Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 20, 2017

Socially Responsible Investing taking off

Socially responsible investing (SRI) - backing shares with good environmental, social and corporate governance (ESG) metrics - has proved to be the winning formula for investors looking to do good through their investments

- ETFs on track for their largest inflow year on record

- Stocks with good ESG metrics have significantly outperformed over the last five years

- Short sellers much less active across companies with good ESG

The landscape of green, socially responsible investing is replete with bright ideas that failed to deliver the long term economic viability sought by investors. Taking solar as an example, we see that the sector's share have lost more than 90% of their value since the Guggenheim Solar ETF, the first solar tracking ETF, launched back in April 2008. Even green firms which have delivered positive returns for investors (such as Tesla) still attract more than their fair share of skeptics - the electric carmaker's shares are among the most shorted assets globally.

Despite this reality, the desire to invest with a conscience is as strong as ever. A Google trend analysis of ESG search terms shows searches on the topic doubled over the last two years.

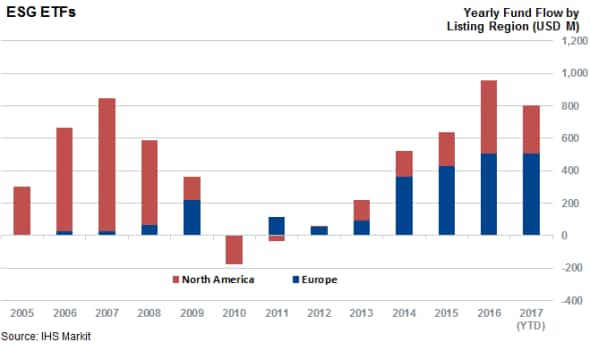

To reconcile these two potentially unprofitable forces, investors have looked beyond the relatively narrow universe of pure play green and socially responsible companies, and invested in firms which make conscious efforts through their ESG policies. ETFs that track these companies have gone from strength to strength in recent years, and the IHS Markit ETF analytics database saw investors plough a record $950m of assets into them in 2016. 2017 is shaping up to be an even better year for SRI, with investors shifting more than $800m to socially responsible funds YTD, propelling their AUM above the $5.5bn mark.

These large investments come from both sides of the Atlantic, but European investors are more eager to invest with a conscience. Interestingly, at the start of 2016, socially responsible ETFs in Europe had less than half the AUM of their North American counterparts, but Europeans have contributed roughly 60% of the new inflows since then.

Returns Since 2012

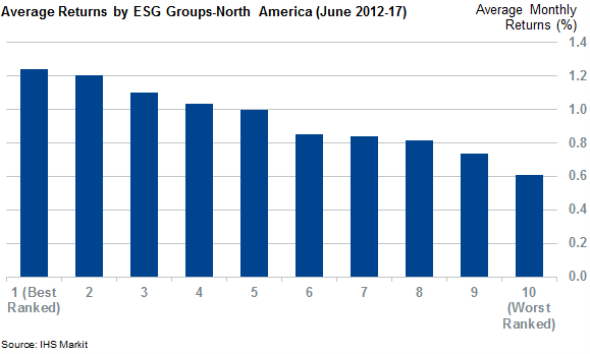

According to the IHS Markit Research Signals Integrated ESG Rating - which ranks compliance to the Principles for Responsible Investment framework - investors haven't foregone returns by investing in socially responsible strategies over the last five years. In fact, the top 10% of North American shares by ESG Rating represent the best performing end of the market. The return difference is significant - these shares returned 1.24% a month on average, which is nearly a third more than the 0.94% all of North American shares since 2012.

Shares on the other side of the ESG Rating have performed worse, with a 0.6% average monthly return.

Short interest

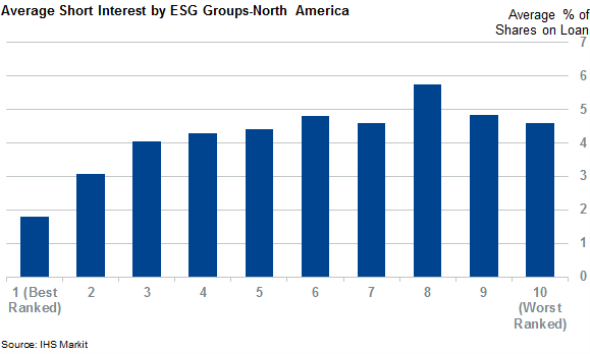

Short sellers are much less sceptical of stocks that score well with socially responsible metrics. The current group of North American shares in the top 10% of the ESG Rating have, on average, 1.8% of shares out on loan. This figure is less than half of that seen worldwide.

Scoring well on ESG metrics isn't a cure all against short sellers, as plenty of short targets are still present among high scoring firms. This short selling is more likely driven by company specific forces than the fundamental sector vulnerability that has made some pure play socially responsible firms the favorite short targets of the last decade.

Hanes Brands is the top target, with more than 17% of its shares shorted, despite scoring in the fourth percentile of the ESG Rating. Its current high short interest reflects the headwinds in North American retail and revenues.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072017-Equities-Socially-Responsible-Investing-taking-off.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072017-Equities-Socially-Responsible-Investing-taking-off.html&text=Socially+Responsible+Investing+taking+off","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072017-Equities-Socially-Responsible-Investing-taking-off.html","enabled":true},{"name":"email","url":"?subject=Socially Responsible Investing taking off&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072017-Equities-Socially-Responsible-Investing-taking-off.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Socially+Responsible+Investing+taking+off http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072017-Equities-Socially-Responsible-Investing-taking-off.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}