Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 20, 2015

Diverse banks fend off bears in Q3 earnings

The third quarter has so far seen trading reliant banks disappoint investors while their universal peers have proved much more resilient and prone to less bearish investors sentiment.

- Capital market firms have seen their short interest double in last two years

- Diversified banks have seen shorts cover their positions by 77% year to date

- Shorts side with sceptics of the Bank of Internet as short interest surges and stock falls

Banking lower profits

Morgan Stanley's third quarter earnings, which came six months after the firm announced its best quarter since the financial crisis, failed to live up to expectations as it reported a 40% fall in profits from the previous quarter, due largely to a fall in trading revenues. The firm's results echo those of its trading reliant peers which together have lagged the rest of the US banking sector.

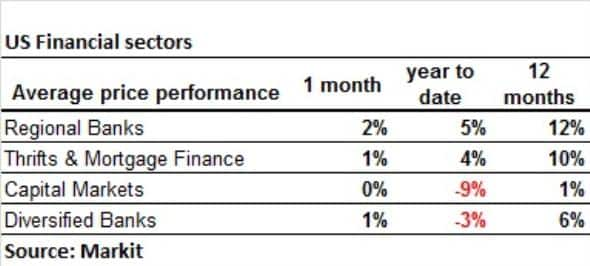

This divergence is evidenced in the year to date stock performance of the banking sector, where US capital market firms (with a market cap greater than $100m) are currently sitting on a 9% average price fall, 6% more than their more diversified peers. Regional banks, on the other hand, have proved much more resilient given the current market forces and are currently sitting on a 5% gain for the year, a massive 14% more than the returns delivered by capital market firms.

Financial short interest

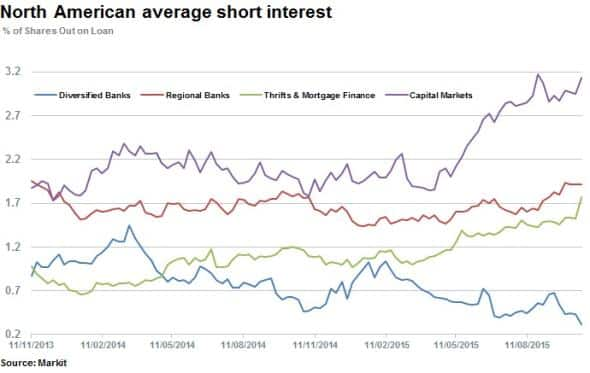

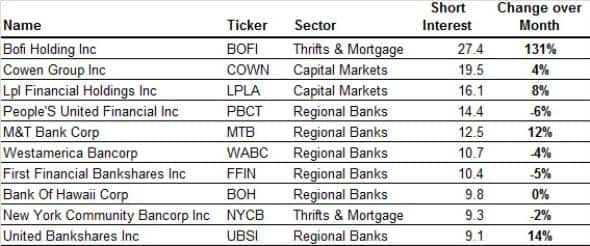

This return divergence has caught the eyes of short sellers in recent months with capital market firms now averaging over 3% of their shares out on loan, more than 50% above the second most shorted sub segment in the industry, regional banks.

Large diversified banks, which include recent earnings overachievers Wells Fargo and Bank of America, run against that trend with these firms now seeing the lowest average of any point in at least two years, after a wave of recent short covering. Regional banks have proven to be the star performer of recent weeks and have seen short sellers hold relatively steady with average short interest now sitting just under 2%.

Shorts bank profits

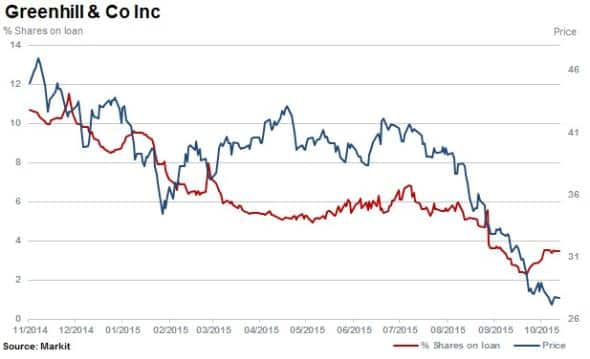

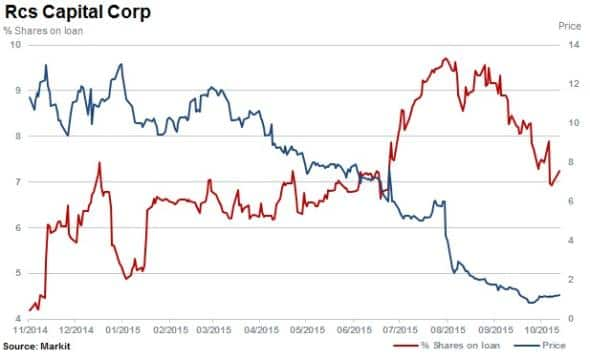

The two worst performing stocks within the US Financials universe with material short interest levels indicating profit opportunities are Greenhill and Rcs Capital, which have fallen 37% and 90%, respectively, year to date.

Short sellers continued to cover positions in Greenhill as prices declined, with shares outstanding on loan decreasing from above 10% in 2014 to 3.5% currently.

Short sellers held on and squeezed profit out of Rcs Capital as shares continued to decline, increasing positions in June before beginning to cover in August. Shares out on loan currently stand at 7.2%.

The bank most shorted

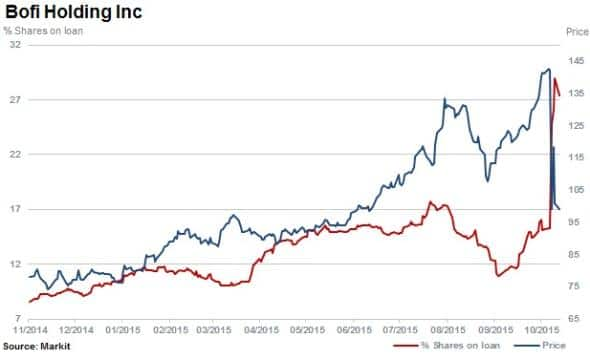

Short sellers have recently been attracted to one of the top performing banks year to date in the US, Thrift & Mortgage Finance Holdings, which was up 82%. The company's shares subsequently fell by 30% with short interest spiking 62% to reach 27% of shares outstanding on loan. The fall occurred as news broke that a former auditor of the firm has filed a lawsuit regarding the firm's regulatory and tax filings. The company provides non-traditional residential loans and other banking products to high net worth individuals through a branchless network.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102015-equities-diverse-banks-fend-off-bears-in-q3-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102015-equities-diverse-banks-fend-off-bears-in-q3-earnings.html&text=Diverse+banks+fend+off+bears+in+Q3+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102015-equities-diverse-banks-fend-off-bears-in-q3-earnings.html","enabled":true},{"name":"email","url":"?subject=Diverse banks fend off bears in Q3 earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102015-equities-diverse-banks-fend-off-bears-in-q3-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Diverse+banks+fend+off+bears+in+Q3+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102015-equities-diverse-banks-fend-off-bears-in-q3-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}