Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 20, 2016

European volatility surges in New Year

Volatility has greeted equity investors in the New Year and Europe is no exception; yet a closer look at the data shows that not all of the region's main indices have felt the same surge in volatility.

- Stoxx 50 90 Day At The Money option implied volatility has jumped by 15% year to date

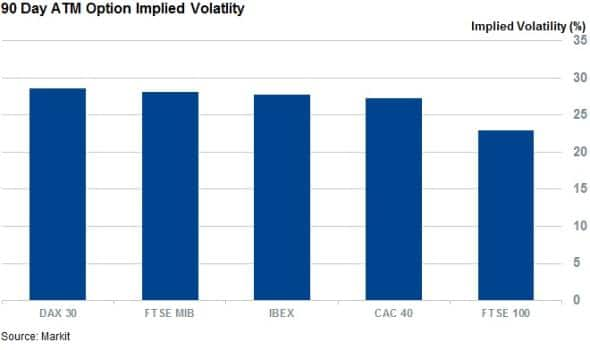

- FTSE 100 options carry the least implied volatility of the major European indices

- European volatility ETFs not receiving the traction as US funds with only "107M of AUM

The key market drivers of the last 12 months, the Chinese slowdown and ensuing commodities slump, have shown little signs of easing into the New Year. Consequently, investors have taken fright of equities as evidenced by the fact that global equities indexes are on track for their worst start to the year in decades. The global market downturn hasn't spared European shares given that both the Stoxx Europe 50 index and its Eurozone focused Euro Stoxx 50 peer were down by around 10% two weeks into the year.

Not surprisingly, these market developments are starting to feed through to options that track the regions equities with these instruments now trading with a greater amount of implied volatility than at the start of the year according to Markit Daily Volatility. 90 day at the money (ATM) implied volatility for options written against the Europe Stoxx 50 index now stands at 28.6%, a jump of 15% on the levels seen at the start of the year.

While this jump trails the 34% jump in implied volatility seen in S&P 500 options, the current level of implied volatility is still significant as it places the current level of market angst on par with that seen over the worst of last summer's swings and the Eurozone sovereign crisis in 2012.

Volatility not uniform across Europe

This volatility is not uniform across the region, however as the main European indices now see their options trade with uneven levels of implied volatility.

Interestingly, 90 day ATM options written against the German DAX index have traded with the highest level of implied volatility of the region's main indices. On the other side of the scale, FTSE 100 options trade with a materially lower level of implied volatility than their regional peers as its 90 day ATM options trade with 23% of implied volatility, over 15% less than the second least volatile CAC options.

Vol ETFs fail to catch traction in Europe

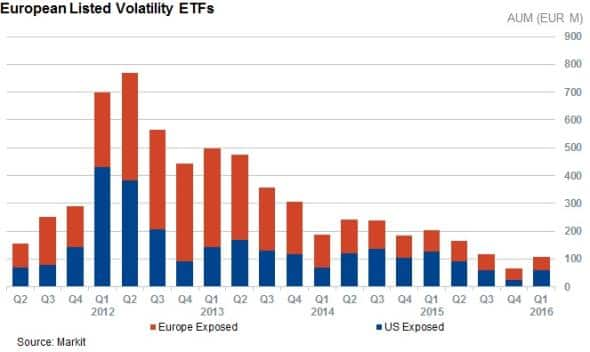

Unlike their US peers however, European investors looking to play this recent upswing in volatility through European volatility ETFs will be left short of options as the asset class has failed to see the same take-up from European investors as that seen in the US. These funds only manage "107M as of latest count, less than 3% of that managed in the US. This dynamic hasn't changed in the wake of the recent volatility as European volatility ETFs have only seen "325K of net fund flows since the start of the year, a much smaller total than that seen on the other side of the year.

Ironically, the majority of that relatively small AUM base is invested in funds exposed to swings in US volatility. While this has made little difference in the last three years given that the 90 day ATM volatility swings in S&P 500 options and those of the Europe Stoxx 500 have been correlated by 85% but the recent market has seen this trend break down somewhat. The largest European volatility ETF, the iPath VSTOXX Short-Term Futures TR ETN has outperformed its US exposed European peer, the iPath S&P 500 VIX Short-Term Futures Index ETN by over 5% since the start of the year which has benefited European volatility investors given their penchant for US exposure.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012016-Equities-European-volatility-surges-in-New-Year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012016-Equities-European-volatility-surges-in-New-Year.html&text=European+volatility+surges+in+New+Year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012016-Equities-European-volatility-surges-in-New-Year.html","enabled":true},{"name":"email","url":"?subject=European volatility surges in New Year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012016-Equities-European-volatility-surges-in-New-Year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+volatility+surges+in+New+Year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012016-Equities-European-volatility-surges-in-New-Year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}