Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 19, 2014

Too late for frontier markets

Global technology infrastructure operators and carriers are scrambling to shore up frontier markets as growth slows in developed markets and competition increases. But the land grab has now become a game of consolidation as some markets leap ahead of others.

- Carriers face increasing competition from peers and mobile applications that operate on their infrastructure

- Ubiquitous smartphone penetration and accelerating adoption in emerging markets represents opportunity, but carriers are struggling to capitalise

- As doors to opportunities close, mobile network carriers are in a similar predicament to fixed line companies two decades ago

Global Consolidation

"Quad play" is driving partnerships and consolidation as operators compete to offer bundled services to customers. The four key elements to quad are fixed-line broadband, telephone, television and mobile phone services.

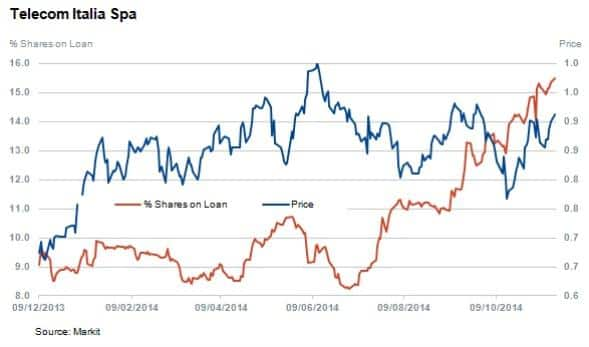

In Brazil, Telecom Italia's subsidiary TIM Brazil was outbid by rival Telefonica to buy GVT from Vivendi. The bid was in an effort to offer converged services to consumers. The deal miss has seen short interest in Telecom Italia almost double since July to 15.5%. The company is now targeting another Brazilian based operator called Grupo Oi.

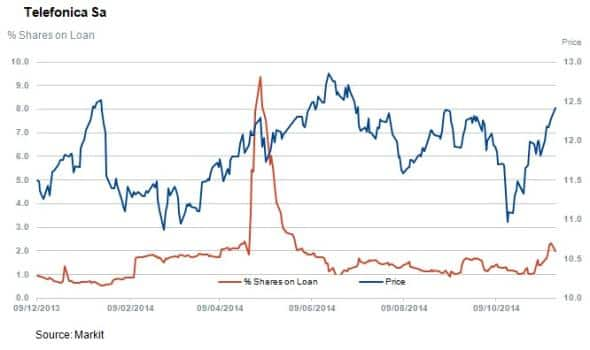

European and Latin American operator Telefonica, recently partnered with TalkTalk in the UK replacing Vodafone in offering converged wireless, broadband and television services. These types of deals aim to extract value by leveraging different user bases of and maximising revenue potential. Telefonica has seen stable short interest throughout the year share with the price reacting positively in recent weeks.

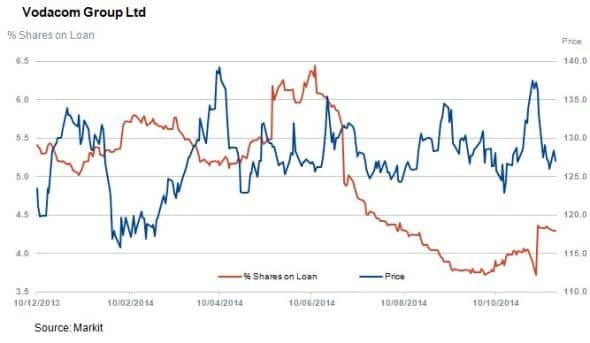

In Africa, short interest in Vodafone has increased substantially (from a small base) from 0.1% to 0.8% and subsidiary Vodacom continues to be among the top shorted operators globally with 4.3% of shares outstanding on loan.

Despite impressive growth in data, declining voice revenues and data prices due to increased competition is putting strain on Vodacom. But short interest, in comparison to Vodafone, has decreased from a 6.5% high reached in June.

Other forces impacting carriers growth plans

Mobile messaging and payment platforms are gaining momentum and carriers are trying to position themselves to protect and grow market share and revenue. Besides Vodafone's M-Pesa below, carriers are behind the curve and competing with their own customers services, which are offered for free or at a fraction of the cost to the carrier to provide directly.

Kenyans have been doing banklesstransfers with M-Pesa for several years without a smartphone or bank account, using just a phone number. Although now cloned by other applications and bank-based services, M-Pesa has not gained traction in other markets.

Snapchat this week revealed a payment service collaborating with payment service platform Square that allows users to send each other 'cash' with the swipe of a finger on a mobile device. This does involve connecting a bank account, which is good for news for VISA and MasterCard, however not so good for newly unbundled PayPal. Visa has witnessed short interest increase throughout the year to hit 6.5% of shares outstanding on loan.

These developments close doors to opportunities carriers could have capitalised on such as Snapchats new bank agnostic service

Applications such as Skype and Whatsapp protect their owner's business (Microsoft and Facebook in this case) by offering the value added communication for free.

This is a threat to network operator growth and has, or will eventually, turn carrier networks into mere data utilities.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112014-equities-too-late-for-frontier-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112014-equities-too-late-for-frontier-markets.html&text=Too+late+for+frontier+markets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112014-equities-too-late-for-frontier-markets.html","enabled":true},{"name":"email","url":"?subject=Too late for frontier markets&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112014-equities-too-late-for-frontier-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Too+late+for+frontier+markets http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19112014-equities-too-late-for-frontier-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}