Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 21, 2016

The big shorts of the faltering FTSE 100

UK short sellers are showing no signs of slowing down in the current market, yet investors relying on publically disclosed short positions are only seeing the tip of the shorting iceberg.

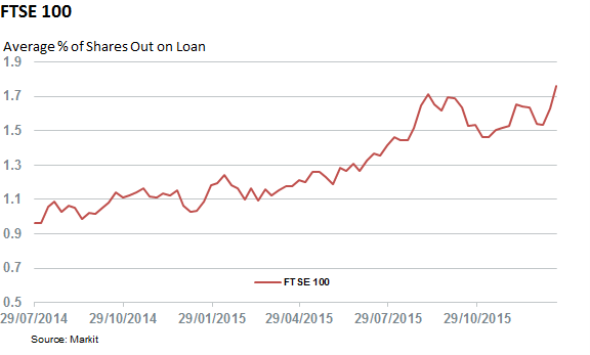

- Current FTSE 100 short interest stands at 1.75%; most since the start of market correction

- Public disclosures capture under one third of UK short positions, which value $25bn

- Royal Dutch Shell has 5% of its shares now shorted, but no publically disclosed positions

The slow start to the year in UK equities has emboldened short sellers to add to their already high positions. The average percentage of shares out on loan across the current constituents of the index now stands at 1.75% of shares outstanding; the highest in at least 18 months and 15% more than at the start of the year.

Now you see them...

Since 2012, European short sellers have been obliged to disclose positions on a daily basis which are then reported in order to increase transparency for all participants. However, the threshold for reporting positions, 0.5% of total shares outstanding, leaves plenty of scope for short sellers to remain below the radar of regulators and public scrutiny.

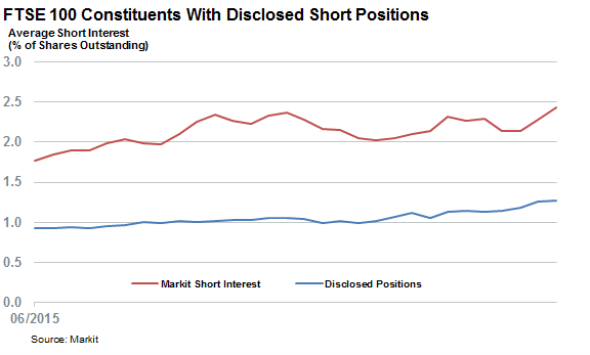

While 62 of the FTSE 100's current constituent companies have recorded at least one material short position since the FCA database went live in 2012, the proportion of short positions disclosed still remains far from the aggregate position of stock on loan out to short sellers. In fact the current average disclosed short positions across that group of 62 names compared to that seen in the Markit Securities Finance dataset has diverged in the last six months when short sellers started to add to their positions in earnest.

The above chart implies that numerous more positions have been entered into by additional firms on aggregate. This shows that the overall bearish market sentiment is not reflected by the public data.

Across the 62 names that have recorded publicly disclosed positions, the current average short interest of these stocks is 1.3%. This is almost half the level of the average revealed using Markit's Securities Finance shares outstanding on loan of 2.4%. The average short interest across the above constituents, as tracked by Markit, has increased by 12% this year to date.

Most shorted - least visibility

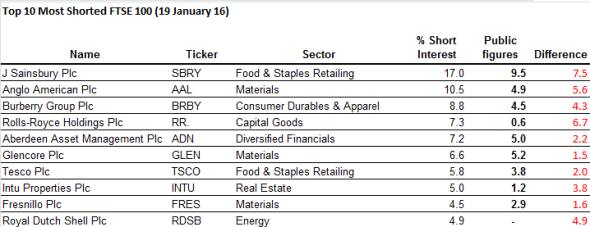

This trend is most pronounced among the most shorted ten constituents of the index, where the average discrepancy between the two shorting datasets now stands at 4.5% of shares outstanding.

Sainsbury's, the most shorted constituent, leads this trend as the gap between the publically disclosed positions and those out on loan to short sellers stands at 7.5%, more than one-third of its short interest.

On the most extreme end of the scale is Royal Dutch Shell. It currently sees $3.7bn of short positions, yet does not currently feature in publicly disclosed datasets. This is due to individual positions not breaching the 0.5% threshold. However with 4.9% of shares outstanding on loan in B shares and 1.7% in A shares, short interest now stands at a record high for the energy firm battling falling prices.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-equities-the-big-shorts-of-the-faltering-ftse-100.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-equities-the-big-shorts-of-the-faltering-ftse-100.html&text=The+big+shorts+of+the+faltering+FTSE+100","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-equities-the-big-shorts-of-the-faltering-ftse-100.html","enabled":true},{"name":"email","url":"?subject=The big shorts of the faltering FTSE 100&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-equities-the-big-shorts-of-the-faltering-ftse-100.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+big+shorts+of+the+faltering+FTSE+100 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-equities-the-big-shorts-of-the-faltering-ftse-100.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}