Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 21, 2015

West is best for dividends

A review of global corporate dividend trends shows payments suffering in Hong Kong but performing much more robustly in Europe and the US.

- Bolstered by scale and refineries, oil majors maintain commitments to payouts

- European dividends diverge as oil price and currency remain volatile

- Banks surge in Europe but weakness present in Asia as region cools

Hong Kong hanging on banks

In Hong Kong, against a backdrop of slowing economic growth, Markit is forecasting dividends from HSCEI and HSI companies to decline in 2015 by 3.1% to HKD 200bn and 10.6% to HKD 516bn respectively.

These decreases are largely due to dividend cuts in the oil & gas sector and reduced growth in banking. Banking dividends are forecast to dip by 2.5% in in the HSCEI and grow moderately by 0.7% in the HCI. Bank's payouts represent a disproportionate amount of Hong Kong's payments; comprising over 50% of the total across both indexes. This dominance is largely due to contributions from HSBC and the China Construction Bank.

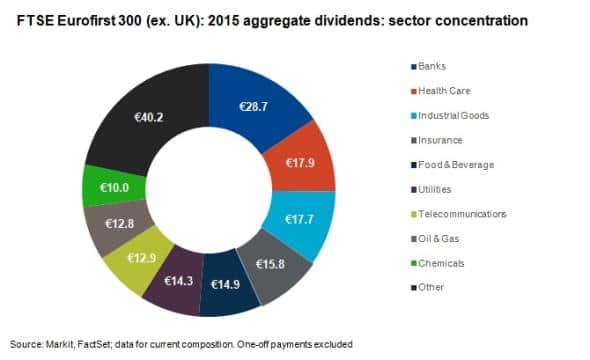

Conversely, banks are thriving in Europe and the UK. In Europe banking is set to remain the highest dividend paying sector at €28.7bn, up by €5bn. This increase is driven by ING's resumption in payments and increases from UBS. The only banks to reduce their dividends were Banco Santander and Caixabank.

In the UK the current health of the banking sector is exemplified by Lloyds' Bank first resumption of dividend payments since the bank's bailout in 2008.

Blue chip oil still pumping

Among the largest 500 firms in the US, Markit anticipates that 422 will pay a dividend this year with 101 raising their payments. Technology, industrials and (somewhat surprisingly) the oil & gas sector are expected to drive aggregate dividend growth for the period in the US.

Including one-off distributions, total payments in the US are forecast to grow by 9.9% to $404bn. Even before stripping out special dividends this represents a slowdown on the 11.8% year-on-year growth achieved last year in ordinary dividends. These ordinary dividends are forecast to grow by 9.2% to $396bn.

It appears that an integrated operating model has shielded the major oil players in the US and the UK, as refinery operations have somewhat bufferedfirms from the drop in oil prices. These companies are able to take advantage of the crack spread in refinery operations and have bolstered their positions as analysts expect continued consolidation and recovery in oil prices.

In 2014 Halliburton's deal for Baker Hughes signalled the start of energy consolidation in the US and the recent bid for BG by Royal Dutch Shell has prompted speculation that the industry has finally reached the low point in the oil cycle.

In the UK, low oil prices have cast a shadow over the future dividends of BP and Royal Dutch Shell. Both companies have reassured shareholders about their commitment to dividends during the latest earnings calls. It is expected that in the short term, key oil names should be able to maintain dividend pay-outs.

The oil & gas and basic resources sectors account for 25% of projected payments from the FTSE 350 this financial year, which are expected to grow by 7% to "79.3bn.

Contrasting with the oil major's impact in the UK; the sectors' contribution to dividend payments in Europe is much less prominent. The oil & gas sector now falls outside the top five dividend-paying sectors across the FTSE Eurofirst 300 (ex UK), dropping from fifth largest in 2014 to expected eighth position in 2015. Were it not for the recent March rebalance of the index, when Norwegian oil and gas laggards were removed (and their dividends suspended), this picture would be even more telling with oil companies dividend contribution falling further.

European divergence

Set to grow by 7.5% in the 2015 annual expiry period, European dividend payments are expected to reach €185bn. Regional analysis reveals divergent growth among constituents, with double digit decreases in Austria and Norway where oil and Ukraine exposure has taken its toll. Contrasting with these are increases in the Netherlands, Belgium and Denmark, with expected dividend growth of over 25% across all three.

Please contact press@markit.com to receive a copy of the full dividend report for each region.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042015-Equities-West-is-best-for-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042015-Equities-West-is-best-for-dividends.html&text=West+is+best+for+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042015-Equities-West-is-best-for-dividends.html","enabled":true},{"name":"email","url":"?subject=West is best for dividends&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042015-Equities-West-is-best-for-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=West+is+best+for+dividends http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042015-Equities-West-is-best-for-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}