Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 21, 2015

Coco ride bullish bank credit wave

benefited contingent convertible bonds.

- Both the Euro and USD denominated Markit iBoxx Contingent Convertible Developed Market indices have returned more than 5% year to date

- Premiums required by investors to hold Coco debt over subordinated debt has been falling

- Issuance has been picking up heading into the final quarter

Financials debt has proven to be one of the areas of relative strength in the current market with the Markit iBoxx $ Banks index and broader iBoxx $ Financials index both delivering positive total returns in the year to the end of August. This relative performance also hold true on the other side of the Atlantic with the iBoxx € Financials and iBoxx € Bank indices outperforming the wider universe of Euro denominated investment grade bonds by 40bps and 50bps, respectively, over the same time period.

The outperformance was largely driven by falling risk perceptions as the index option adjusted spread of both the Euro and USD bank indices have performed better than the wider bond market. Falling risk perceptions have been most felt on the subordinated segments of bank balance sheets with the Markit iBoxx € Banks Subordinated and iBoxx $ Eurodollar Banks Subordinated indices outperforming their more senior peers since the start of the year.

This trend has also held for the most subordinated portions of bank balance sheets, the relatively new contingent convertible bonds (coco) issued by banks to meet capital requirements in the wake of the financial crisis.

Cocos outperform

The coco bonds issued in both euro and dollars by developed market issuers have largely outperformed all segments of the already high flying bank debt in the last few months. Both the Markit iBoxx USD Contingent Convertible Developed Market and iBoxx EUR Contingent Convertible Developed Market indices have returned more than 5% since the start of the year.

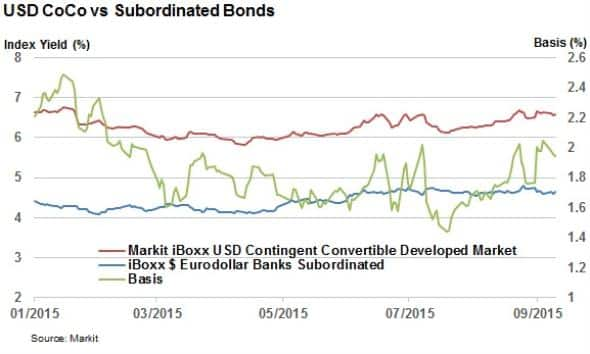

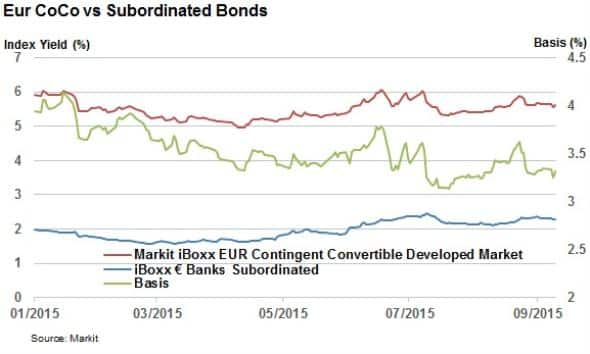

These returns are partly attributed to falling risk perceptions seen by bank debt in general as well as the relatively generous yield which contingent convertible bonds offer. The latest yield on the USD and EUR denominated developed market indices stood at 6.6% and 5.6%, respectively, despite the falling yields.

The coco premium over subordinated debt has also been coming down over the course of the year as the yield differential between the Markit iBoxx EUR Contingent Convertible Developed Market and iBoxx $ Eurodollar Banks Subordinated indices has tightened by 60bps from the start of the year. Dollar denominated issuance has also seen the same trend with the coco spread falling by 26bps in the last nine months.

Issuances healthy

While traders bemoan current market circumstances, banks look to have been taking advantage of the recent improving market conditions. Issuances of coco debt have picked up in recent weeks after a summer lull that saw no new issuance join the Markit iBoxx Contingent Convertible index family. August saw five new issuances join the three main iBoxx Contingent Convertible indices after a GBP and four USD denominated issues saw their genesis.

Coco bonds have also moved on from "bulge bracket" issuers which were early adopters, as seen by the recently announced 1bn AT1 issue from ABN Amro. Investor demand for the asset class also looks to be healthy as the Dutch bank's offering was over three times covered, according to Reuters.

Simon Colvin, Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21092015-credit-coco-ride-bullish-bank-credit-wave.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21092015-credit-coco-ride-bullish-bank-credit-wave.html&text=Coco+ride+bullish+bank+credit+wave","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21092015-credit-coco-ride-bullish-bank-credit-wave.html","enabled":true},{"name":"email","url":"?subject=Coco ride bullish bank credit wave&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21092015-credit-coco-ride-bullish-bank-credit-wave.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Coco+ride+bullish+bank+credit+wave http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21092015-credit-coco-ride-bullish-bank-credit-wave.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}