Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 19, 2015

Bears take on unicorns

Short interest in firms which recently IPOd with a market value greater than $1bn has surged since the start of the year, with tech firms the favourite target of short sellers.

- Short interest in "unicorn" listings has jumped by 62% ytd to 6.3% of free float

- Tech firms make up half of the 20 IPOs which listed above $1bn of market cap

- Fitbit is the standout short target with 42% of its free float now out on loan

This week's hot market activity revolves around tech IPOs, with payment processing firm Square and dating website Match both joining the herd of publically traded "unicorns" or firms with a market value north of $1bn. While both listings eventually made a successful (and profitable) trading debut, their course to market was not as smooth as some of their peers which preceded their listings as both firms had to offer shares either below or at the low end of their original pricing estimates.

This shift in attitudes towards unicorns was also evidenced last week when Twitter, one of the herd's trailblazers, saw its share price dip below its IPO price last week. This marks a stunning reversal of fortunes from a firm whose shares surged by 75% on its listing debut. Short sellers have been omnipresent on the firm's recent downturn, as demand to borrow Twitter shares jumped by more than ten-folds in the last six weeks with 7.5% of the social media platform's shares now out on loan.

Short sellers invigorated

Scepticism towards recent IPO listings is fairly universal given that short interest in the 200 US traded firms which have listed since January 2013 with a market value greater than $1bn has surged to new highs in recent weeks. Demand to borrow shares in newly listed firms has jumped by over 60% since the start of the year and now stands at 6.3% of freely traded shares on average.

Performance wise, these firms have proven to something of a disappointment given that these shares have returned 2.7% on average. While this trails the returns seen in the overall market in the last two and a half years, the main disappointment stems from the fact that half the recent listings are now seeing their shares trade at a lower price than the closing price on their first day of trading. These underperforming listings are also trailing the market by quite a wide margin as the average price fall stands at 35% on average.

Leading the disappointing performances is shale driller Eclipse Resources whose shares are now trading 90% off its first closing price. Shorting wise, the forms now has an all-time high 5.2% of its free float now out on loan.

Tech firms most shorted

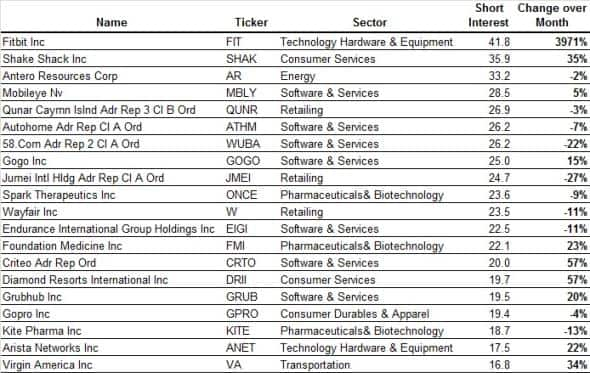

While energy names such as Eclipse have made for some very successful short trades, the most bearish sentiment seen among the recent unicorn listing revolves around tech firms whose high private valuations coined the term in the first place. To this end, tech firms make up half of the names in the 20 most shorted large IPOs whose trading debut occurred after January 2013.

This list includes household names such as Gopro, Grub Hub and Shake Shack, along with less well known Mobileye which makes software for autonomous cars.

Among the firms seeing heavy short interest, the one standout is recent listing Fitbit which has 41% of its free float now out on loan, a fifth more than the second most shorted firm Shake Shack. As seen in Twitter, the high conviction of short sellers has been rewarded as the firm now trades below its closing price after a 45% retreat from the highs seen in August.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112015-Equities-Bears-take-on-unicorns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112015-Equities-Bears-take-on-unicorns.html&text=Bears+take+on+unicorns","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112015-Equities-Bears-take-on-unicorns.html","enabled":true},{"name":"email","url":"?subject=Bears take on unicorns&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112015-Equities-Bears-take-on-unicorns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bears+take+on+unicorns http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112015-Equities-Bears-take-on-unicorns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}