Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Dec 19, 2014

Watch the skew

The recent volatility has triggered some unusual market dislocations

- Considerable volatility this week in main credit indices

- The index skew on the Markit iTraxx Europe briefly turned positive

- Further volatility and dislocations are likely if ECB refuses to step up intervention

If one were to look at the week-on-week change of the main credit indices, it would be perfectly understandable to assume that it was another uneventful few days in the markets. The Markit iTraxx Europe was trading at 61.5bps on December 18, just 1.5bps wider than the previous week. The Markit CDX.NA.IG was 3bps tighter at 66bps over the same period.

But an assumption of docility would be mistaken. Volatility has returned and the indices have seen large swings, particularly in high yield. The Markit iTraxx Crossover was trading at 336bps on December 11th, widened beyond 400bps on December 16th and then two days later it was back at 336bps.

Even though it is investment grade, the Markit iTraxx Europe is traditionally the most volatile index due to its status as the instrument of choice for directional macro trades. The VolX Europe, which tracks investment grade realised volatility, moved above 50% after falling to 28% earlier this month.

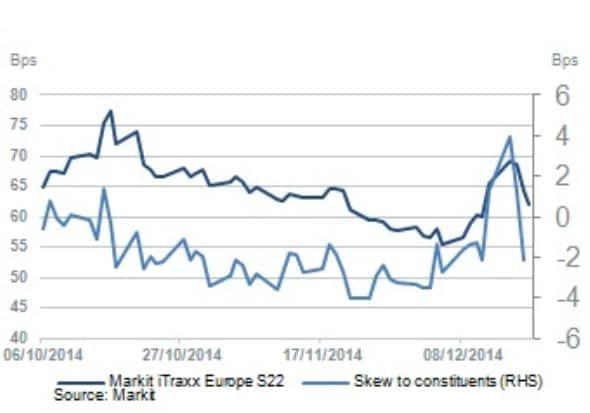

The unpredictable trading climate has produced some unusual phenomena beyond the headline figures. The skew to the underlying constituents for the Markit iTraxx Europe has been negative since the roll in October, i.e. the theoretical level of the index was wider than the traded level. Volatility observed this week caused that relationship to change, albeit briefly. The skew became positive, and on December 15th it was as high as 4bps. Positive skew was also seen during the volatility spike in October, though it wasn't as large.

This indicates that risk aversion triggers flows into the most liquid products - the indices - and pricing dislocations often occur as a consequence. If volatility subsides going into year-end, we can expect the normal relationship to resume, as it appears to have done so in the latter part of this week (The skew is back to a more typical -1.4).

It is no secret that the falling oil price and the negative effects on emerging markets, particularly Russia, were probably the main driver of bearish sentiment. A dovish interpretation of Federal Reserve comments on Wednesday helped the market to recover.

Central banks have been the saviours of bullish investors this year and will continue to play a pivotal role in 2015. The market is pricing in the ECB implementing full QE sooner rather than later, and will surely need central bank intervention to prevent more frequent - and vicious - bouts of volatility.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19122014-credit-watch-the-skew.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19122014-credit-watch-the-skew.html&text=Watch+the+skew","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19122014-credit-watch-the-skew.html","enabled":true},{"name":"email","url":"?subject=Watch the skew&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19122014-credit-watch-the-skew.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Watch+the+skew http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19122014-credit-watch-the-skew.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}