Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 20, 2015

CEE banks see credit spreads widen

Poland looks set to follow Hungary's path by introducing new banking measures allowing mortgages denominated in Swiss francs to be converted into local currency, with banks facing resultant losses.

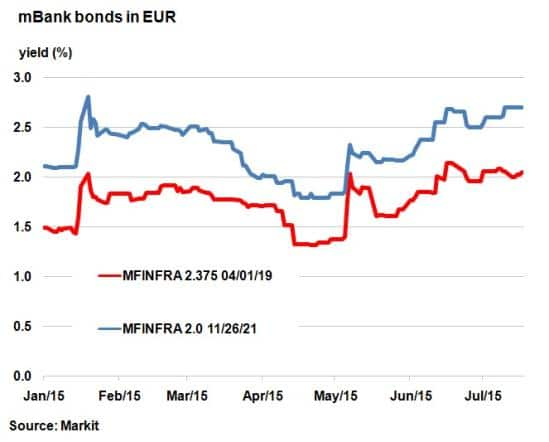

- Poland's mBank has seen its 5-yr bond yield widen 87bps since June 1st

- Raiffeisen's CDS curve has remained inverted since January, signalling credit distress

- 5-yr CDS spreads imply a 37% probability of default on Raiffeisen's subordinated debt

Over the past few months Europe's biggest banks in the periphery have come under sustained pressure, with plunges in share prices and widening credit spreads. The impact of the Greek crisis on banks such as Portugal's Banco Comercial Portugues, Italy's Monti dei Paschi and Austria's Raiffeisen highlights that there is still much work to be done to create a tighter European banking union.

Polish nerves

The latest anxieties stem in central and eastern Europe (CEE), in Poland's banking sector and the reforms put forward by the incumbent leaders. Poland faces elections in October and whatever the outcome, banks are likely to face subsequent taxes and levies.

Earlier this month the government proposed a bill that will allow holders of mortgages denominated in Swiss francs (CHF) the right to convert into local currency, zlotys, with lenders forced to pay for half of the conversion cost.

However, Swiss francs have surged against the zloty since francs were unpegged against the euro in January. It is estimated that these potential mortgage currency conversions could cost Polish banks around $2.5bn over the next five years.

mBank, Poland's fourth biggest lender by assets and a subsidiary of Commerzbank, has seen yields on its bonds widen. Yields on mBank's 2.35% 2019 bond denominated in euros have widened 73bps from year to date lows of 1.24% in mid-April, according to Markit's bond pricing service. The current yield of 2.05% is comparable to mid-January highs seen during the unpegging of the Swiss franc. Five year bonds present a similar story, with the bond due 2021 standing 87bps wider than at June 1st.

Raiffeisen

The Polish story is not a secluded case. Ever since the financial crisis, banks operating in Hungary have been hit by special taxes and levies; none so more than Austrian Bank Raiffeissen Zentralbank Oesterreich AG and its subsidiary Raiffeisenbank International AG.

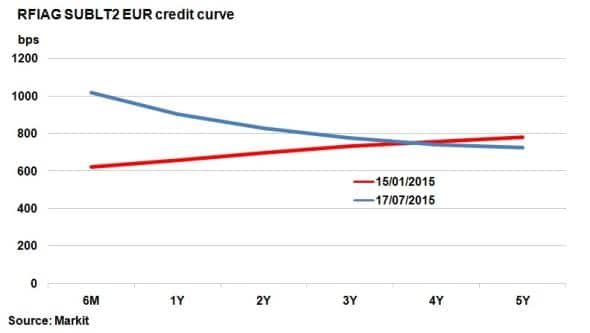

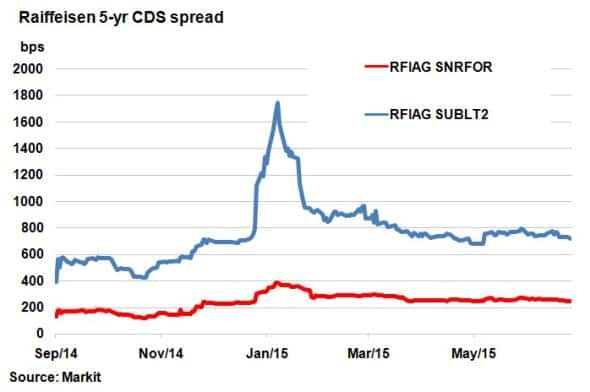

Having already suffered heavy losses in its Hungarian retail banking business, to a large extent due to Hungary's banking sector tax, Raiffeisen has faced further challenges with the unpegging of the Swiss franc. Raiffeisen's subordinated CDS curve has been inverted ever since January, a sign of distress in the credit, with the short end of the curve touching 1000bps.

The prospects of extraordinary government support following the implementation of the EU bank recovery and resolution directive, including bail-in powers, have put additional pressure on subordinated bondholders.

According to its 5-yr CDS spreads, the implied probability of default for Raiffeisen's subordinated debt is 37.26% and has remained heightened since January. Raiffeisen's current senior 5-yr CDS spread also remains at an elevated level, standing at 185bps wider than the Markit iTraxx Europe Senior Financials.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072015-Credit-CEE-banks-see-credit-spreads-widen.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072015-Credit-CEE-banks-see-credit-spreads-widen.html&text=CEE+banks+see+credit+spreads+widen","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072015-Credit-CEE-banks-see-credit-spreads-widen.html","enabled":true},{"name":"email","url":"?subject=CEE banks see credit spreads widen&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072015-Credit-CEE-banks-see-credit-spreads-widen.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CEE+banks+see+credit+spreads+widen http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072015-Credit-CEE-banks-see-credit-spreads-widen.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}