Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 20, 2016

Investors play safe while avoiding high flyers

Investors have chosen to pile into funds which aim to invest in 'safe' shares since the start of the year, while those that invest in high momentum shares have fallen out of favour.

- US large caps with the lowest beta have proven to be winning bet ytd promoting large inflow

- Low beta preference also seen in utilities ETFs, which have seen $4bn of inflows in 2016

- Momentum strategies have stalled in 2016 promoting investors to flee the strategy

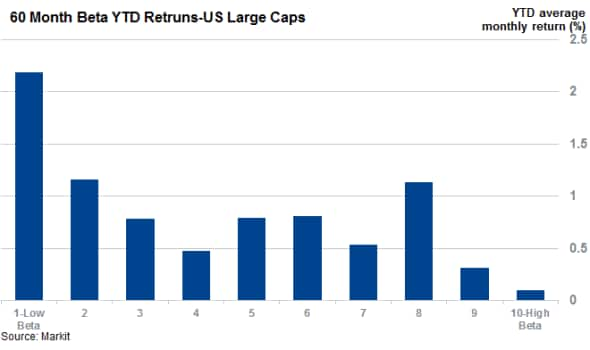

High flying Facebook, Amazon, Netflix and Google shares, or 'FANGs', were hotly tipped at the start of the year, but the recent market volatility has seen average returns delivered by these mercurial shares lag behind the rest of the market. This underperformance has not been isolated to technology names as the most volatile half of US large cap shares, as identified by the Markit Research Signal 60 Month Beta factor, have consistently lagged behind their historically less volatile peers since the start of the year.

This consistent underperformance means that the year to date return delivered by the less volatile half of the Markit US large cap universe stands at 5.4% which is 2.5% ahead of their peers on the other half of the volatility spectrum.

Low beta ETFs in vogue

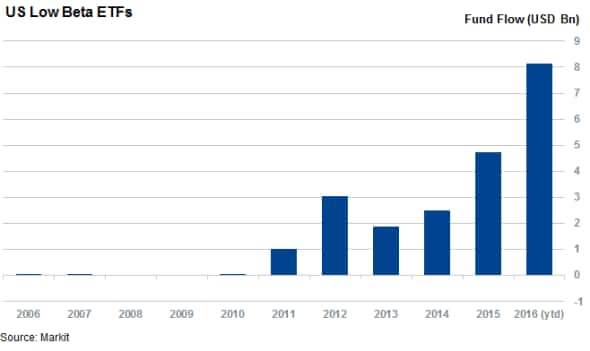

This outperformance delivered by low beta investing has been the de rigueur smart beta strategy of the year so far. US-exposed low beta ETFs have seen inflows every week of the year so far, with total inflows summing up to $8.1bn.

These strong inflows, which have already overtaken last year's record haul of $4.7bn, means that the formerly obscure asset class has seen its AUM swell to $25.3bn

Utilities benefit from the tend

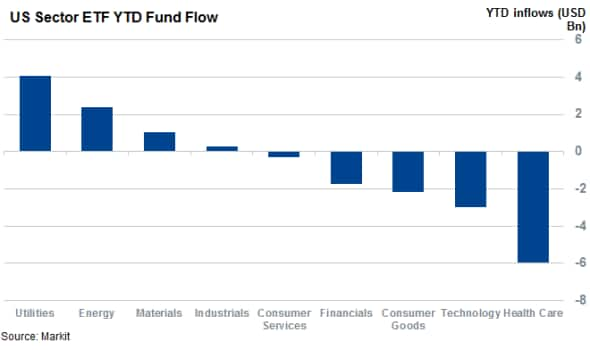

The market's new found fondness for low beta shares is also seen in their sector ETF preferences, as historically prosaic sectors have seen the strongest inflows for the year so far. Utilities, which have the lowest average beta rank according the average 60 month beta ranks, have seen the largest inflows so far this year with $4bn flowing into ETFs exposed to the sector year to date (ytd).

Relatively more volatile sectors such as healthcare and technology, which have a much higher average beta rank, have seen the opposite trend with investors pulling $6bn and $3bn from these funds respectively over the same period of time.

Momentum underperforms

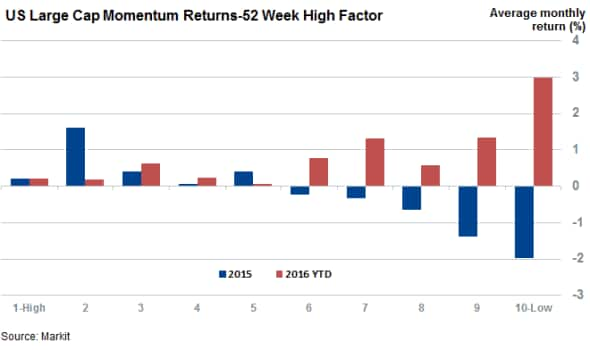

Momentum strategies which chase high flying shares have proven to be a much tougher sell in the current market with these ETFs as the 19 momentum focused ETFs in the Markit ETF universe have seen $838m of outflows year to date.

This investor exodus from the strategy, which had been one of the most popular investment strategies of the last year, is driven by a reversal of fortune seen by momentum investing. In the fact that the shares which trade the furthest away from their 52 week high, a measure of low momentum names, have proven to be the standout performers of the current market.

The 10% of shares which trade the furthest away from their 52 week highs have been returned 3% a month on average ytd, which is over 1.7% more than any other momentum decile. This is a total reversal from last year when these shares were lagging the market by the widest margin.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-equities-investors-play-safe-while-avoiding-high-flyers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-equities-investors-play-safe-while-avoiding-high-flyers.html&text=Investors+play+safe+while+avoiding+high+flyers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-equities-investors-play-safe-while-avoiding-high-flyers.html","enabled":true},{"name":"email","url":"?subject=Investors play safe while avoiding high flyers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-equities-investors-play-safe-while-avoiding-high-flyers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+play+safe+while+avoiding+high+flyers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-equities-investors-play-safe-while-avoiding-high-flyers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}