Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 21, 2016

Convertible bonds fall out of favour

Despite a broad rally in equities and corporate bonds which have seen investors rush to these asset classes, convertible bonds ETFs whose performance tracks both markets have failed to regain investor confidence after the volatility seen earlier in the year.

- Convertible bond ETFs have trailed both large cap equities and investment grade bonds ytd

- The four largest convertible bond issuers have seen their equities fall by 7% ytd

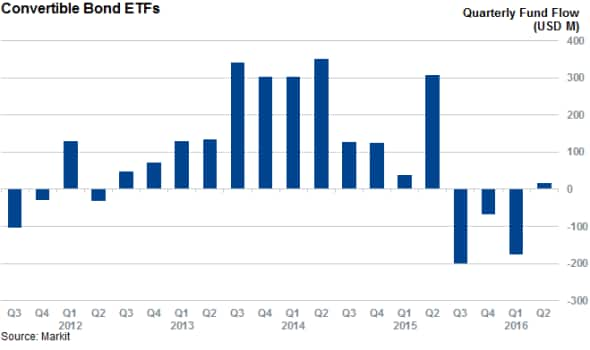

- Investors have pulled $170m from convertible ETFs in Q1, with three months of straight outflows

Convertible bonds which have both equity and bond characteristics have lost some of their lustre in the wake of the recent market turbulence. The asset class dropped severely in the opening weeks of the year and has yet to fully convince investors to return despite a rally which means convertible bonds are back in the black for the year to date.

While year to date returns for the largest convertible bond ETF, the SPDR Barclays Convertible Bond ETF, is up by 1.9% year to date on a total return basis, this is 1.5% less than that delivered by investment grade corporate bonds tracked by the iShares iBoxx $ Investment Grade Corporate Bond ETF and 3.8% behind the ytd returns of large cap equities which make up the SPDR S&P 500 ETF.

Convertible bonds trade very much like equities and the underperformance of the asset class represents unease around equities in the wake of the recent volatility. This underperformance was further driven by the mix of issuers given that the four largest issuers of convertible bonds in the index which underpin the ETF have seen their equities fall by 7% or more since the start of the year.

This is most pronounced in Allergan which has seen its shares lose over a quarter since the start of the year after its proposed tie-up with fellow drug maker Pfizer fell through after the US Treasury Department took steps to stop tax inversions. The value of its preferred shares has reflected these headwinds with the instrument which makes up 4% of the SPDR Barclays Convertible Bond ETF, now trading 18% lower YTD.

Investors not returning

While investors have shown willingness to return to corporate bond and equity funds as both asset classes rebounded from their lows, the added complexity around convertible bonds looks to have put off investors. The eight convertible bond ETFs globally have continued to see strong outflows in the eight weeks since the market started to rally in mid-February. Convertible bond ETFs saw $173m of outflows in the opening quarter, which is the third straight quarterly outflow for the asset class.

These outflows represent 5% of the assets managed by these ETFs at the start of the year and contrast with the ytd inflows seen into equity funds and those into the wider corporate bond asset class which underpins how unpopular convertible bonds have become in the current market.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042016-Credit-Convertible-bonds-fall-out-of-favour.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042016-Credit-Convertible-bonds-fall-out-of-favour.html&text=Convertible+bonds+fall+out+of+favour","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042016-Credit-Convertible-bonds-fall-out-of-favour.html","enabled":true},{"name":"email","url":"?subject=Convertible bonds fall out of favour&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042016-Credit-Convertible-bonds-fall-out-of-favour.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Convertible+bonds+fall+out+of+favour http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042016-Credit-Convertible-bonds-fall-out-of-favour.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}