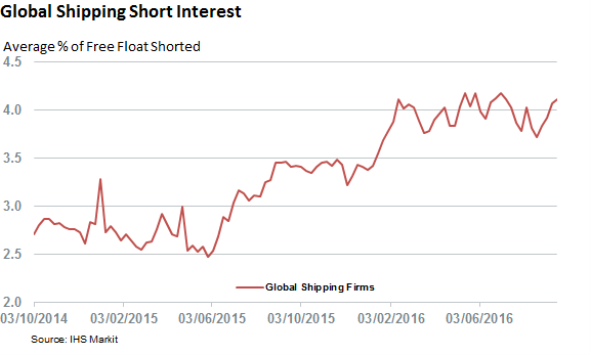

The shipping industry's ongoing slump claimed its largest scalp three weeks ago as South Korean container ship operator Hanjin Shipping, the ninth largest container operator, declared bankruptcy. This follows a stream of bankruptcies amongst dry bulk and oil shippers since the start of the year, as all corners of the industry reel from slowing global trade and a chronic oversupply of ships ordered under rosier market circumstances. Short sellers, which have never shied away from marine shipping, have continued their activity within the sector with the average short interest across the 85 shipping firms holding a market cap that now stands at the highest level in over two years, according to Markit Securities Finance.

The current average demand to borrow shares in shipping firms now stands at 4.12% of free float; over 20% higher than at the start of the year. This bearish sentiment has paid off so far, as the 85 publically listed marine shipping firms have fallen by 15% on average since the start of the year. However, this continued appetite to sell short indicated that these sellers are preparing for a further patch of rough weather ahead.

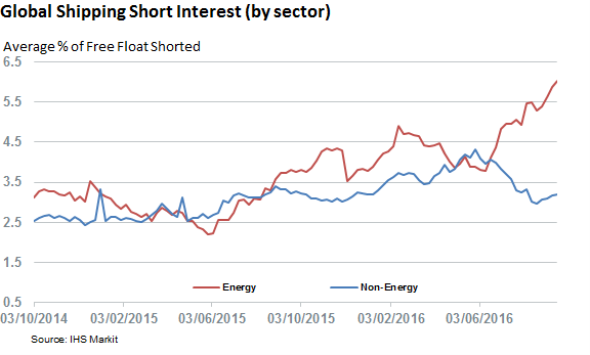

While the average short interest in marine shipping firms has stayed relatively flat in the last few months, we've noticed that short sellers have been rotating out of non-energy related shippers into the energy space. Demand to short energy-related shipping firms, which includes tanker and LNG owners and operators, now stands at over 6% of free float on average for the first time since the current downturn in energy prices. The demand for floating storage had isolated energy shippers from the worst of the shipping downturn, but spot charter rates are now tracking materially lower than last year due to an influx of new supply and a shift in global routes.

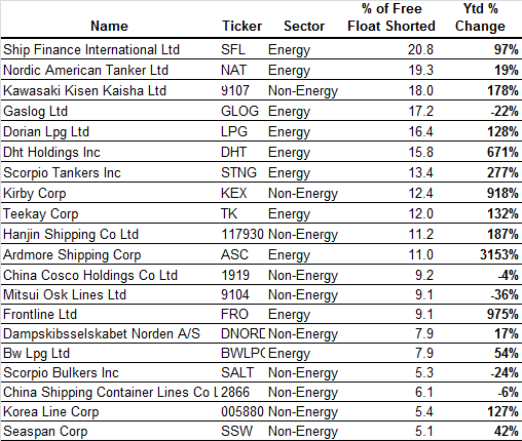

Operators favored by short sellers include Ship Finance International, Dorian and DHT Holdings- all of which have seen short interest more than double YTD ; passing the 15% of free float mark.

Despite the recent Hanjin Bankruptcy, short sellers are largely avoiding the non-energy related part of the shipping sector as their current average short interest stands at the same level seen in January. These diverging paths mean that the gap between the average short interest seen on both sides of the market is at its widest in over two years.

As ever, there are exceptions to the rule as Japanese shipper Kawasaki Kisen Kaisha has seen its short interest nearly triple since the start of the year. This makes it the most shorted non-energy focused shipping firm with 18% of its free float out on loan.

Short sellers have been equally voracious in targeting US barge operator Kirby Corp whose short interest has jumped by over 900% ytd to over 12.4% of its freely traded shares.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21092016-equities-high-seas-short-sellers-prefer-energy-shipping.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21092016-equities-high-seas-short-sellers-prefer-energy-shipping.html&text=High+seas+short+sellers+prefer+energy+shipping","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21092016-equities-high-seas-short-sellers-prefer-energy-shipping.html","enabled":true},{"name":"email","url":"?subject=High seas short sellers prefer energy shipping&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21092016-equities-high-seas-short-sellers-prefer-energy-shipping.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=High+seas+short+sellers+prefer+energy+shipping http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21092016-equities-high-seas-short-sellers-prefer-energy-shipping.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}