Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 20, 2015

Loan spreads tighten amid easy credit

Leveraged Loans have enjoyed a stellar start to 2015 on the back of easy monetary policy and a bounce in commodity prices.

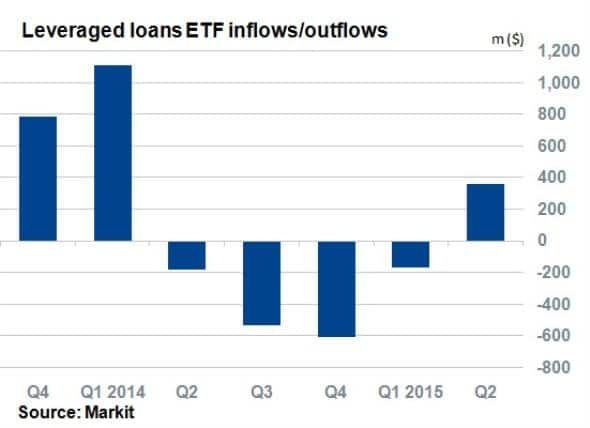

- Second quarter sees first inflows into Loan ETFs since Q1 2014

- Yields across all sectors have compressed this year, especially in Energy

- European BB loans provide 300bps over Libor, despite compressing over 9% post QE

Today's low interest environment sees the hunt to secure yield become increasingly focused. Leveraged loans, a popular funding asset class among high yield companies, offer unique advantages to both issuers and investors. For investors they offer a unique diversification option within fixed income with their senior status in issuers' capital structure, low duration and attractive risk/return profile. For issuers they offer a cheap way to fund operations such a refinancing debt or M&A activity.

Leveraged loan ETFs see inflows

Investors have taken note of the appeal of this asset class, with Leveraged Loan ETFs' AUM doubling over the last two years to hit $7.18bn (majority of the inflows were in 2013).

Leveraged Loan ETF flows have seen a very strong start to the second quarter. April has experienced $363m of inflows so far. If this trend continues, Q2 will post the best quarter

since Q1 2014. These developments mark a reverse in the trend seen over the past year, with the previous four quarters experiencing ETF outflows. Q4 2014 suffered highest outflows, seeing $613m taken off the table.

Secondary market

The pickup in ETF inflows may be partly due to the recent spread compression across assets lower down the capital structure, such as high yield bonds. The total return for the Markit iBoxx USD leveraged Loan index has steadily crept higher this year, surpassing 2%.

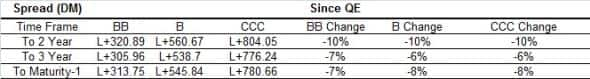

New capital from ETF inflows has also helped drive demand for commercial paper. In Europe, QE has had a knock-on effect with spreads over Libor and yields coming down across rating buckets and sectors.

Since the mid-January QE announcement, yields have decreased by around 10% across all maturities and sectors, although short maturity bonds have performed the best. Sectors most sensitive to oil prices (Energy, Basic Materials and Industrials) have also outperformed. Notably, while European high yield bonds yield less than 4%, leveraged loans still provide a yield north of 5%.

The resurgence of the loan market is encapsulated by the CLO (collateralised loan obligation) market. These are special purpose vehicles set up to manage a pool of leveraged loans and are key to driving demand in the primary loan market. Issuance has picked up since 2012 after coming to a grinding halt in the aftermath of the financial crisis in 2008. 2015's issuance levels so far have already surpassed 2006/7.

Further ongoing QE, fund flow reversal and an optimistic primary issuance pipeline this summer all point to growing demand for the asset class.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20042015-Credit-Loan-spreads-tighten-amid-easy-credit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20042015-Credit-Loan-spreads-tighten-amid-easy-credit.html&text=Loan+spreads+tighten+amid+easy+credit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20042015-Credit-Loan-spreads-tighten-amid-easy-credit.html","enabled":true},{"name":"email","url":"?subject=Loan spreads tighten amid easy credit&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20042015-Credit-Loan-spreads-tighten-amid-easy-credit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Loan+spreads+tighten+amid+easy+credit http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20042015-Credit-Loan-spreads-tighten-amid-easy-credit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}