Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 21, 2015

UK sales surge as sun shines on retailers

A surge in retail sales in April suggests the consumer mood remains upbeat, contradicting worries about the UK falling into any kind of deflationary slump. With plenty of sunshine and falling prices, the high streets saw people flocking to buy summer clothing.

The strong sales data add to signs that the economy has picked up speed again after a disappointing first quarter, but also add to the likelihood of interest rates rising later this year.

Sun adds to sales drivers

Retail sales rebounded 1.2% April after dropping 0.7% in March, according to the Office for National Statistics. The recovery marks a super-strong start to the second quarter.

Sunny weather was clearly a major factor behind the better-than-expected rise (analysts were anticipating a more modest 0.4% increase), boosting sales of summer clothing by 5.2% compared to March - the biggest surge for four years.

However, the increase was not just weather related. The sunshine added to a variety of factors that are helping retailers enjoy an upward sales trend, including record employment, improving wage growth and, perhaps the most important of all, falling prices. Inflation fell negative for the first time since the 1960s in April. Falling inflation not only means regular wages are rising in real terms at the fastest rate since 2007, but also that consumers are taking advantage of lower prices while they last.

Not surprisingly, consumers are feeling better about their finances, with Markit's Household Finance Index rising to its highest level seen since the recession in May. With the consumer mood remaining buoyant, retail sales look likely to enjoy a strong second quarter rise, which should help drive an ongoing recovery in the wider economy. GDP growth is therefore likely to pick up from the 0.3% expansion seen in the first quarter.

Rate hike possibility

However, while we expect the sales trend to remain positive in coming months, it's likely that the rate of growth will weaken from April's surging pace. The spree in summer clothes buying in April means fewer shorts, sandals and other seasonal items will be bought in coming months. Furthermore, while households were upbeat about their current finances in May, they grew more concerned about their future finances, possibly reflecting the prospect of prices starting to rise later this year, which will also mean interest rates are more likely to increase. With retail sales numbers as strong as these seen in April, rate hikes later this year are certainly a growing possibility.

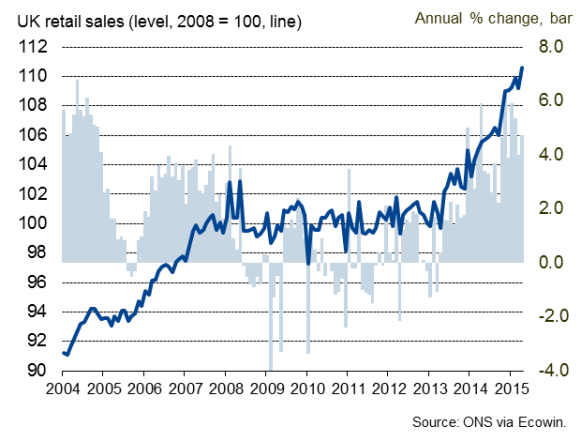

UK retail sales

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-UK-sales-surge-as-sun-shines-on-retailers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-UK-sales-surge-as-sun-shines-on-retailers.html&text=UK+sales+surge+as+sun+shines+on+retailers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-UK-sales-surge-as-sun-shines-on-retailers.html","enabled":true},{"name":"email","url":"?subject=UK sales surge as sun shines on retailers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-UK-sales-surge-as-sun-shines-on-retailers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+sales+surge+as+sun+shines+on+retailers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-UK-sales-surge-as-sun-shines-on-retailers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}